London and Abu Dhabi: Al Noor Hospitals Group Plc. (ANHA.L; the 'Company' or 'Al Noor' or 'Group'), the largest private healthcare service provider in Abu Dhabi, today issued its Trading Update for the period 1 January 2015 to 12 May 2015, including a summary of key financial highlights for the three months to 31 March 2015.

Key Financial Highlights for 3 months to 31 March 2015

Highlights

- Al Noor continued to perform in line with management's expectation in Q1 2015, demonstrating strong revenue growth and stable EBITDA margins.

- In line with the Group's growth plans, our new medical centre at the Emirates Nuclear Energy Company (ENEC) power plant has started trading and is contributing to volume growth. The Group continues to make progress on medical centres in Sharjah, Abu Dhabi City, and Al Ain and expects to open them in the second half of this year.

- Al Noor continues to remain debt free with a strong net cash position of US$ 93.7m allowing the Group to continue exploring further acquisition opportunities.

Ronald Lavater, CEO, Al Noor Hospitals Group Plc. said:

"Our business for the first quarter has been in line with management's expectations and we continue to make good progress moving forward with our key initiatives to deliver sustainable returns and take advantage of our high-growth home market of Abu Dhabi. Furthermore, we continue to pursue our expansion plans into new markets and development of clinical services to achieve a robust 'continuum of care' for our patients."

Overview

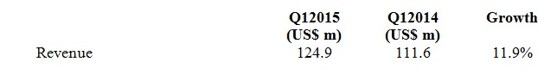

During the three month period ended 31 March 2015, Al Noor's revenue increased by 11.9% to US$124.9m, compared with the same period in 2014. Outpatient volume increased as expected with good growth contribution from new and acquired clinics. Inpatient volume increased as expected, with increases in Airport Road Hospital and Al Ain Hospital compensating for a reduction at the Khalifa Street Hospital, which continues to face increasing competition and temporary disruption from on-going refurbishments.

The company continues to closely monitor competitor activity and the impact of new facilities scheduled to open in our home market of Abu Dhabi in the second half of 2015.

On-going growth initiatives

As part of our growth plan, we continue to take up additional space in the Khalifa Hospital building, expanding our clinical services and planning for improved patient access on the ground and mezzanine levels. We are also continuing the outpatient clinic and inpatient room upgrades to enhance our patients' experience and grow volumes. For example, nine refurbished maternity rooms opened in April 2015 and quickly reached capacity with positive comments from patients.

Construction on the new hospital in Al Ain continues as planned. We expect to inaugurate the hospital in 2016.

The expansion of our medical centre network is also continuing as planned with the addition of four new sites in 2015 including our first centre in Sharjah, just north of Dubai, which is scheduled to open in the second quarter.

Management change

The Company's Chief Financial Officer, Pramod Balakrishnan, has resigned from Al Noor Hospitals Group to pursue an alternative opportunity. Mr. Balakrishnan will leave the Company on 31 July 2015 after completing his notice period. A search for his successor has begun and the appointee will be announced in due course.

Ian Tyler, Chairman of Al Noor added: "On behalf of the entire Board of Al Noor I would like to thank Pramod for his hard work and total commitment to the Company. Through his high standards and financial leadership he has made a very significant contribution. We wish him well."

Ron Lavater, CEO, added: "Pramod has been an important member of the senior leadership team and played a major role in the listing of Al Noor on the London Stock Market. Al Noor has a well-established leadership team which will work with the finance and accounting teams at each hospital and at the corporate level, until such time as a new CFO is appointed. I would like to personally thank Pramod for all his support and hard work."

Financial position

As at 31 March 2015, Al Noor was debt free and had US$93.7m of cash and bank deposits. As earlier stated, a dividend payment for 2014 amounting to US$15.6m (GBP9p per share) will be paid on 15 May 2015 to shareholders on the register on at the close of business on 17 April 2015.

Al Noor has a committed US$81.7m working capital and acquisition revolver facility that is unutilized and available for future use. There were no other material events or transactions that impacted the Group's financial position during the period.

For enquiries please contact:

Al Noor Hospitals Group plc.

Dr Sami Alom +971 2 406 6992

Brunswick Group

Jon Coles / Craig Breheny +44 20 7404 5959

Rupert Young / Jeehan Balfaqaih +971 4 446 6270

Cautionary statement

This Trading Update has been prepared solely to provide additional information to Shareholders to assess the Group's performance in relation to its operations and growth

Potential. This is an unaudited Trading Update and should not be relied upon by any other party or for any other reason. Any forward looking statements made in this document are done so by the directors in good faith based on the information available to them up to the time of their approval of this report. However, such statements should be treated with caution due to the inherent uncertainties, including both economic and business risk factors, underlying any such forward looking information.

© Press Release 2015