The headlines that captured the news scene this week, affecting the financial markets was Britain's referendum on EU membership. The potential exit together with the Fed's meeting in which the Fed had decided not to raise interest rates for some time, coupled with the fall of crude oil prices from its highs, all had a negative impact on investors' buying appetite, hence prompting caution for investors. According to alternative asset management and advisory firm Al Masah Capital's weekly investment report, this lack of positive triggers, coupled with weak crude oil prices will most probably pressure volumes more and keep them low during Ramadan and the holiday season.

Two major pieces of news this week highlighted interesting activities on the regional front. The National Bank of Abu Dhabi and First Gulf Bank said they're in talks to merge in a deal that would create the largest lender by assets in the Middle East and Adeptio AD Investments SPC Ltd., the group led by Alabbar stated that it agreed to buy Kuwait Food Co. shares from its majority stockholder for USD 2.36 billion.

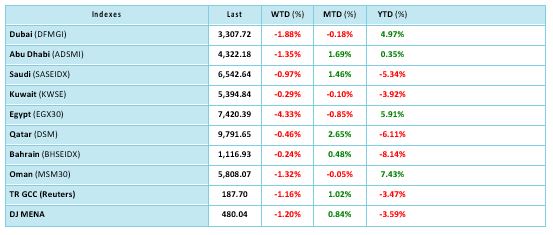

The negative news won over the week with most of the indexes ending the week in the red, with Dubai down by almost 2%, Egypt 4%, Saudi .97%, and Qatar .46%.

-Ends-

About Al Masah Capital

Al Masah Capital is one of the fastest growing alternative asset management and advisory firms focused on the MENA and SEA regions. Established in 2010 Al Masah Capital provides tailored solutions to a broad investor base, offering private equity advisory (across Healthcare, Education, Food & Beverages, Logistics and other consumer driven sectors), asset management, corporate and real estate advisory as well as public market research services.

With operations in Dubai, Abu Dhabi and Singapore, Al Masah advises qualifying investors on growth opportunities in 13 focus markets in MENA and South East Asia.

For further information, please log on to www.almasahcapital.com

For more information, please contact:

Krishika Mahesh/Aser Ismail: Krishika@matrixdubai.com / Aser@matrixdubai.com

© Press Release 2016