PHOTO

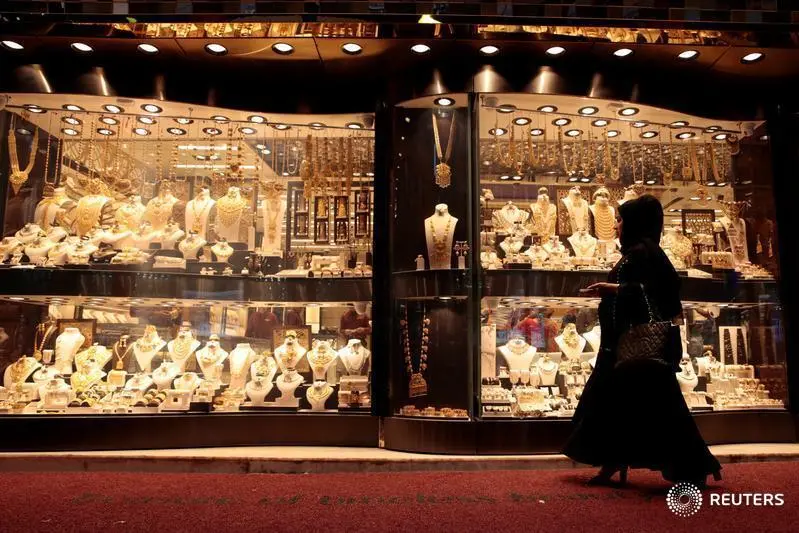

Retail prices across jewellery stores in the UAE jumped by 2 UAE dirhams ($0.54) per gram on Wednesday, as the bullion climbed to a seven-year peak of $1,612.62 an ounce, as traders and investors migrated from virus-exposed assets to traditional safe havens.

Gold jewellery prices in the UAE could soar further before the end of the first quarter this year on concerns of economic impact triggered by the novel coronavirus (COVID-19), a top jeweller told Zawya.

“Gold has already crossed the $1,600 mark. They are now expected to reach the next level of $1,650 an ounce,” Karim Merchant, group CEO and managing director of Pure Gold Jewellers, told Zawya.

Traders and investors are migrating to safe-haven or traditional assets amid concerns that the Wuhan coronavirus could have rippling effects on the global economy.

American tech giant Apple had warned investors early this week that it may fail to meet revenue targets for the first quarter as the virus is crippling production and reducing demand for its products in China. Apple’s warning sent investors offloading riskier assets in favour of the precious metal and other safe havens.

“[Apple’s] stark warning has quelled investor optimism over monetary policy easing from China and other major central banks, shielding the global economy from the detrimental impact of the virus outbreak,” Lukman Otunuga, senior research analyst at FXTM wrote in his latest analysis.

Global concerns

The virus has so far killed more than 2,000 people and the total number of individuals who have been infected has reached more than 75,600, according to media reports. Eight cases have been reported in the UAE. However, one of the infected patients, a 73-year-old Chinese national, has managed to recover from the illness.

Economic experts have warned that the spread of the virus could hurt the global economy.

[Related story: Coronavirus: Global economy, trade expected to take a big hit in H1 2020]

On Thursday, Oxford Economics cautioned that countries around the world could lose more than $1 trillion in income if the virus becomes a global pandemic. In the UAE, travel and hospitality operators said they are already feeling the impact of the virus, with guest numbers at restaurants and hotels dwindling as a result of the travel and flight restrictions imposed by authorities to stop the virus from spreading.

[Related story: China’s coronavirus impact: UAE’s travel, hospitality businesses fear impact]

Support for gold

According to Pure Gold’s Merchant, growing concerns about the virus could further prop up gold prices. “[The] price of gold always rises during times of panic and uncertainty. That is exactly what we are seeing currently,” he said.

He added that the bullion could hit as much a $1,650 an ounce, “given the current strong fundamentals for a price increase.”

Otunuga said the precious metal has gained more than 4.5 percent year-to-date and has the potential for further upside this week. He said Apple’s dismal forecast alone has “rekindled fears around the coronavirus outbreak and the negative impact it may have on the global economy.”

“[Gold] could push higher this quarter amid renewed global growth concerns and speculation around looser monetary policy,” he said.

(Reporting by Cleofe Maceda; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020