PHOTO

Last week, oil prices stayed neutral against the backdrop of the OPEC+ production policy announcement, and the ambiguous US statistics on crude inventories and its local output.

The 20th OPEC and non-OPEC ministerial meeting agreed to adhere to pre-approved plans to increase production by 0.4 million barrels per day, despite the August surge in coronavirus disease cases in Asia. The decision was expected, and did not lead to a significant impact on oil prices; few expected the alliance would slow the increase in production, and they had reasons to believe that, given the ongoing pandemic and a slowdown in the Chinese economy.

Indeed, the decision taken by the group appears very balanced. There are too many factors in the market that impact prices, from the short-term effects of Hurricane Ida in the US to the long-term deterioration of the COVID-19 situation in many major economies, which threatens the path of the oil demand recovery globally.

The calm nature of the meeting suggests that while some OPEC+ members are concerned about the prospects of demand in Asia and the US, they are not yet ready to discuss whether to suspend production increases. However, such a decision will certainly depend on the overall market dynamics and, more importantly, on the number of COVID-19 cases and economic data from key markets.

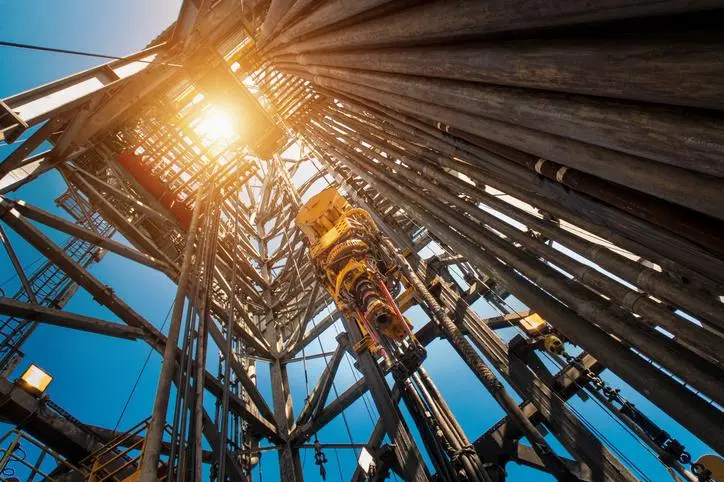

On the other hand, statistics from the US Energy Information Administration, published on Sept. 1, created a mixed impression. Even though on Thursday, Aug. 26, there were reports of evacuations of personnel from offshore platforms in the Gulf of Mexico, the weekly level of production increased to 11.5 million bpd.

Apparently, the increase in American production is significantly ahead of forecasts. At the same time, oil inventories fell by 7.2 million barrels against the expected decrease of 3.1 million, considering the growth in production and a slight decrease in net imports, it can be assumed that the fall is due to high demand. Indeed, the total supply of petroleum products rose to 22.8 million bpd. The average for four weeks increased to 21.4 million bpd — the maximum since September 2019.

Thus, EIA statistics show strong demand, but supply is also beginning to accelerate. At the same time, the dynamics in the next four months may be multidirectional. The high driving season is coming to an end, which may soften the demand for fuel, but production forecasts indicate growth. This can contribute to the widening of the spread between Brent crude and West Texas Intermediate.

At the same time, the climate situation in the Gulf of Mexico may act as an important factor. The US National Oceanic and Atmospheric Administration is predicting an active hurricane season, which could limit the Gulf’s production. That accounts for about 17 percent of all US oil production; if the forecasts are correct, the deficit in the US market will only worsen, and spur price growth to July highs.

For now, the short-term outlook for the market is positive. Brent is widely expected to be traded in the range of $70-$75 per barrel in anticipation of new drivers. Oil prices remain higher over the week, with Brent trading above $72.5 a barrel and WTI above $69.25 a barrel, driven by bullish US inventory and demand data, a weaker US dollar and the effects of Ida on production in the Gulf of Mexico. Moving forward, the focus will be returned to the uncertain demand outlook caused by the rapid spreading of the delta coronavirus variant, particularly in key markets.

• Dr. Namat Al-Soof is an Iraqi oil expert with long experience in upstream and market analysis. He held senior analyst positions at OPEC, IEF in Riyadh, and OPEC FUND for International Development. Currently, he is a consultant to a number of companies in the oil industry.

Copyright: Arab News © 2021 All rights reserved. Provided by SyndiGate Media Inc. (Syndigate.info).