PHOTO

Moroccan banks have recorded strong growth in the past few years by expanding abroad, but regulators are now worried about contagion risks.

Constrained by the limits of the domestic economy, Moroccan banks have pursued cross-border deals in recent years to expand their networks across 22 Sub-Saharan African states, and these now generate a fifth of banking revenue.

Attijariwafa Bank has bought Credit Agricole's banking network in five West Africa countries, and in March raised its stake in Ivory Coast's Societe Ivoirienne de Banque to bring its total stake to 75%.

Banque marocaine du commerce extrieur (BMCE) has steadily raised its stake in Bank of Africa, while Banque Centrale Populaire holds a 50% stake in Atlantic Financial Group and has established an Atlantic international business network.

Morocco has benefited from banks' expansion across the continent, with trade between Morocco and Sub-Saharan Africa rising fivefold over the past decade.

But now Bank Al Maghrib (BAM), the country's central bank, is looking to rein in such expansion and encourage banks to manage their risk profiles instead.

The International Monetary Fund has said that while some of the banks' foreign subsidiaries have high profit rates, they also have higher levels on non-performing loans.

"BAM's preference at this stage is that the Moroccan cross-border groups consolidate their current presence in the countries (for example, integrate their accounting standards and their IT systems) rather than expanding further," the Fund said.

"The cross-border groups have also indicated that they are not considering further significant expansion in the near future," it added.

International activities, mostly in Africa, make up about 19% of total volume of activity of the Moroccan banking sector. International activity accounted for 21% of total deposits, 16% of credit, and 21% of revenues on a consolidated basis.

The IMF said that for some groups with publicly available data, return on assets varied between -1.6% and 2.7% across subsidiaries from different countries, while NPLs varied from 0.7% to 29.8%.

CONTAGION RISKS

BAM is taking a proactive role to strengthen its supervisory standards after a new law was approved late last year that authorized the central bank governor to impose prudential measures for banks.

"The rise of Pan-African banks opens new channels for transmission of macrofinancial risks and other spillovers across home and host countries," the IMF said. "Together with the benefits, cross-border banking may also bring new channels through which the contagion of negative shocks can be transmitted.'

"One channel through which such financial contagion could be transmitted is the presence of a "common lender" that may be the main funding source for a number of countries. If the common lender is "contaminated" the liquidity or solvency problem could be expanded to other countries," the IMF added.

The banking sector has assets valued at 129% of the Morocco's gross domestic product (GDP) and the central bank's move comes at a time of sluggish growth in the Moroccan and the wider Sub-Saharan economy.

The North African state's manufacturing, textile and tourism sectors have underperformed, household confidence has dropped and unemployment has risen to 9.9%.

BAM has lowered interest rates in recent months, but there is no certainty that this will be enough to encourage banks to lend more at a time when the cost of risk is rising, according to French bank BNP Paribas.

"This is especially true since the troubles in the real estate sector are far from being resolved, BNP said in a recent report. It said that excluding mortgage loans, the real estate sector accounts for only 8.6% of total loans.

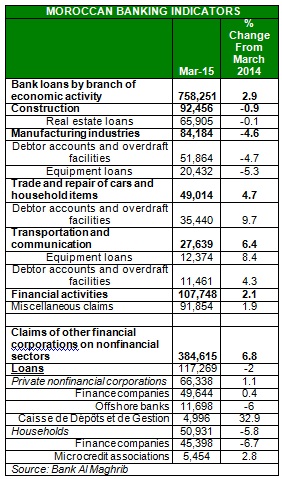

The slowdown in Moroccan bank loans reflects a sharper drop in financial loans from 0.8 to 4%, Bank Al Maghrib said in a recent report. Loans granted by other financial corporations to non-financial units also recorded a sharp drop in the first quarter in the domestic economy, the bank noted.

The feature was produced by alifarabia.com exclusively for zawya.com.

Zawya 2015