Kuwait – Kuwait Financial Centre “Markaz”, in its recent research report titled GCC Bonds & Sukuk Market Survey, has highlighted the trends pertaining to bonds and sukuk issuances in the GCC region during H1 2019.

The aggregate primary issuance of bonds and sukuk by GCC entities, including Central Banks Local Issuances, GCC Sovereign and Corporate Issuances, totaled USD94.79 billion in H1 2019, marginally lower (0.47%) from the total amount raised in H1 2018. Saudi entities were the top issuers in terms of total value issued.

GCC Central Banks Local Issuances (CBLI’s) decreased by 8.9% to USD29.77 Billion

Central Bank Local Issuances are issued by GCC central banks in local currencies and with short maturities for regulating levels of domestic liquidity. During H1 2019, a total of USD29.77 billion was raised by the GCC central banks, namely by the Central Bank of Kuwait, Bahrain, Qatar, and Oman. (The only publically available information is from the Central Bank of Bahrain, the Central Bank of Kuwait, the Central Bank of Oman, and the Central Bank of Qatar). The Central Bank of Bahrain raised the highest amount with USD11.96 billion (BHD 4.51 billion), representing 40.19% of the total amount raised by CBLIs through 44 issuances, followed by the Central Bank of Kuwait, which raised a total of USD8.13 billion (KWD2.47 billion).

GCC Sovereign and Corporate Bonds & Sukuk Market

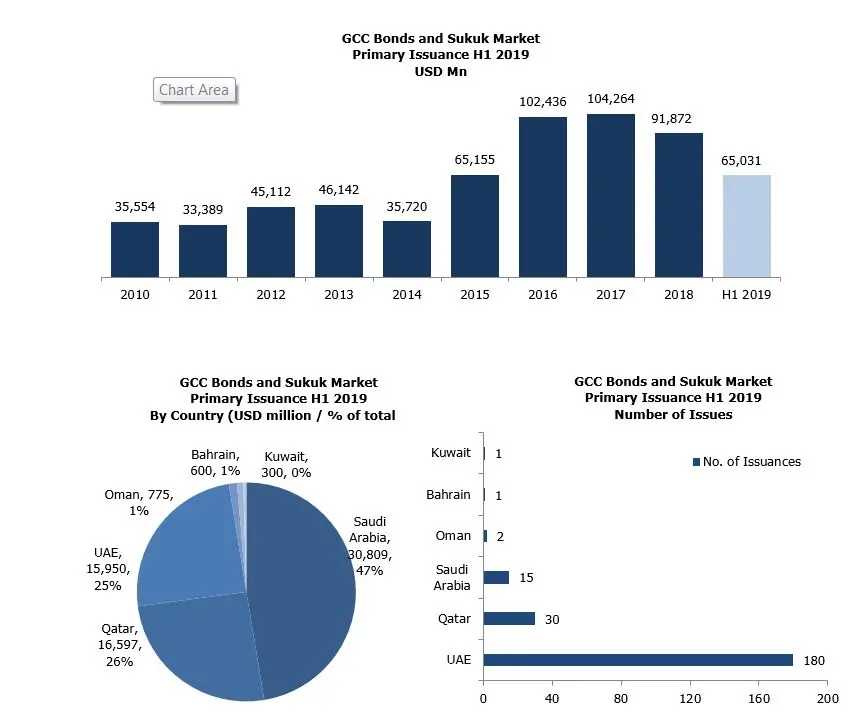

A total of USD65.03 billion was raised in the GCC sovereign and Corporate bonds and sukuk market in H1 2019, an increase of 3.94% from USD62.57 billion raised in H1 2018.

First quarter of 2019 recorded the highest value of GCC issuances with total value of USD 38.49 billion through 111 issuances, while a total of USD26.54 billion was issued in the second quarter through 118 issuances.

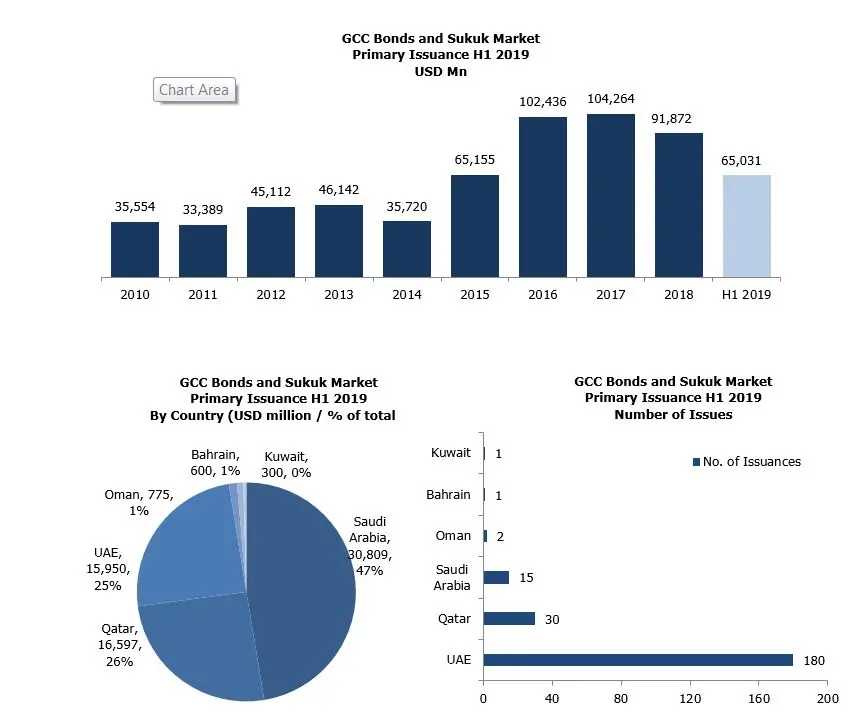

Geographical Allocation: Saudi Arabia based issuers led the GCC in H1 2019, raising a total of USD30.81 billion through 15 issuances and representing 47% of the total value raised in the GCC, followed by Qatar with 26% and UAE with 25%. Kuwaiti Issuers made up 0.46% of the primary market with a single issuance during H1 2019.

Sovereign Vs. Corporate: Sovereign issues contributed 60.2% to the overall market with a total value of USD30.13 billion as compared to USD37.68 billion in H1 2018. Total value raised by corporate entities in H1 2019 increased by 40%, to USD34.91 billion in H1 2019 from USD24.89 billion in H1 2018. Saudi Arabian Government raised USD16.93 billion out of which USD9.43 billion (SAR35.35 billion) was through domestic bonds and USD7.5 billion through US Dollar denominated Bonds and Sukuk. Government of Qatar issued bonds totaling to USD12 billion with maturities of 5, 10 and 30 years while Government of Sharjah issued USD1.2 billion in through two sukuks maturing in 2025 and 2026.

Conventional Vs. Sukuk: Conventional issuances were lower by 4.29% versus last year as it raised USD48.02 billion, representing 73.84% of the total amount raised. During H1 2019, Sukuk issuances raised USD17.01 billion, 37.21% higher as compared to USD12.40 raised in H1 2018 and represented a share of 26.15% of the market in H1 2019.

Sector Allocation: Government sector accounted for the largest amount raised during H1 2019, with USD30.13 billion representing 46.3% of the total amount raised as compared to USD37.68 billion issued in H1 2018. The Financial sector followed with USD20.1 billion (30.9% of total market) raised through 207 issues.

Maturity Profile: Issuances with tenures of more than ten years raised the highest amount, USD26.22 billion, through 35 issuances, representing 40.3% of the total amount raised. Issuances with maturities less than 5 years represented 32.8% with USD 21.35 billion.

Issue Size Profile: The sizes of GCC bonds and sukuk issuances during H1 2019 ranged from USD5 million to USD6 billion. Issuances with principle amounts greater than or equal to USD1.0 billion raised the largest amount – USD47.54 billion, representing 73.10% of the total value.

Currency Profile: US Dollar denominated issuances lead the GCC Bonds and Sukuk market, raising USD50.5 billion (77.66% of the total amount raised) through 137 issuances. Followed by issuances in Saudi Riyal raising USD9.55 billion (SAR 35.85 billion) through 6 issuances and represented 14.70% of the total amount raised.

Rating: During H1 2019, a total value of 77.8% of the Sovereign and Corporate issuances were rated by either one or more of the following rating agencies: Moody’s, Standard & Poor’s, Fitch, and Capital Intelligence - out of which 94.62% issuances had investable grade ratings.

Listing: During H1 2019, 59% of the total issuances or 136 GCC Bonds and Sukuk issuances, with an aggregate value of USD61.22 billion were listed on exchanges. Listing on international exchanges accounted for 92.06% with London accounting for the listing of 47 of such issuances.

Bonds and Sukuk Total Amount Outstanding in the GCC

As of 30th June 2019, the total amount outstanding of corporate and sovereign bonds and sukuk issued by GCC entities was USD528.95 billion. Government issuances made up 50.7% of the total amount. Financial sector led the corporates with a total amount outstanding of USD123.05 billion, or 23.3% of the total amount.

Of the amount outstanding as of 30th June 2019, USD217.41 billion, or 41.10% were issued by Saudi Arabian entities. Bonds and Sukuk by Kuwaiti entities represented USD20.56 billion, or 3.89% of the total amount outstanding.

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.16 billion as of 31st March 2019 (USD 3.80 billion). Markaz was listed on the Boursa Kuwait in 1997.

For further information, please contact:

Sondos Saad

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Tel: +965 2224 8000

Fax: +965 2246 7264

Email: ssaad@markaz.com

© Press Release 2019

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.