Arabian Centres Company (“Arabian Centres” or “the Company”) announces the successful completion of its Initial Public Offering (“IPO” or the “Offering”) of shares with the conclusion of the retail offering.

Following the completion of the institutional book building process, the one day retail offering took place on 9 May 2019. The retail offering saw 26,476 individual investors subscribe for 5,701,670 shares at the IPO price of SAR 26 per share, which represented 6.0% of the Offer Shares (as defined below).

The retail offering followed the completion of the institutional book building process. The book building process generated an order book of SAR 3.1 billion and resulted in a subscription of 126% of the Offer Shares (as defined below) as per the following breakdown:

- Public Funds, Private Funds and Discretionary Portfolios 57.1%;

- Non-KSA investors (including GCC investors, QFIs and non-resident investors through swap agreements) 16.7%; and

- Others (including Government Institutions, Private Companies, Financial Institutions and Authorized Persons) 26.1%.

Based on the results of the retail offering, the shares allocated to institutional investors will be scaled back to 89,298,330 shares excluding the Purchase Option (as defined below), representing 94.0% of the Offer Shares (as defined below). Final allocations and refunds (if any) will be processed on 14 May 2019.

Confirmation of Offer Details

- The price for the Offering has been set at SAR 26 per share, implying a market capitalisation on admission of SAR 12.4 billion.

- The Offering includes a total of 95,000,000 shares comprised of 65,000,000 existing shares to be sold by the current shareholders and 30,000,000 new shares to be issued by the Company by way of a capital increase (together the "Offer Shares").

- The Offering size is SAR 2.5 billion excluding the Purchase Option (as defined below) and total Offering size is SAR 2.8 billion including 12,825,000 Over-allotment Shares (as defined below) that have been allocated pursuant to the Purchase Option (as defined below).

- Immediately following admission, the Company is expected to have a free float of 20% of the Company’s enlarged issued share capital (prior to any exercise of the Purchase Option (as defined below) or 22.7% in the event of full exercise of the Purchase Option (as defined below).

- For the purposes of allowing Goldman Sachs Saudi Arabia, as stabilising manager (the "Stabilising Manager"), to cover short positions resulting from any over-allotments, FAS Real Estate Company (the "Over-allotment Shareholder") has granted the Stabilising Manager a purchase option (the "Purchase Option"), pursuant to which the Stabilising Manager may purchase additional shares up to a maximum of 12,825,000 shares, representing 13.5 percent of the total number of shares comprised in the Offering (the "Over-allotment Shares") at the offer price out of the initial maximum number of 14,250,000 over-allotment shares. The Purchase Option will be exercisable in whole or in part upon notice by the Stabilising Manager, at any time on or before the 30th calendar day after the commencement of dealings of the shares on the Tadawul (the “Stabilising Period”). Any shares made available pursuant to the Purchase Option will rank pari passu in all respects with the shares being sold in the Offering, including for all dividends and other distributions declared, made or paid on the shares, and will be purchased on the same terms and conditions as the shares being sold in the Offering and will form a single class with such shares.

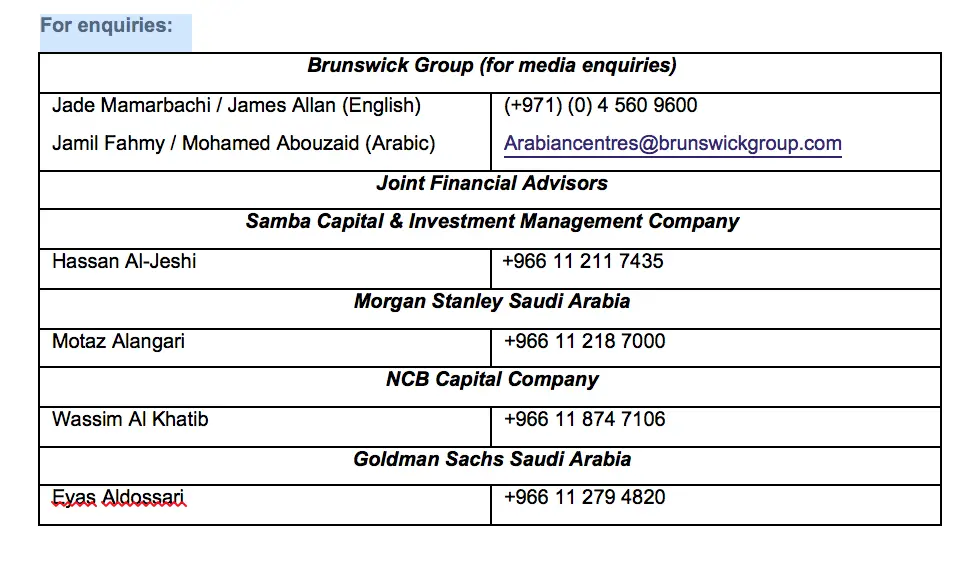

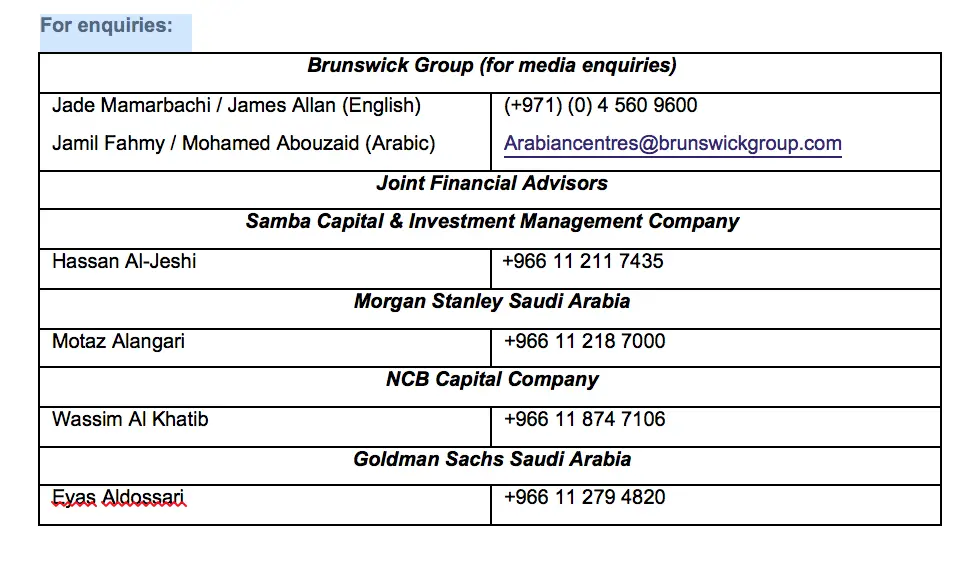

The Company has engaged Samba Capital & Investment Management Company, Morgan Stanley Saudi Arabia, NCB Capital Company and Goldman Sachs Saudi Arabia to act as Joint Financial Advisors and Joint Bookrunners, and appointed Citigroup Saudi Arabia, Credit Suisse Saudi Arabia, EFG Hermes KSA, Emirates NBD Capital KSA and Natixis to act as Joint Bookrunners in connection with the Offering. In addition, Samba Capital & Investment Management Company has been appointed as Lead Coordinator and Lead Manager. Furthermore, Samba Financial Group and National Commercial Bank acted as receiving agents for the retail offering.

For more information and for the prospectus, please visit the Capital Market Authority website www.cma.org.sa, Arabian Centers website www.arabiancentres.com or the websites of the Joint Financial Advisors (www.sambacapital.com) (www.morganstanleysaudiarabia.com) (www.alahlicapital.com) (www.goldmansachs.com/worldwide/saudi-arabia).

- Ends-

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.