Dubai: Emirates NBD’s strong Q3 results, with net profit up 29% YoY, demonstrate financial resilience and the success of its diversified business model. Interest rates remain at record low levels, yet underlying business momentum is strong with record demand for retail financing. The Group’s balance sheet strengthened with further improvements in deposit mix, credit quality, capital and liquidity. Emirates NBD continues to support businesses and customers recovering from the global pandemic, while investing in its digital platform and its international network to drive future growth.

Key Highlights – Q3 2021

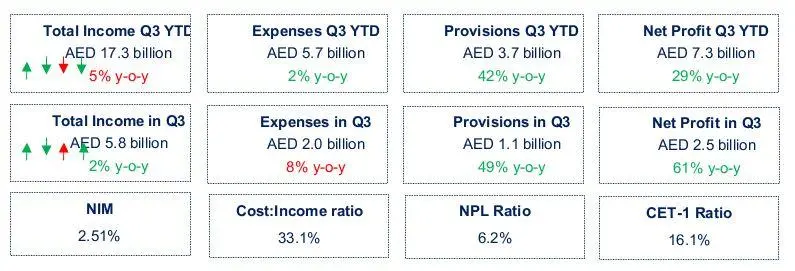

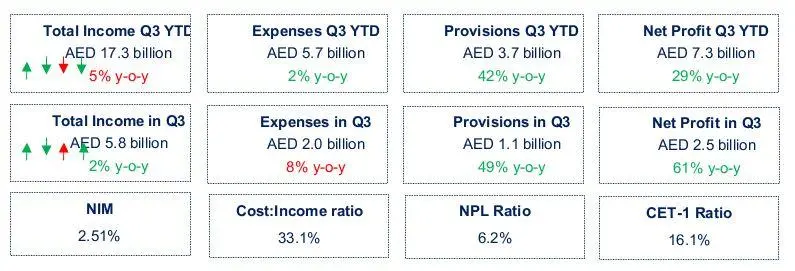

- Strong operating performance as loan mix improved on strong demand for retail financing, a more efficient funding base and a substantially lower cost of risk

- Total income up 7% on Q2 2021 as margins improved on record demand for retail financing, a more efficient funding base and a higher contribution from DenizBank. Down 5% y-o-y YTD from record low interest rates

- Expenses declined 2% y-o-y YTD with 33.1% cost-to-income ratio within management guidance

- Impairment allowances down substantially 42% y-o-y YTD, with 106 bps cost of risk at lower end of pre-pandemic range

- Resulting net profit jumped 29% y-o-y YTD to AED 7.3 billion

- Strong balance sheet and resilient profitability enable the Group to support customers and empower them to benefit from the continuing economy recovery

- Total assets: stable at AED 699 billion maintaining a strong asset base

- UAE’s largest lender: Customer loans at AED 438 billion with Q3 2021 a record quarter for demand for personal loans and credit cards

- Deposit mix: highest ever CASA balances, increasing by AED 30 billion YTD, positioning the Group very well for eventual rate rises

- Credit quality: NPL ratio improved by 0.1% to 6.2% with coverage ratio strengthening to 126.7% reflecting Group’s prudent approach to earlier credit provisioning

- Capital and Liquidity:2% Liquidity Coverage Ratio and 16.1% Common Equity Tier-1 ratio reflect the Group’s core strengths to support customers and create opportunities to prosper

- The Group is committed to supporting and adapting to customers’ changing needs by offering market-leading products and services, digital innovation and a superior customer experience while further expanding its international presence

- Customer support: AED 10.7 billion of support provided to over 127,000 customers

- Customer repayments: AED 8 billion of deferral support demonstrate the Group’s successful efforts in mitigating the financial impact on customers from Covid-19

- Social responsibility: Certified last month with the ISO 26000 international standard on Social Responsibility

- Advanced Analytics: Launched a state-of-the-art Advanced Analytics centre of excellence that will enable the Group offer our customers, people, and communities the personalized experiences they need to prosper

- Credit Rating: Moody’s improved Emirates NBD’s Outlook to ‘Stable’ and affirmed all ratings

- DenizBank Credit Rating: Moody’s upgraded DenizBank’s foreign currency deposit rating to ‘B2’ from ‘B3’

- Digital: digital bank continues to successfully expand; servicing more than 500,000 customers in the UAE and 80,000 customers in KSA

- International expansion: Received approval to expand India branch network with two further branches in Gurugram and Chennai

Hesham Abdulla Al Qassim, Vice Chairman and Managing Director said:

- “Emirates NBD’s growth in income and profitability in the third quarter of 2021 is a clear sign of improving economic conditions within the region.

- The UAE economy has fully reopened, thanks to the successful handling of the pandemic by the Country’s wise and visionary Leadership and is well positioned to benefit from the expected growth in international travel.

- As the Official Banking Partner of Expo 2020 Dubai, the Group is excited to showcase our pioneering vision for the future of global banking and spotlight the UAE’s investment potential.

- Emirates NBD is fully committed and aligned to the ‘Projects of the 50 plan’ to further develop the Emirati talent pool in the national workforce.’’

Shayne Nelson, Group Chief Executive Officer said:

- “Emirates NBD’s profits jumped 29% to AED 7.3 billion for the first nine months of 2021 as the strong economic recovery drove record demand for retail financing.

- The diversified balance sheet and solid capital base remains a core strength of the Group. We are using this strength to support our customers, empowering them to benefit from the growing economy as Expo 2020 Dubai begins.

- This strength is reflected in Moody’s recent affirmation of Emirates NBD’s ratings and improved ‘Stable’ Outlook, combined with the upgrade in DenizBank’s credit ratings.

- International expansion continues with additional branches in the Kingdom of Saudi Arabia, approval for further branches in India and strong results in Turkey. The Group continues to diversify with 36% of income now coming from international operations.”

Patrick Sullivan, Group Chief Financial Officer said:

- “There are many positives in the Group’s strong set of results. Total income rose 7% in the third quarter as margins expanded on an improved loan mix, lower cost of funding and a higher contribution from DenizBank.

- We continue to maintain a strict control on expenses with the cost to income ratio within guidance.

- The 106 bps cost of risk is at the low-end of the pre-pandemic range despite the Group maintaining the highest coverage level amongst its peers.

- The balance sheet remains rock solid with a further improvement in capital, liquidity and credit quality during Q3.”

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.