PHOTO

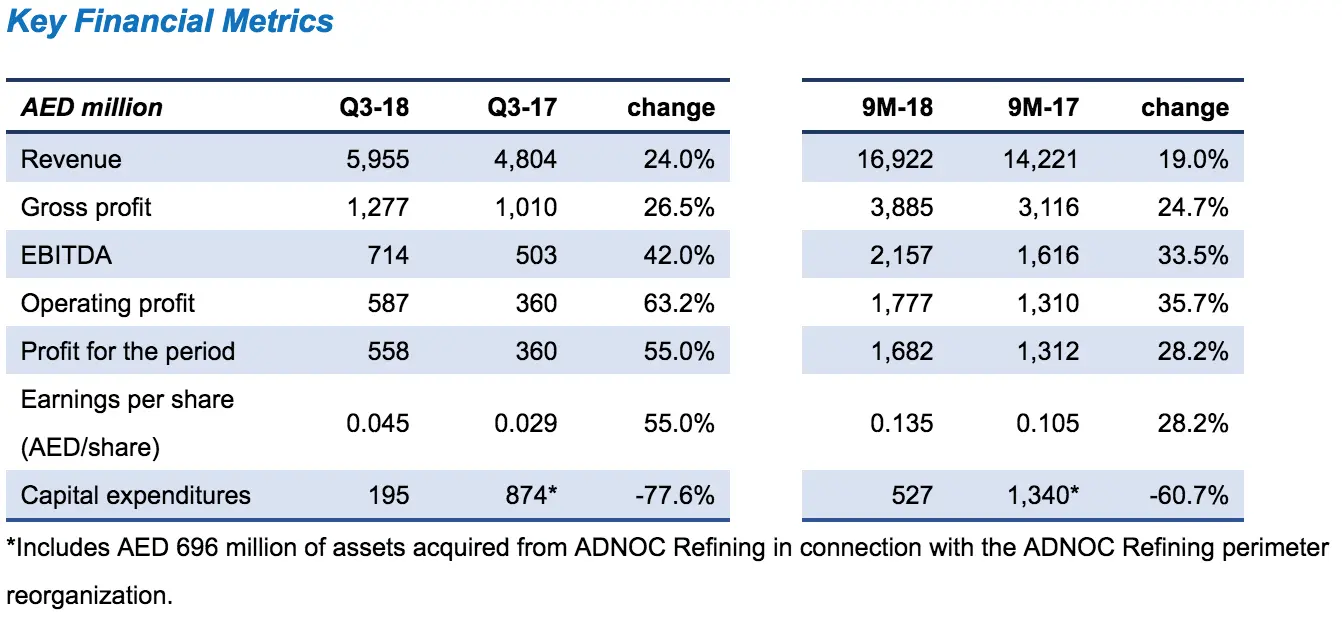

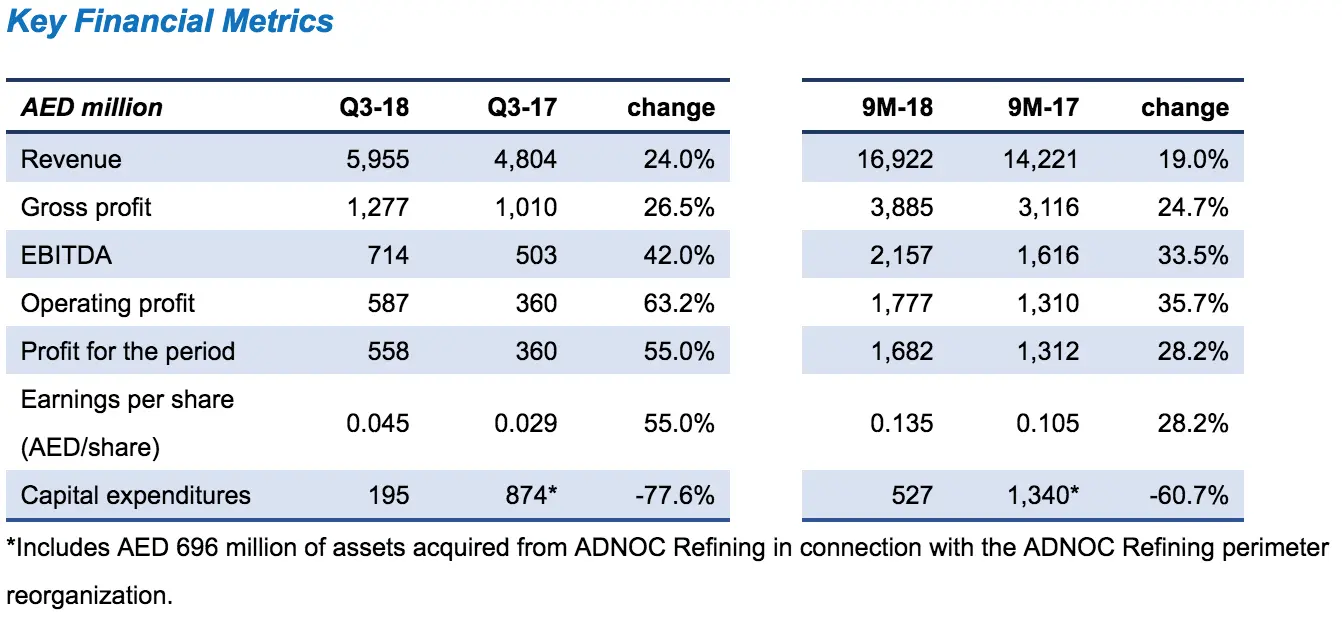

- 9M 2018 EBITDA of AED 2,157 million represents 33% year-on-year growth; 9M 2018 net profit of AED 1,682 million represents 28% year-on-year growth

- 3Q 2018 earnings per share AED 0.045, a year-on-year increase of 55%; 9M 2018 earnings per share AED 0.135, a year-on-year increase of 28%

- Continued cost focus underpins solid performance

- Strong free cash-flow generation

Abu Dhabi: ADNOC Distribution, the UAE’s largest fuel and convenience retailer, has reported that net profit for the nine months ended September 30, 2018, increased by 28% to AED 1,682 million compared with the same period last year. EBITDA grew by 33% to AED 2,157 million. Adjusted free cash-flow (EBITDA minus capital expenditures) generation was up 68% year-on-year to AED 1,630 million in the first nine months of 2018.

Year-on-year, the company has also shown continued momentum, with EBITDA margin for the nine months ended September 30, 2018, reaching 13%, up from 11% during the same period last year.

The company’s financial performance during the first nine months of 2018 remained resilient notwithstanding a 2.3% decrease in fuel volumes sold compared to the same period last year to 7,179 million liters.

The company’s convenience stores generated higher revenues driven by increased footfall and conversion rates in the third quarter compared to the second quarter of 2018. This was driven by management initiatives to improve the customer experience, including a more focused store revitalization program and the implementation of Flex Rewards, which offers Premium refueling rewards that may be redeemed in its stores convenience stores.

Commenting on the results, ADNOC Distribution Acting CEO Saeed Mubarak Al Rashdi said: “Our third quarter results confirm that we continue to deliver on our strategy, delivering and sustaining robust financial results through our focus on operational excellence, innovation, and cost efficiency. We have made significant progress across all three pillars of our strategy – fuel, non-fuel and cost-efficiency initiatives. I am pleased that our commitment to improve our customer experience by offering customers choice, convenience and better-quality products and services while also focusing on improving our financial performance has generated positive momentum and has led to the strong results we are announcing today.

“While we are continuing to strengthen our competitive positioning, we remain committed to our shareholders by pursuing our ambition to transform the company into a more performance-driven, commercially minded business and through our disciplined, return-driven capital allocation strategy.”

ADNOC Distribution's Deputy CEO, John Carey, added: “ADNOC Distribution continues to demonstrate strong and profitable performance supported by improved margins and a continued cost focus. We have seen good momentum across our businesses, led by a 54% increase in EBITDA in our Retail segment and a 3% increase in volumes sold by our Corporate Sales segment in the first nine months of 2018. We remain confident on the delivery of our business plan for 2018 and beyond, and are well on our way to making ADNOC Distribution a world-class fuels and convenience retailer.”

- Includes AED 696 million of assets acquired from ADNOC Refining in connection with the ADNOC Refining perimeter reorganization.

Our full Q3 2018 and 9M 2018 earnings announcement can be found at https://www.adnocdistribution.ae/en/investor-relations/investor-relations/

-Ends-

For media, please contact:

Tanya Hughes,

+97150 298 3295 or

media@adnocdistribution.ae

For investor relations, please contact:

IR@adnocdistribution.ae

About ADNOC Distribution

ADNOC Distribution, listed on the Abu Dhabi Securities Exchange (ADX) under the symbol “ADNOCDIST”, is the leading fuel distributor and convenience store operator in the UAE with an approximate 67% market share by number of retail fuel service stations, the largest market share in the wholesale segment, and the largest retail store network by number of sites. ADNOC Distribution operates 364 retail fuel stations and 241 ADNOC Oasis convenience stores as of 30 September 2018 in the emirates of Abu Dhabi and Sharjah, in each of which the Company is the sole fuel retailer, and in the emirates of Ajman, Fujairah, Ras Al Khaimah and Umm Al Quwain. ADNOC Distribution is also the leading marketer and distributor of fuels to commercial, industrial and government customers throughout the UAE, with a particularly dominant position in Abu Dhabi, and provides refueling and related services at seven commercial airports in the UAE.

To find out more, visit www.adnocdistribution.ae

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.