PHOTO

The Federal Tax Authority (FTA) of the United Arab Emirates on Wednesday shed more light on a decision announced earlier this month to exempt the commercial trade in gold and diamonds from the new value-added tax introduced in January this year.

In a statement sent to media, the authority clarified that the exemption "only pertains to commercial transactions between registered dealers".

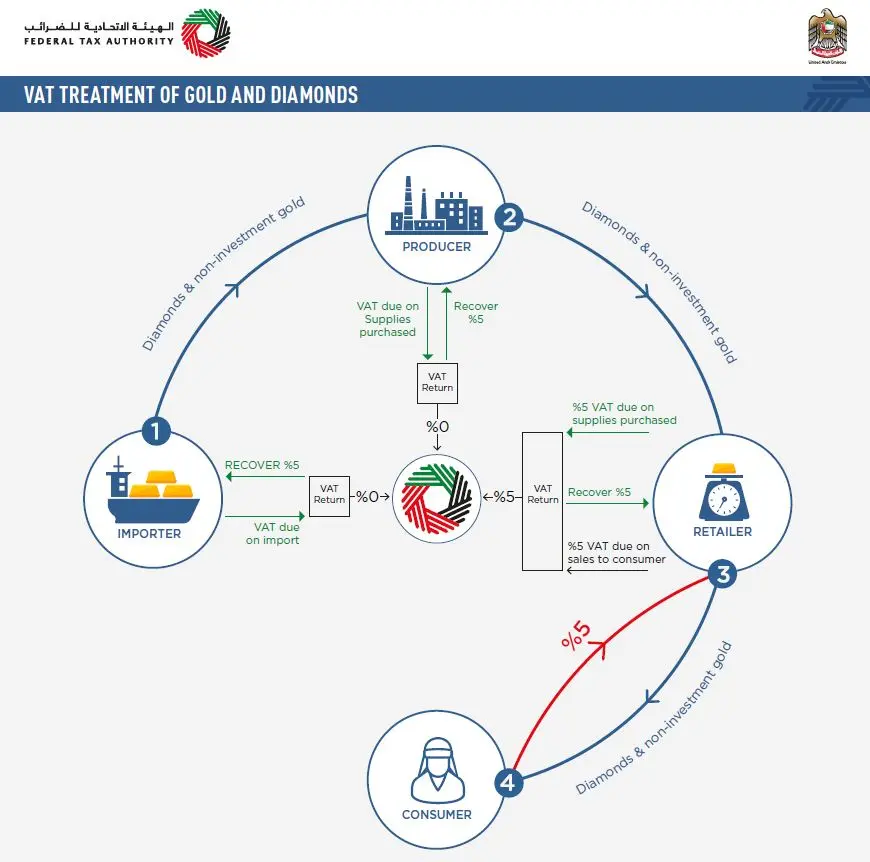

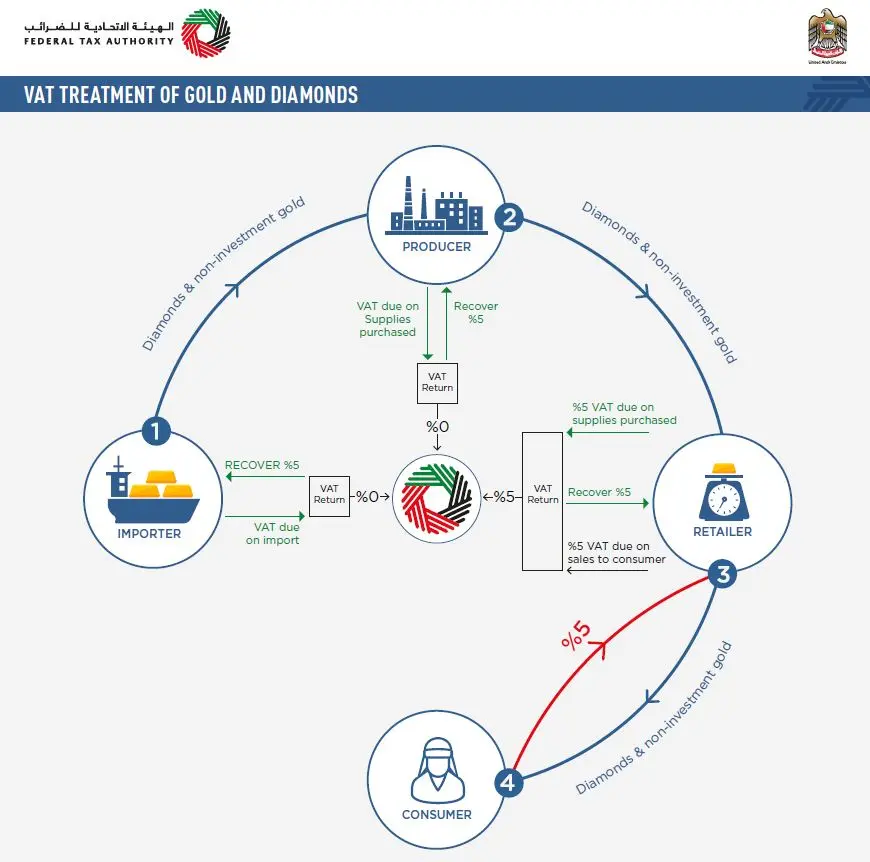

It said that under the reverse charge mechanism introduced as part of the UAE's VAT law, dealers that had registered with the authority did not need to charge VAT when supplying another tax-registerd merchant with either gold, diamonds, "or products where the principal component is gold or diamonds".

The recipient firm must declare the purchase in the VAT returns it submits to the authority, it added.

An accompanying document stated that the recipient “must be purchasing the goods in order to resell, produce or manufacture them into another product where the principal component is gold or diamonds”. The reverse charge mechanism does not apply to the supply of investment metals, or of products destined for export, which were already zero-rated under the law. Non-registered businesses will still need to pay the standard 5 percent VAT rate on gold and diamond purchases, it added.

Click on the image above to open a high-resolution PDF version in a new tab.

The exemption announced earlier this month was seen as a major boost to an industry whose livelihood had been threatened by the introduction of a value-added tax on the trade of goods that might have a high value, but may not always generate high margins through trading.

Dubai's Multi-Commodities Commodities Centre - the free zone in which much of the city's gold and diamond trading takes place - had not been granted designated zone status under the UAE's VAT Implementing Regulations, meaning that companies operating within it were liable for the standard 5 percent VAT rate.

In February, the DMCC's executive director of commodities, Sanjeev Dutta, told Zawya that it was still working with the government in a bid to secure designated zone status for the free zone.

The cabinet instead exempted VAT on the commercial trade of gold and diamonds, with the decision being announced by state news agency WAM on May 1.

In the statement issued yesterday, the FTA's chief executive, Khalid Al Bustani said the cabinet's decision "supports the local gold and diamonds sector, and ensures its stability and competitiveness”.

Companies operating within the gold and diamond industry generally welcomed the government's announcement, but some called for the exemption to be extended to the city's vibrant jewellery retail trade.

In an emailed statement sent to Zawya earlier this month, Firoz Merchant, founder of and chairman of the Pure Gold jewellery retail chain, said that there had been "a transitory impact" on business since the introduction of VAT on January 1.

"People have been focusing more on their needs rather than discretionary spend. We expect consumers to invest further into gold and diamond jewellery if VAT is relaxed at a retail level,” he said.

T S Kalyanaraman, chairman and managing director of Kalyan Jewellers, said in an emailed statement that the cabinet's decision "will surely make [the] wholesale jewellery sector in the UAE more competitive".

"However, VAT rule for the retail jewellery sector remains unchanged. We are hopeful that some amendment will be introduced in the near future to benefit the retail consumers,” he added.

Further reading:

- VAT-free gold to boost UAE market: analysts

- UAE's maritime industry seeking VAT exemption

- UAE jewellery industry, government in talks to levy VAT only on making charges

- Has VAT taken shine off gold?

- Commodities Outlook: Precious metals - all that glitters

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018