PHOTO

- In April 2020, we saw 1,808 transactions recorded, despite being on full lockdown in April

- Dubai Land Department successfully managed to continue transacting properties digitally

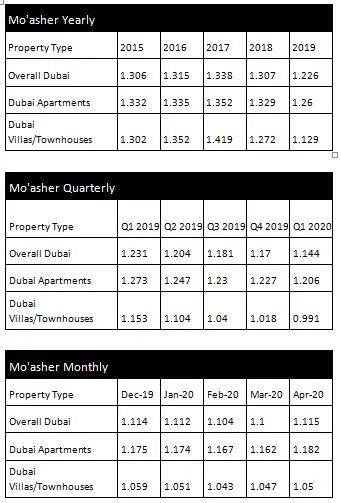

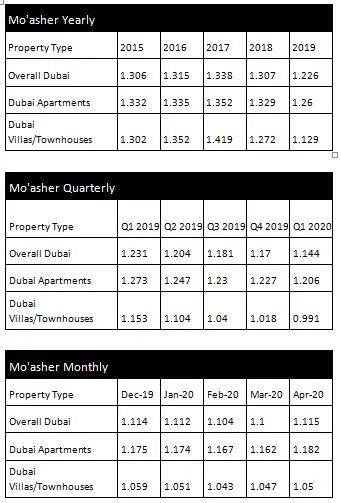

Dubai - Dubai Land Department (DLD), in partnership with Property Finder, launched the second edition of Mo’asher, Dubai’s official sales price index, working to improve and expand it to become an annual, quarterly, and monthly index that includes the Q1 2020 index and the monthly index for 2020 until April. The base year for Mo’asher is 2012, and the base month for the monthly index is January 2012 with the base quarter for the quarterly index is Q1 2012.

This new launch displays the history of how trends have changed over the past few years based on the data from Dubai Land Department, whereby Dubai registered a total of 40,517 sales transactions in 2019, representing a growth of 18 per cent in the volume of registered property sales transactions compared to 34,414 registered sales transactions in 2018.

Latifa Ibrahim Ahmed, Senior Director of Real Estate Studies & Research Department at DLD said: “We are pleased to present the second edition of Mo’asher in cooperation with our partners at Property Finder, especially as it is an official sales price index of Dubai’s real estate that aims to provide customers with the latest price updates. As the reliance on the relevant monthly data that is combined with data on the required real estate prices increases so would the importance of the indicator. The index includes tremendous market advantages as it provides all those interested with an overview of an in-depth market analysis and insight into how real estate prices in Dubai change during a particular month.”

Overview

Looking at the data quarterly, since the highs of Q2 2009 when the Dubai property sales market transacted 37,556 sales transactions, the next peak was during Q4 2013, with 20,935 sales transactions when the Dubai real estate market rebounded from the 2007 financial crisis, followed by Q1 2017 with 15,179 sales transactions. The only peak after 2017 was visible in Q4 2019 with 12,448 sales transactions where we started to see transaction volumes increase month-on-month due to the market picking up ahead of EXPO2020.

In H2 of 2019, we started to see sales volumes increase month-on-month. This trend continued until February 2020. In the first quarter of 2020, there was a 16 per cent rise in overall transactions compared to the first quarter of 2019, and February 2020 saw an enormous 40 per cent hike in transactions compared to February 2019.

In March 2020, we started to see a slight decline in sales transactions, in which 3,120 sales transactions were recorded, due to the implications caused by the global COVID-19 pandemic, and they continued to decline into April.

In April 2020, we saw 1,808 sales transactions recorded, despite the full lockdown, and Dubai Land Department successfully managed to continue transacting properties digitally and providing all of its services to its customers.

The most important results

The value of the sales price index in the residential sector was 1.115 in April 2020, while the average sales price index was AED 1,078,398, an increase of 11.5 per cent compared to the base year of 2012. In the second half of 2019, there was an increase in the volume of sales on a monthly basis, continuing this trend until February 2020. In the first quarter of 2020, there was a 16 per cent increase in the total number of transactions compared to the first quarter 2019, while February saw a massive 40 per cent increase in the number of transactions compared to February 2019. In March 2020, there was a slight decrease in the number of transactions, as 3,120 transactions were registered despite the exceptional situations that resulted from a global virus outbreak, and the decrease continued until April 2020.

“Comparing Q4 2019 and Q1 2020, the index value for Dubai overall decreased by 2.2 per cent, apartments have decreased by 1.7 percent and villas/townhouses decreased by 2.6 per cent,” said Lynnette Abad, director, research and data at Property Finder. “Comparing monthly March 2020 and April 2020, the index value for overall Dubai increased by 1.4 per cent, with apartments having increased by 1.72 percent and villas/townhouses by 0.3 percent.”

In conclusion, by relying on this index, investors can feel confident about the accuracy of the data provided by Mo’asher. It contributes to enhancing the transparency of the real estate market, with its ability to see the average sales prices, the average square foot price, and other important details.

To download Mo’asher, please visit the following links:

https://dubailand.gov.ae/en/studies/research/mo-asher-april-2020/#/

https://www.datafinder.ae/moasherapril

-Ends-

About Dubai Land Department:

Dubai Land Department (DLD) was founded in January 1960 to establish the most prominent real estate sector in the Middle East and the world. It provides outstanding and integrated services to all its customers while developing the necessary legislation to propel the real estate sector in Dubai through the regulation of the sector, organising and promoting real estate investments, and spreading industry knowledge in search of regional and worldwide real estate innovation.

DLD seeks regional and worldwide innovation in real estate with the aid of its active sectors that include real estate registration services, real estate investment promotions, and corporate support, and with the aid of its active organisations that include the Real Estate Regulatory Agency, the Dubai Real Estate Institute, and the Rental Dispute Centre.

Unified Toll Free Number:

In order for Dubai Land Department to provide the best possible service in a rapid manner and to ensure the comfort and happiness of our customers, it has activated a new toll-free call centre number [8004488]. This can be used for all Dubai Land Department and Rental Disputes Centre enquiries.

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.