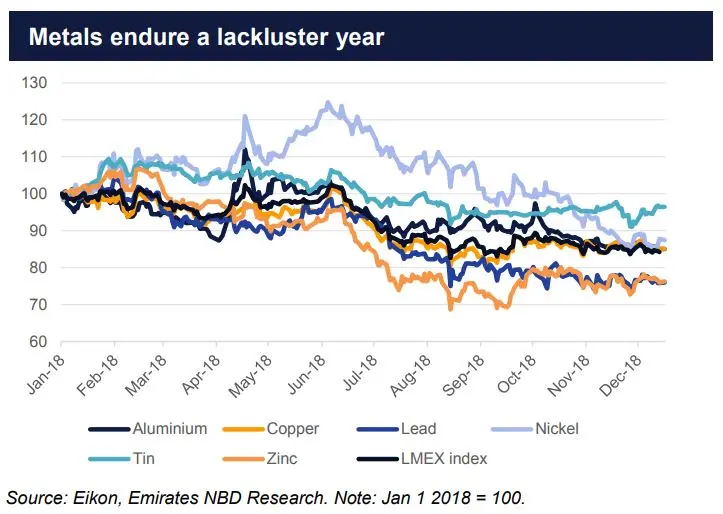

Industrial metals markets have endured a lackluster year, battered by concerns that a China-US trade war would dent demand and suffering from growing anxiety over economic conditions in major emerging markets. All of the major LME metals are on track to record a loss this year: the LMEX index has given up 16 percent year to date. Most metals have been trading in relatively well defined ranges for the last quarter of the year although all of them are within reach of 2019 lows.

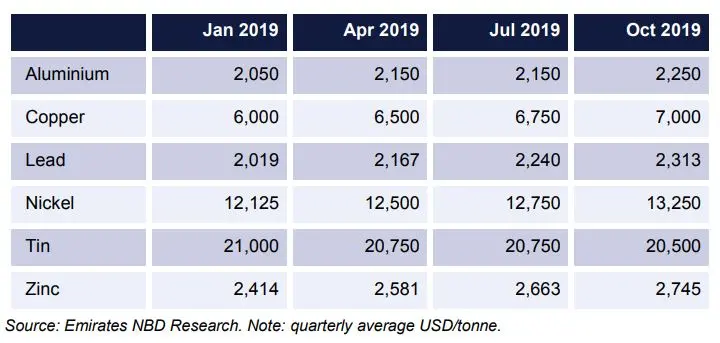

We had relatively cautious 2018 forecasts for the LME complex when we rolled out projections for all six metals and we have held reasonably close to our initial forecasts over the course of the year for all metals barring nickel. Our call on average LME 3mth copper at the start of the year was USD 6,462/tonne compared with a most recent forecast of USD 6,553/tonne and an YTD average of USD 6,563/tonne (less than a 2 percent divergence from our initial expectation).

Looking ahead into 2019 we have a positive view on most metals but note that Q1 2019 will be subject to enormous uncertainty. As a supportive factor we still see Chinese authorities stepping in to support the economy from slowing too rapidly even as concerns over local government debt haven’t dissipated.

But the dominant factor on the trajectory for metals will be the outcome of trade talks between the US and China. The trade war is on hold at least until March but while both sides have an incentive for a positive outcome to talks we can’t rule out negotiations breaking down and metals prices falling victim to mercurial tweets of the US president.

(Download a PDF of the full Emirates NBD report here).

Any opinions expressed here are the author’s own.

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© Opinion 2018