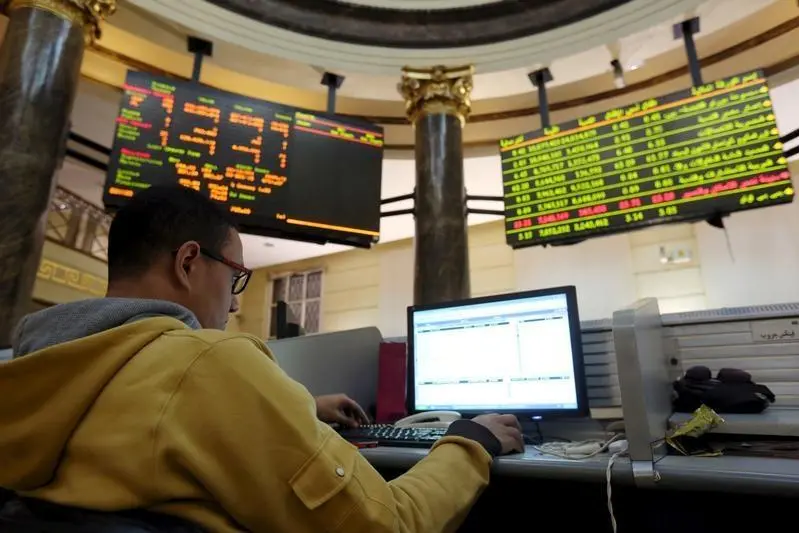

PHOTO

DUBAI, Sept 21 (Reuters) - Stock markets in the Middle East will likely trade cautiously on Wednesday as investors are reluctant to take fresh positions with international monetary policy taking centre stage and oil prices offering little impetus to push investors.

Global investor expectations are low that the Federal Reserve will raise U.S. short-term interest rates, but investors will listen closely to Chair Janet Yellen's speech on Wednesday for any hint that the U.S. central bank could hike rates as soon as December.

Japanese stocks rallied in volatile trade after the Bank of Japan decided to change its policy framework by adopting a target for long-term interest rates, ammending its purchases of exchange traded funds (ETFs) and maintaining the 0.1 percent negative interest rate.

Brent futures

In Saudi Arabia, the banking sector has been hit hard over the last several weeks and may continue to underperform as investors acutely assess the negative impact on lenders' bottom line from a bruised construction sector and a population hindered by futher austerity expected in the coming months.

"The recent misfortunes of the construction sector continue to weigh on banks and investors are concerned we could see an increase in banks cost of risk over the coming quarters," said Mohamed Eljamal, director of capital markets at Abu Dhabi's Waha Capital.

The main index

The exchange will be closed on Thursday in observance of the kingdom's national day holiday.

Qatar's index

(Reporting by Celine Aswad; Editing by Biju Dwarakanath) ((celine.aswad@thomsonreuters.com)(+9715 62247653)(Reuters Messaging: celine.aswad.thomsonreuters.com@reuters.net))

Global investor expectations are low that the Federal Reserve will raise U.S. short-term interest rates, but investors will listen closely to Chair Janet Yellen's speech on Wednesday for any hint that the U.S. central bank could hike rates as soon as December.

Japanese stocks rallied in volatile trade after the Bank of Japan decided to change its policy framework by adopting a target for long-term interest rates, ammending its purchases of exchange traded funds (ETFs) and maintaining the 0.1 percent negative interest rate.

Brent futures

In Saudi Arabia, the banking sector has been hit hard over the last several weeks and may continue to underperform as investors acutely assess the negative impact on lenders' bottom line from a bruised construction sector and a population hindered by futher austerity expected in the coming months.

"The recent misfortunes of the construction sector continue to weigh on banks and investors are concerned we could see an increase in banks cost of risk over the coming quarters," said Mohamed Eljamal, director of capital markets at Abu Dhabi's Waha Capital.

The main index

The exchange will be closed on Thursday in observance of the kingdom's national day holiday.

Qatar's index

(Reporting by Celine Aswad; Editing by Biju Dwarakanath) ((celine.aswad@thomsonreuters.com)(+9715 62247653)(Reuters Messaging: celine.aswad.thomsonreuters.com@reuters.net))