PHOTO

Most major Gulf markets rose on Sunday as financial shares climbed, with Saudi leading the gains, though Egypt was pressured by a sell-off in blue chip stocks.

Saudi's benchmark index ended up 0.7%, with Al Rajhi Bank rising 1.2% and Saudi Basic Industries gaining 0.9%.

State-owned Saudi Aramco inched up 0.1%. On Tuesday Aramco said Goldman Sachs may make additional purchases of the oil giant's shares to support the price of the stock. The so-called stabilisation period will end on Jan. 9.

But Arab National Bank lost 1.3%. Post trading hours, the lender's board proposed a lower second-half dividend.

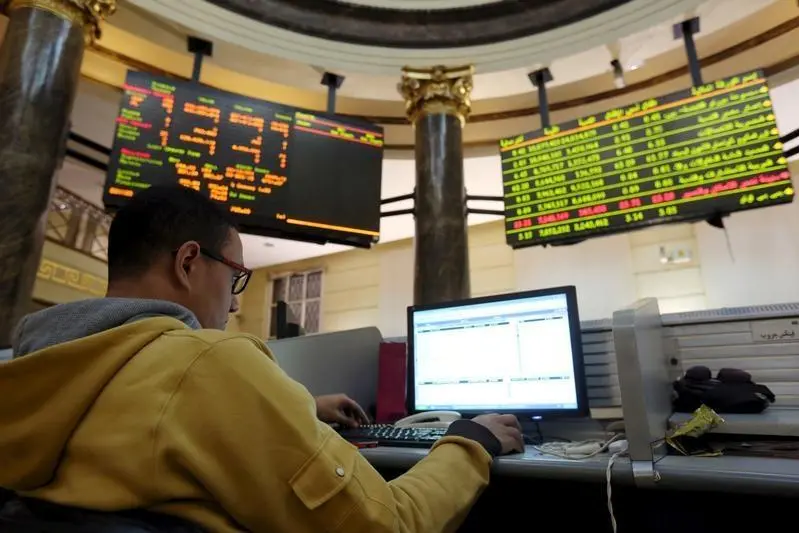

Outside of the Gulf, Egypt's blue-chip index declined 0.5% with 21 of its 30 stocks in the red, including Commercial International Bank, which was 1.3% lower, and EFG Hermes , down 2.1%.

Exchange data on Sunday showed foreign investors were net sellers of Egyptian stocks.

Dubai's index added 0.4%, with the United Arab Emirates' largest sharia-compliant lender Dubai Islamic Bank and Emirates NBD Bank increasing 1.1% and 0.8% respectively.

In Abu Dhabi the index climbed 0.4%, driven by a 0.4% rise in First Abu Dhabi Bank FAB.AD and a 0.6% gain in telecoms firm Etisalat.

The Dubai government will spend a record 66.4 billion dirhams ($18.08 billion) in 2020 as part of its budget, hiking outlays to stimulate the economy and support the Expo 2020 world fair, Reuters reported, citing state news agency WAM.

State spending will increase by 17%, compared with the original budget plan of 56.8 billion dirhams for 2019.

The Qatari index also closed down 0.1%, with Qatar National Bank, the Gulf's largest lender, dropping 1% and Commercial Bank shedding 1.1%.

($1 = 3.6730 UAE dirham)

(Reporting by Ateeq Shariff in Bengaluru; Editing by Jan Harvey) ((AteeqUr.Shariff@thomsonreuters.com; +918067497129;))