PHOTO

The MENA region saw a total debt issuance of $34.8 billion during the first quarter of 2021, up 61 percent from the same period in 2020. According to Refinitiv data, this is the best start to a year since records began in 1980.

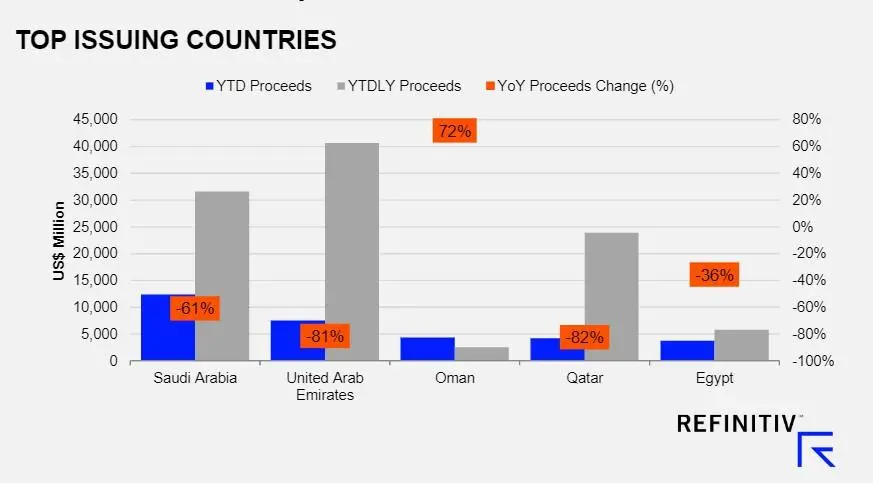

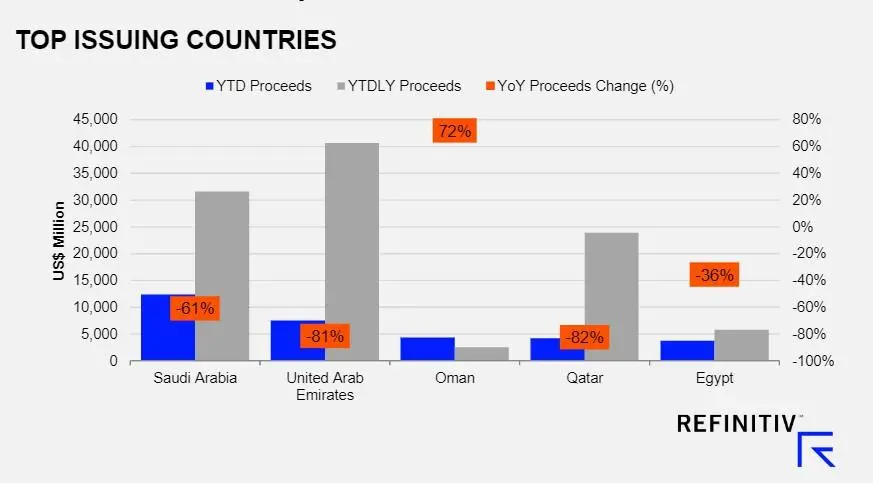

“We have seen a significant amount of issuance from the MENA region year-to-date (YTD). On the Sovereign side Saudi Arabia, Egypt, Oman, and Bahrain were the largest issuers. On the Corporates side, the issuance has been dominated by corporates from the UAE and Qatar,” said Sergei Strigo, Co-Head of EM Fixed Income at Amundi Asset Management.

Of this, 48 percent came from investment grade issuance which totaled $17 billion. Saudi Arabia and the UAE were the most active issuer nations with $12.3 billion and $7.5 billion in bond proceeds, respectively.

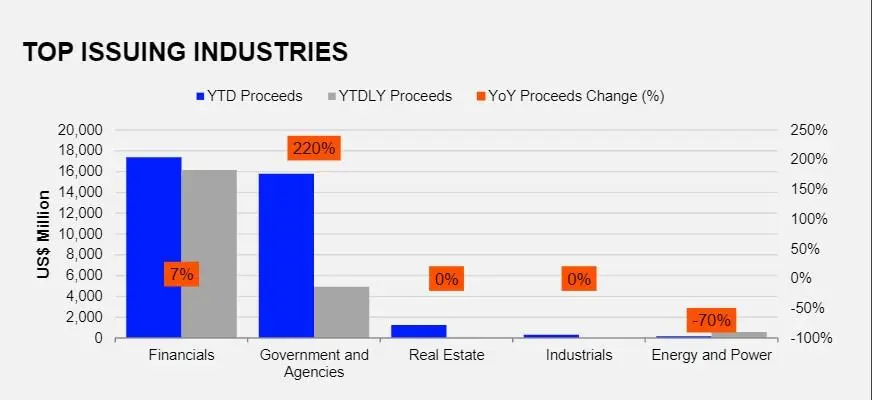

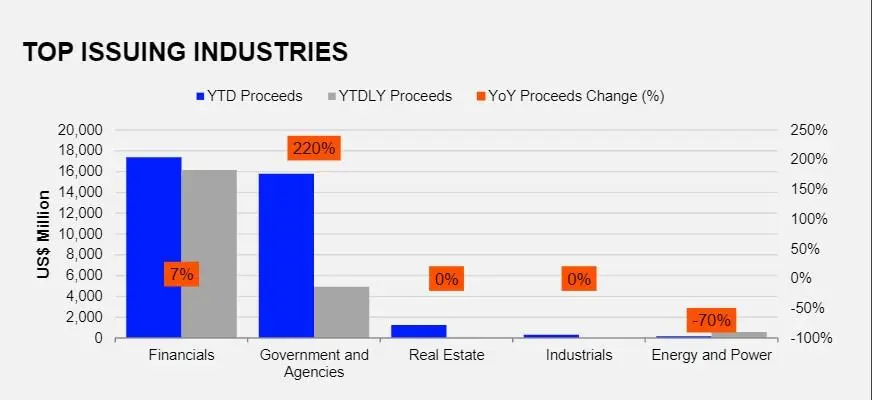

According to Refinitiv data, Financials led the issuances, with over $17 billion, which was 7 percent higher than issuances last year for the same period. Governments and agencies issued debt worth close to $16 billion, a three-fold jump year-on-year.

“We have seen more issuance coming from MENA Corporates YTD. On the Sovereign side the pace of the issuance was generally in line with market expectations. Part of the issuance is a regular and expected annual funding, but part of it clearly due to the larger fiscal need due to COVID-19,” Strigo said.

Issuers are also keen to lock in low interest rates considering possible increase in US treasuries over the next few months, he added.

Saudi Arabia’s bond sale in January this year of $4.9 billion was the largest MENA bond sale of the quarter.

The trend is expected to continue in the next quarters of 2021. According to Strigo, some of the larger Sovereign issuers should come to the market later this year.

“Among the Sovereign issuers we are seeing a mix of IG (Investment Grade) and HY (High Yield) names in 2021. On the HY side, both Oman and Egypt will probably issue more sovereign bonds. On the IG side, we would expect Saudi Arabia and the UAE to have larger issuance in the remainder of the year.”

Standard Chartered took the top spot in the MENA Debt Capital Market league table during Q1 2021 with $4.5 billion of related proceeds, or a 13 percent market share.

(Reporting by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021