PHOTO

- Lending growth more than doubled to 5 percent quarter-on-quarter (QoQ)

- Cost of Risk (CoR) decreased substantially and reached pre-pandemic levels

Dubai – Leading global professional services firm Alvarez & Marsal (A&M) in its latest Saudi Arabia Banking Pulse for Q1 2021 highlights that the top 10 Saudi banks have rebounded to deliver blockbuster first-quarter profit as the aggregate income increased substantially by 34.1 percent. The strong earnings are riding on the improving macroeconomic conditions, the Kingdom’s buoyant capital market, and a significant decrease in impairments.

In the traditional business of loans and deposits, the report indicates that growth in loans and advances (L&A) increased by 5 percent in Q1’21 while deposit growth slowed to 2.2 percent in the same period. The lending picked up on the back of mortgage financing in the retail sector driven by a variety of government initiatives to increase home ownership.

The Cost of Risk (CoR) across all the banks fell to its lowest level in the last five quarters from 1.3 percent in Q4’20 to 0.6 percent in Q1’21 and reached the pre-pandemic level. The total impairments declined by 50 percent as the banks saw a reversal of some bad loans that had previously been set aside during the Covid-19 pandemic.

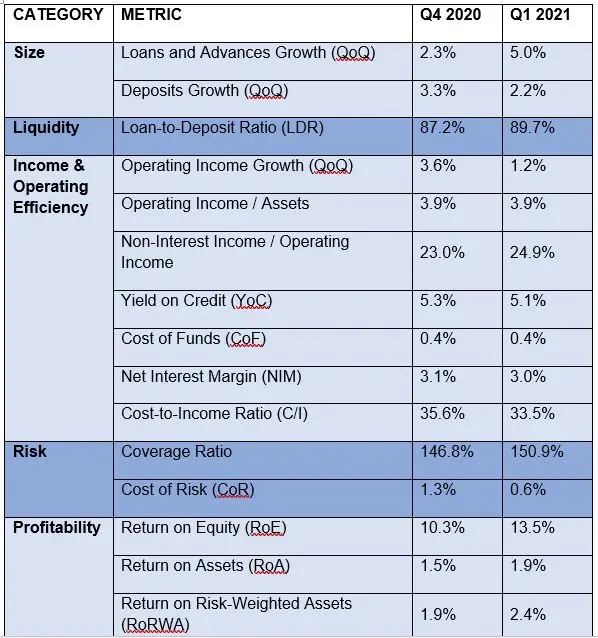

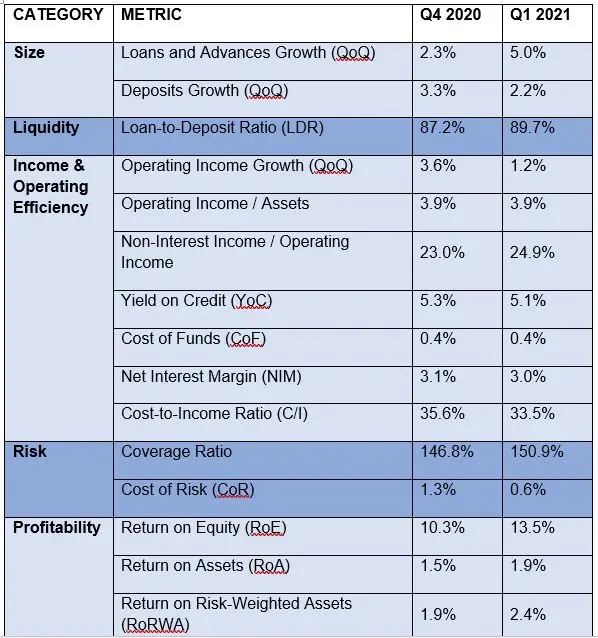

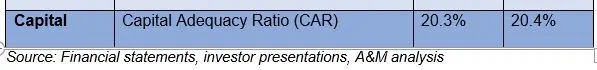

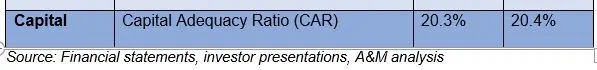

Authored by Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services, Alvarez & Marsal’s Saudi Arabia Banking Pulse, examines the data of the 10 largest listed banks in the Kingdom, comparing the Q1’21 results (Q1’21) against Q4’20 results. Using independently sourced published market data and 16 different metrics, the report assesses banks’ key performance areas, including size, liquidity, income, operating efficiency, risk, profitability and capital.

The country’s 10 largest listed banks analysed in A&M’s KSA Banking Pulse* are Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank, Saudi British Bank, Banque Saudi Fransi, Arab National Bank, Alinma Bank, Bank Albilad, Saudi Investment Bank and Bank Aljazira.

The prevailing trends identified for Q1 2021 are as follows:

- Aggregate loans and advances (L&A) of the top ten banks increased by 5.0 percent QoQ in Q1’21 while deposit growth slowed to 2.2 percent in Q1’21. L&A growth was driven by strong increase in mortgage lending (+20.2 percent QoQ). Consequently, loan-to-deposit-ratio (LDR) increased from 87.2 percent in Q4’20 to 89.7 percent in Q1’21. Eight of the top ten banks reported an increase in LDR.

- Aggregate operating Income increased for the third consecutive quarter. Total operating income increased by 1.2 percent QoQ (compared to 3.6 percent QoQ in Q4’20), as banks reported strong increase in their trading income.

- Aggregate net interest margin (NIM) decreased by 13 bps QoQ to reach its multi-period low levels of 3.02 percent, as system-wide rates continue to slide. Yield on credit decreased by 24 bps QoQ, while cost of funds remained largely unchanged at 0.4 percent. NIM for seven of the top ten banks witnessed contraction during Q1’21.

- The cost-to-income (C/I) ratio improved by 2.2 percent QoQ to 33.5 percent in Q1’21. Operating efficiency of KSA banks improved significantly, after deteriorating in the previous period. Aggregate operating expenses decreased 5.0 percent QoQ, while income increased by 1.2 percent during the same period. SABB saw the highest improvement in C/I ratio, decreasing from 60.5 percent in Q4’20 to 45.2 percent in Q1’21, as the bank realized synergies from its merger. Five of the top ten banks witnessed improvement in cost to income ratio.

- Cost of risk (CoR) has improved across all banks. Total provisioning decreased by about 50 percent QoQ, after rising sharply in Q4’20 leading to decrease CoR across all the banks from 1.3 percent in Q4’20 to 0.6 percent in Q1’21. Coverage ratio increased to reach 151 percent, which indicates that the Saudi banks are well covered for any potential asset quality risks.

- Return ratios increased in line with improved profitability levels. The aggregate net income increased by 13.1 percent QoQ, driven by higher operating income and lower operating expenses and provisioning. As a result, combined return on equity (RoE) increased from 10.3 percent in Q4’20 to 13.5 percent in Q1’21, highest in the last six quarters, reaching pre-pandemic levels.

OVERVIEW

The table below sets out the key metrics:

Mr. Ahmed commented: “Looking ahead, credit growth is likely to be driven by continuous strength in mortgage lending and a pick-up in corporate credit demand in H2’21, as the economic activity continues to improve. Corporate lending is expected to gain traction as the Public Investment Fund’s (PIF) plans to invest USD 40billion into the economy annually until 2025, to support business activity. Our outlook on cost of risk remains negative for the near term, as Saudi Central Bank’s loan deferral program comes to an end by H1’21.

‘Furthermore, as the NCB-SAMBA merger comes into effect, other domestic banks could also look to consolidate their position. This is because merged banks have stronger capital bases, know-how and can grab a larger share in major project financing.”

*Note

Following the completion of NCB’s and SAMBA’s merger, the top 10 listed banks in A&M’s KSA Banking Pulse universe has been modified to include The Saudi National Bank (the merged entity, SNB) and Bank Aljazira (BJAZ) instead of NCB and SAMBA, as the Pulse tracks the performance of the top ten banks by asset size. Hence, for consistency of comparison, all historical data has been adjusted to include SNB and BJAZ instead of NCB and SAMBA. The Q1’21 results of the new entity apparently include financials of NCB, as a standalone entity, as the merger came into effect in April’21. SAMBA’s and merged entity’s pro-forma financials are not available for Q1’21.

About Alvarez & Marsal

Companies, investors and government entities around the world turn to Alvarez & Marsal (A&M) for leadership, action and results. Privately held since its founding in 1983, A&M is a leading global professional services firm that provides advisory, business performance improvement and turnaround management services. When conventional approaches are not enough to create transformation and drive change, clients seek our deep expertise and ability to deliver practical solutions to their unique problems.

With over 5,400 people across four continents, we deliver tangible results for corporates, boards, private equity firms, law firms and government agencies facing complex challenges. Our senior leaders, and their teams, leverage A&M’s restructuring heritage to help companies act decisively, catapult growth and accelerate results. We are experienced operators, world-class consultants, former regulators and industry authorities with a shared commitment to telling clients what’s really needed for turning change into a strategic business asset, managing risk and unlocking value at every stage of growth.

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.