PHOTO

The performance of Middle East stock markets was mixed last year, as volatility in global markets and oil prices weighed on investor sentiment across the world and on stock markets in the region.

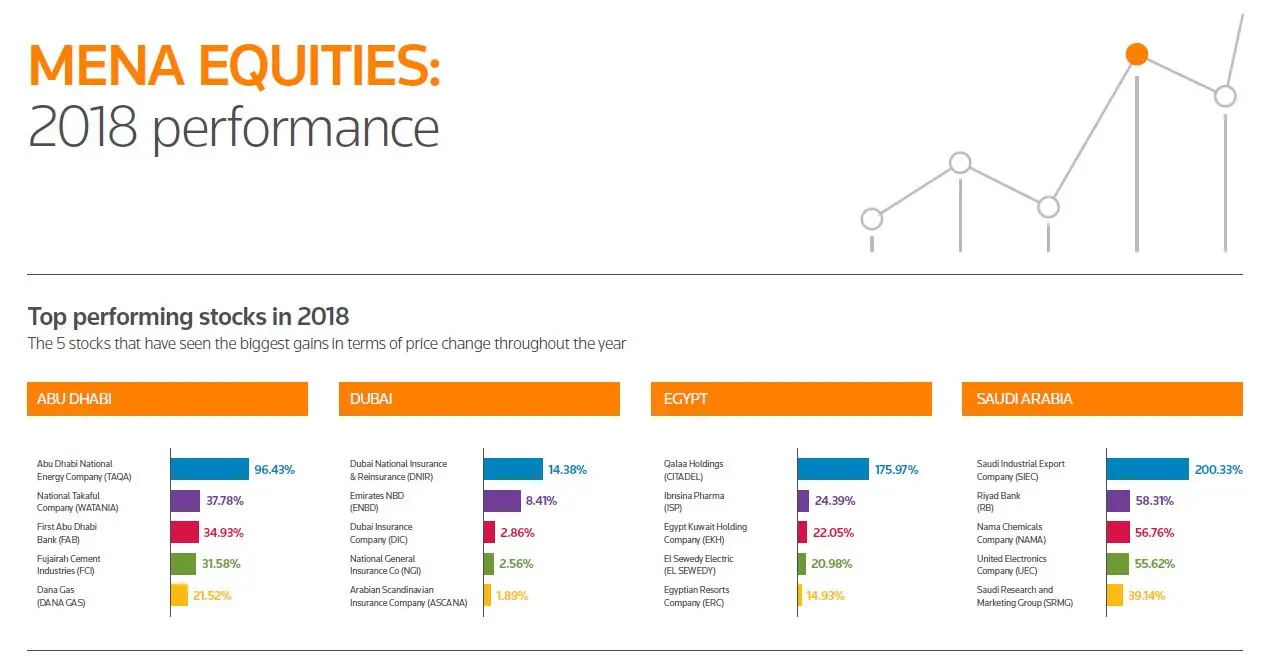

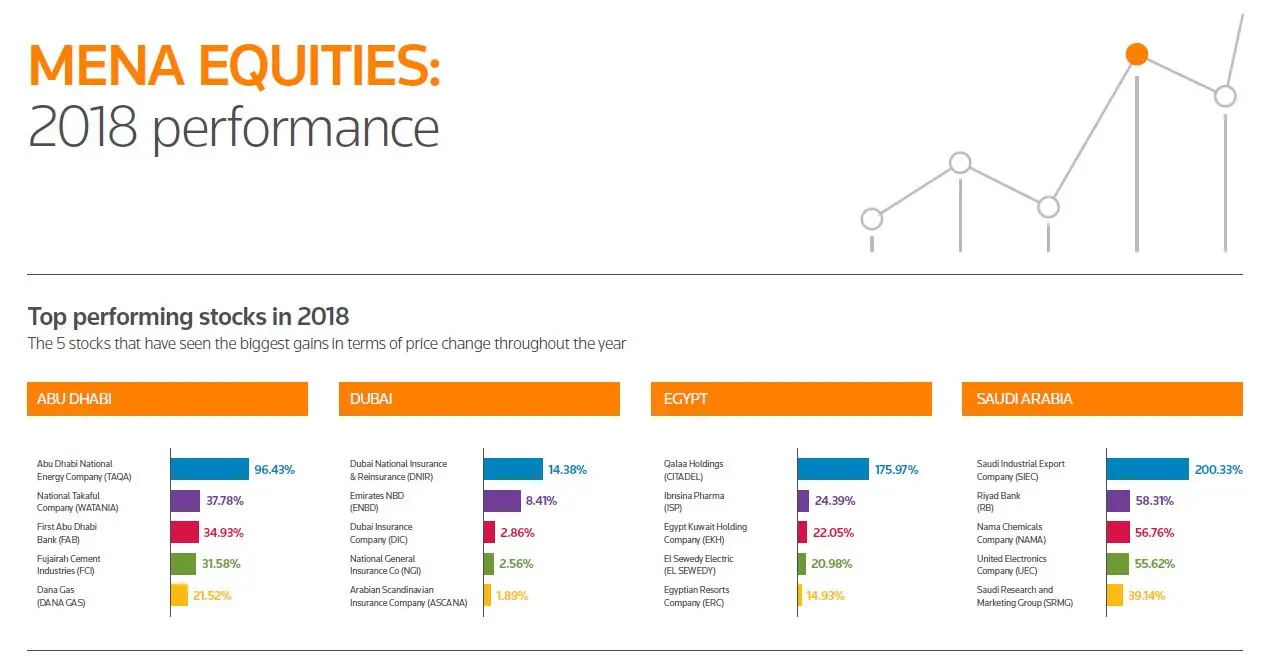

Click on the image above to open a high-resolution PDF version in a new tab.

However, given that the MSCI World index of the 23 biggest stock markets dropped by 10.4 percent in 2018, and that the MSCI Emerging Markets Index fell 16.6 percent, a 12.1 percent growth in value of the MSCI GCC index indicates a significant outperformance - the market capitalisation of the seven GCC stock markets increased to just over $1,103 billion, from $951.2 billion at the end of 2017.

Yet this aggregated index markets marks stark differences in performance by GCC equity markets last year. (Read more here).

The Qatar market led the way in 2018, finishing the year more than 20 percent higher in value terms. Its growth was spurred by foreign ownership limit increases in many of its major financial institutions. As a result, the market's biggest gainers were mainly banks, with Qatar Islamic Bank's shares up 56.5 percent and Qatar National Bank up 53.4 percent. (Read more here).

Saudi Arabia's stock market also gained in value by 8.4 percent, bolstered by announcements by index compilers FTSE Russell in March, MSCI in June and by S&P Dow Jones in July that the country's biggest stocks will feature in their global emerging markets indices from this year. Approximately $17 billion of passive investment flows are expected into Saudi stocks this year, with EFG Hermes anticipating a similar amount of active flows. Riyad Bank, which is the subject of a proposed merger with National Commercial Bank, was one of the market's main gainers. (Read more here).

Kuwait’s market momentum was also shaped by index inclusion. FTSE Russell had announced in September 2017 that it would upgrade Kuwait to secondary emerging market status in two phases - the first in September 2018 and the second in December 2018. This led to a spike in traded volumes at the end of the year. MSCI's announcement in June 2018 that it had placed Boursa Kuwait on a watchlist, which could lead to it announcing Kuwait’s upgrade in June, has also triggered speculative flows. (Read more here).

Bahrain's stock market just about finished in positive territory last year, edging up in value by 0.4 percent. It was among the few markets that also saw an increase in volume in 2018. (Read more here).

Positive investor flows into Saudi and Kuwait meant markets elsewhere in the Gulf struggled to attract (or even retain) investor interest.

The Muscat Securities Market declined in value by 15.2 percent, finishing the year with a market capitalisation of just $12.6 billion. The value of stocks traded also fell by more than one-fifth. (Read more here).

UAE markets, too, saw declines in volumes but the Abu Dhabi Securities Exchange (ADX) and the Dubai Financial Market (DFM) fared very differently in valuation terms.

Although the total traded volume of stocks on ADX dropped 26 percent last year, the performance of First Abu Dhabi Bank (which comprises just below one-third of the index, in value terms) was strong enough to provide an overall boost to the market. The ADX index finished the year 10.7 percent higher, and First Abu Dhabi Bank was its third-best performing stock, increasing in value by almost 35 percent.

For the Dubai Financial Market, however, 2018 was an annus horribilis. Traded volumes fell by 48.2 percent and the market was the worst-performing in value terms in the region. The DFM General Index closed the year 25.8 per cent lower, as real estate stocks took a pounding on the back of investor concerns about an oversupply of property markets. There has been some respite for the likes of Emaar Properties and Damac Properties so far this year, but both have a lot of lost ground to make up, having fallen by 37.5 percent and 54.7 percent in 2018. (Read more here).

Egypt’s equities market took off rapidly in 2018, and was the top performer by April, having posted gains of 20 percent. However, the country was impacted by the sell-off in emerging market assets sparked by subsequent interest rate rises in the United States. As investors withdrew cash from equities into money market instruments, the EGX 30 index of the market’s biggest stocks reversed and finished the year 13 percent lower.

This year has begun much more positively, with the government’s public enterprises IPO programme restarting through a stake sale in tobacco firm Eastern Company, and the interest rate cut by the central bank last month fuelling a revival of interest in equities. By close on Wednesday, March 6, Egyptian equities were up 13 per cent since the start of the year, according to Eikon data. (Read more here).

(Writing by Staff Writer; Editing by Mily Chakrabarty)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019