PHOTO

Muscat: Low growth forecasts for the current year weighed somewhat on sentiment among executives interviewed for the 2019 edition of the Business Barometer: Oman CEO Survey carried out by Oxford Business Group (OBG), although a plurality remained upbeat about the sultanate’s prospects, reflecting the much more promising outlook that both the World Bank and IMF have indicated for 2020.

As part of its survey on the economy, the global research and advisory firm asked around 100 C-suite executives from across the sultanate’s industries a wide-ranging series of questions on a face-to-face basis aimed at gauging business sentiment. The results are now available to view in full on OBG’s Editors’ Blog at: https://oxfordbusinessgroup.com/blog/billy-fitzherbert/obg-business-barometer/sultanate-aims-promote-growth-omani-business-leaders

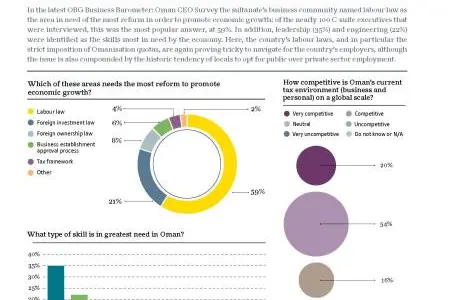

Almost half (47%) described their expectations of local business conditions as positive or very positive for the coming 12 months, down from 80% in OBG’s December 2018 survey. Considerably more business leaders responded favourably to Oman's current tax environment (business and personal), however, with 74% describing it as competitive or very competitive on a global scale.

On a separate issue, more than one third (35%) of those interviewed described Oman’s efforts to improve the ease of doing business as good, suggesting that the Royal Decrees issued in July approving new laws on foreign capital investment, privatisation, bankruptcy and public-private partnerships will be welcomed by the broader business community.

In a sign that business leaders are struggling with the extension of a ban on recruiting foreigners for key roles, 59% of those surveyed cited reforms to labour laws as the legislative changes they felt would be most effective in promoting economic growth. Leadership (35%) and engineering (22%) ranked first and second respectively as the skills executives thought were most needed to support growth, in another indication of the challenges recruiters face stemming from the sultanate’s Omanisation quota and a longstanding preference among locals for working in the public sector.

Regional political volatility remains the top external event that interviewees believe could impact the local economy in the short to medium term beyond the movements in commodity prices, chosen by 64% of interviewees, although there were also signs of the growing impact that China is having on the local economy. Demand in growth from the Asian giant was the response given by 12% of executives to this question, ahead of protectionism in trade (10%).

Commenting in his blog, Billy FitzHerbert, OBG’s Regional Editor for the Middle East, said that while Oman, and the region as a whole, was still recovering from the crash in oil prices five years ago, there were several bright spots to draw on.

“The imposition of fiscal reforms in the shape of the so-called sin tax that came into effect in June and the value-added tax, which is now likely to be implemented in 2020, bode well for government efforts to broaden revenue streams, and feed into the government’s wider goals of economic sustainability and a reduced reliance on hydrocarbons revenues,” he noted.

FitzHerbert said executives’ recognition of China’s growing role in Oman’s development reflected broader economic activity, most notably the investments being made by the Asian powerhouse under its Belt and Road Initiative.

Turning to business leaders’ evident frustration at some of the country’s labour laws, he acknowledged that the challenge presented both economic and social considerations. “The authorities are well aware of the need to better align public sector compensation with that of the private sector if this tendency is to be successfully curbed,” he said.

FitzHerbert’s in-depth evaluation of the survey’s results can be found on OBG’s Editor’s Blog,

titled ‘Next Frontier’. All four of OBG’s regional managing editors use the platform to share their expert analysis of the latest developments taking place across the sectors of the 30+ high-growth markets covered by the company’s research.

The OBG Business Barometer: CEO Surveys features in the Group’s extensive portfolio of research tools. The full results of the survey on Oman will be made available online and in print. Similar studies are also under way in the other markets in which OBG operates.

About OBG Business Barometer

OBG Business Barometer: Oman CEO Survey Copyright (c). All rights reserved.

This survey has been designed to assess business sentiment amongst business leaders (Chief Executives or equivalent) and their outlook for the next 12 months. Unlike many surveys, the OBG Business Barometer is conducted by OBG staff on a face-to-face basis, across the full range of industries, company sizes and functional specialties. The results are anonymous.

OBG Business Barometer is based on data from companies with revenue within the following parameters, among others:

- 77% of companies surveyed were private

- 53% of companies surveyed were local

- 9% of companies surveyed were regional

- 36% of companies surveyed were international

The data generated allows for analysis of sentiment within an individual country, as well as regionally and globally. Additionally, comparisons can be drawn between both individual countries and regionally. The results are presented statistically within infographics and discussed in articles written by OBG Managing Editors.

OBG provides this survey, infographics and accompanying analysis from sources believed to be reliable, for information purposes only.

OBG accepts no responsibility for any loss, financial or otherwise, sustained by any person or organisation using it. For further information on the content of the survey, please contact Billy FitzHerbert, Regional Editor, Middle East, at bfitzherbert@oxfordbusinessgroup.com. Should you wish to reproduce any element of this survey, infographics and accompanying analysis please contact: mdeblois@oxfordbusinessgroup.com. Any unauthorised reproduction will be considered an infringement of the Copyright. For further details about OBG and how to subscribe to our widely acclaimed business intelligence publication please visit www.oxfordbusinessgroup.com

Click here to subscribe to Oxford Business Group’s latest content: http://www.oxfordbusinessgroup.com/country-reports

About Oxford Business Group

Oxford Business Group (OBG) is a global research and advisory company with a presence in over 30 countries, from the Middle East, Asia and Africa to the Americas. A distinctive and respected provider of on-the-ground intelligence on the world’s fastest growing markets for sound investment opportunities and business decisions.

Through its range of products – Economic News and Views; The OBG Business Barometer CEO Survey; OBG Events and Conferences; Global Platform, which hosts exclusive video interviews; The Report publications – and its Consultancy division, OBG offers comprehensive and accurate analysis of macroeconomic and sectoral developments.

OBG provides business intelligence to its subscribers through multiple platforms, including its subscribers, CNKI, Dow Jones Factiva subscribers, the Bloomberg Professional Services’ subscribers, Refinitiv’s (previously Thomson Reuters) Eikon subscribers, and more.

For more information, please contact:

Marc-André de Blois

Director of PR and Video Content, Oxford Business Group

E-mail: mdeblois@oxfordbusinessgroup.com

802 Publishing Pavilion, Production City

PO Box 502 659 Me’aisem First Dubai UAE

T +971 4 426 4642

F +971 4 426 4641

6th Floor 105 Victoria Street

London SW1E 6DT

T +44 203 457 2825

F +44 17 3026 0274

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.