PHOTO

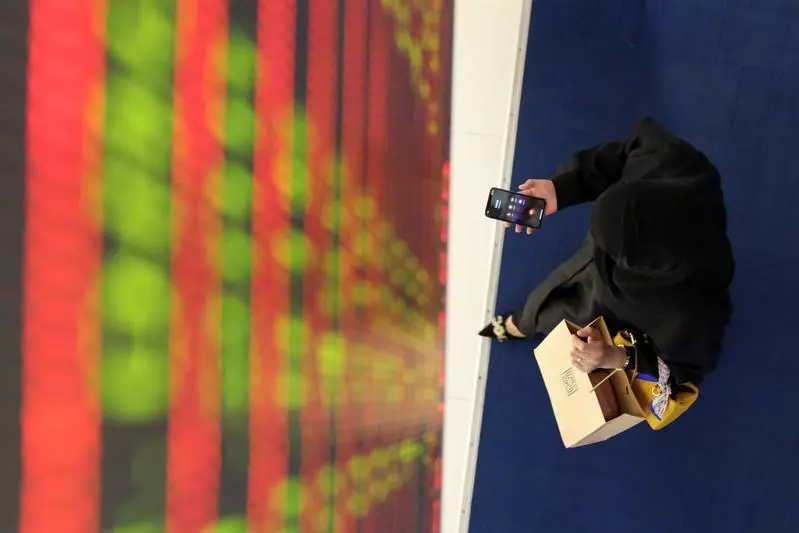

DUBAI - Here are some factors that may affect Middle East stock markets on Thursday. Reuters has not verified the press reports and does not vouch for their accuracy.

INTERNATIONAL/REGIONAL

* GLOBAL MARKETS-Stocks sell-off as coronavirus surge knocks recovery hopes

* Oil prices fall further on virus fears, U.S. crude stock build

* MIDEAST STOCKS-Saudi index retreats on haj curbs; Egypt outperforms

* PRECIOUS-Gold eases off multi-year peak as virus surge drives cash hunt

* U.S. puts sanctions on 5 Iranian ship captains for bringing oil to Venezuela

* EXCLUSIVE-U.S. warns Russia, China of U.N. isolation if Iran arms ban extension blocked

* ANALYSIS-No sweet victory for Assad as economy collapses and U.S. sanctions hit

* EU says engagement needed to build trust with Turkey after migration dispute

* As Lebanese pound crumbles, Berri urges 'financial state of emergency'

* APICORP sells $750 million in 5-yr bonds - document

EGYPT

* Egypt looking to sell majority stake in Arab Investment Bank, potential buyers say

SAUDI ARABIA

* IMF sees sharper than anticipated recession in Saudi Arabia

* Saudi inflation eases in May ahead of likely jump as VAT triples

* Saudi-led coalition deploys troops to monitor truce between Yemeni allies

* Saudi Cabinet denounces attacks by Yemen's Houthis on Saudi Arabia - SPA

UNITED ARAB EMIRATES

* UAE lifts coronavirus-related curfew - tweet

* DP World sells $1.5 billion in perpetual sukuk - document

* NMC administrators consider sale of international fertility business -sources

* UAE's flydubai to resume flights from July 7

QATAR

* BRIEF-Fitch Affirms Qatar At 'Aa-' Outlook Stable

(Compiled by Dubai newsroom) ((dubai.newsroom@thomsonreuters.com))