PHOTO

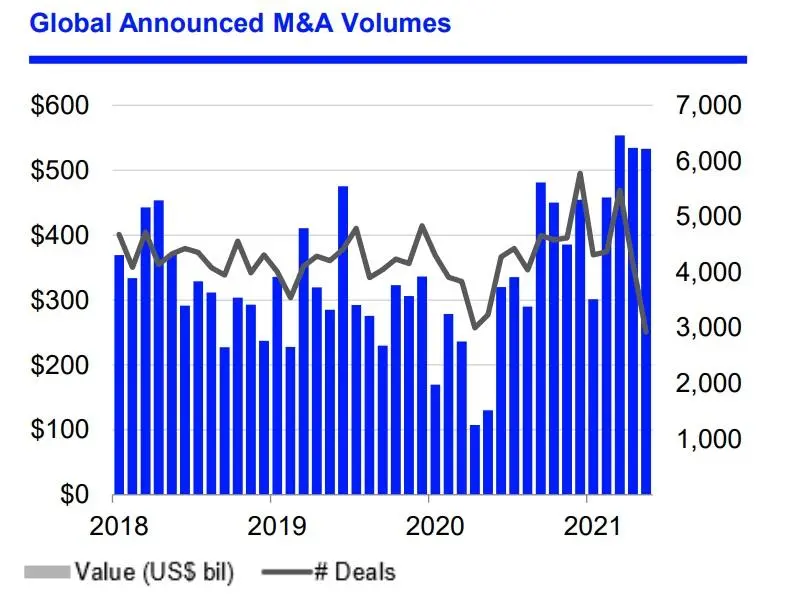

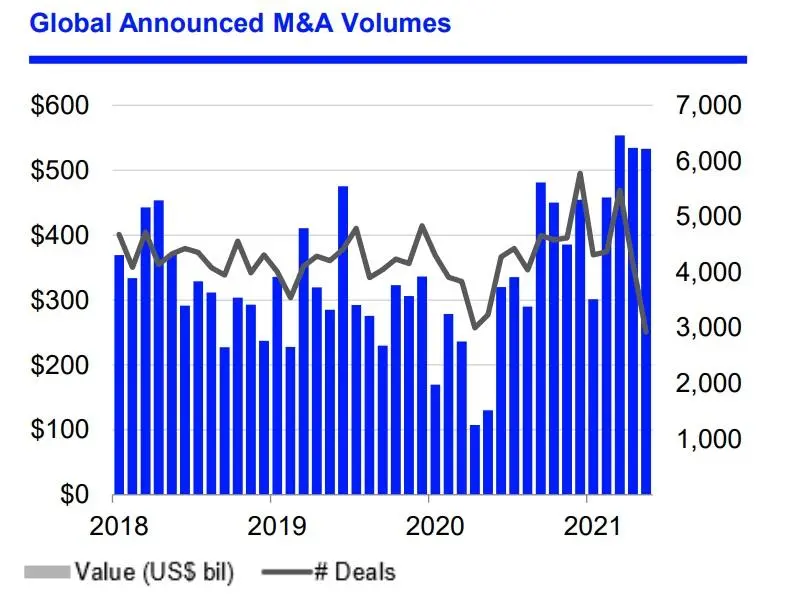

Despite the global economic disruption of 2020 due to the coronavirus pandemic, M&A deal makers on average, predict a 6 percent increase in activity this year, following on from an explosive start to the year.

According to Refinitiv data, the first five months of the year saw $2.4 trillion worth of M&A deals announced globally, 158 percent more than the same period last year. It’s the highest year-to-date total since records began in 1980.

In May alone $532.9 billion worth of deals were recorded, more than four-times the value recorded in the year-earlier period. This too was an all-time high.

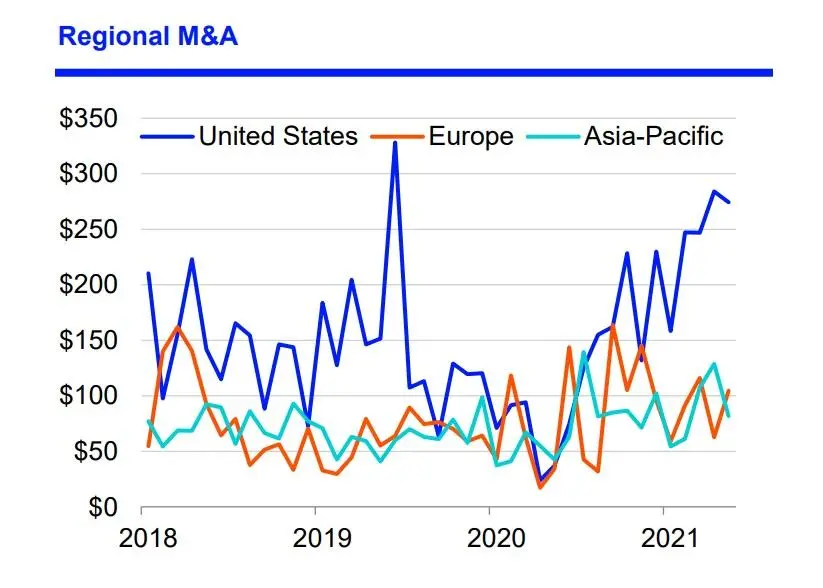

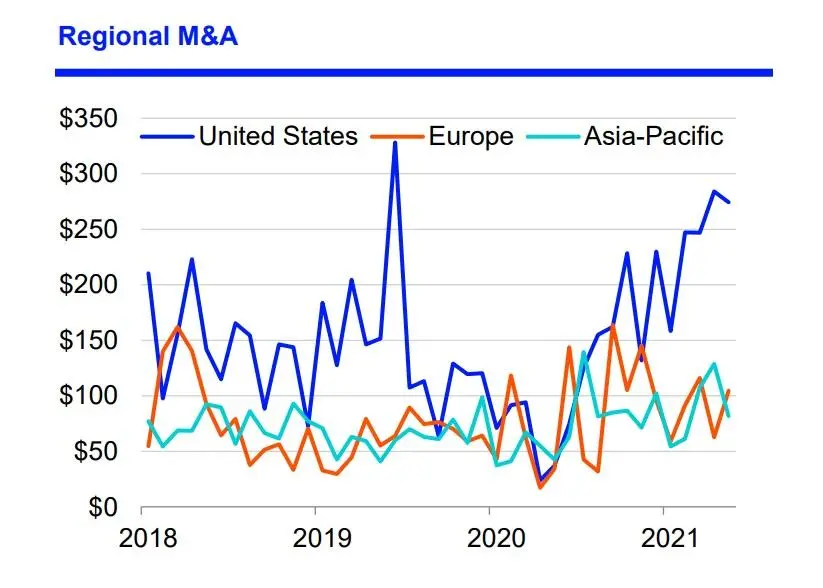

The value of US deals recorded during the first five months of 2021 is $1.2 trillion, more than three-times the value recorded during the same period last year and an all-time year-to-date high, according to Refinitiv data.

The Rise of SPACs

There were 28 SPACs (special purpose acquisition company) combinations announced globally during May 2021, the third highest monthly tally of all time, the data showed.

Year-to-date (YTD), 163 SPAC acquisitions have been announced, compared to just 14 during the same period last year. The combined value of these deals is $348 billion, almost 40-times the value recorded during the first five months of 2020 and an all-time YTD high.

Meanwhile a Refinitiv report titled: Deal Makers M&A predictions for 2021, said activity would continue the resurgence in the second half of 2020, which was 93 percent larger than the first half, and two remarkably large, back-to-back trillion-dollar quarters to close the year.

When deal makers surveyed were asked about the impact of COVID-19, more than half of M&A professionals expected the pandemic to increase activity, with just 12 percent expecting it to cause a contraction.

While there were many reasons given for corporate M&A, the prominent driver was ‘to recover losses and reduce risk’, as well as to protect profitability, cost effectiveness and business sustainability.

Tech and healthcare in focus

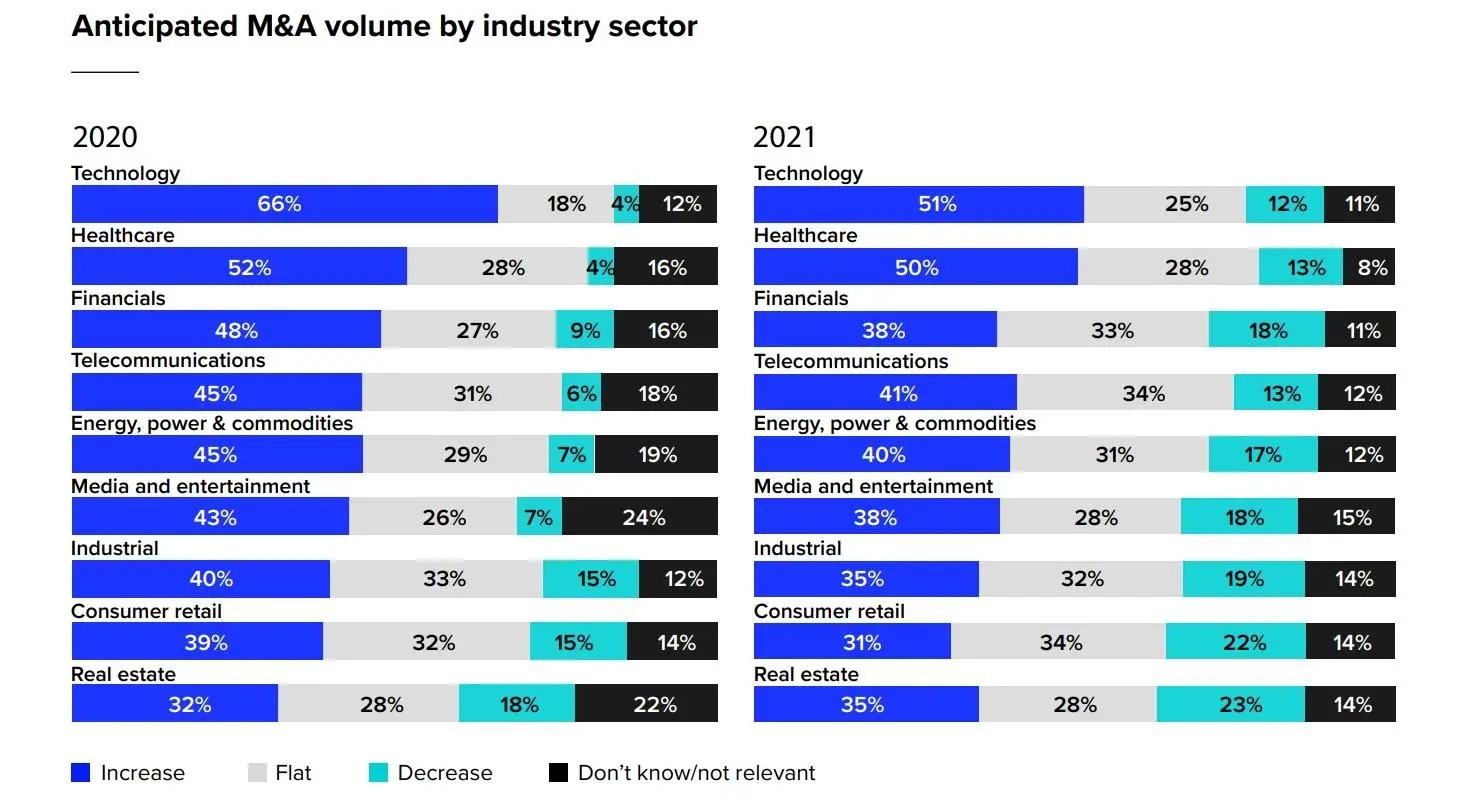

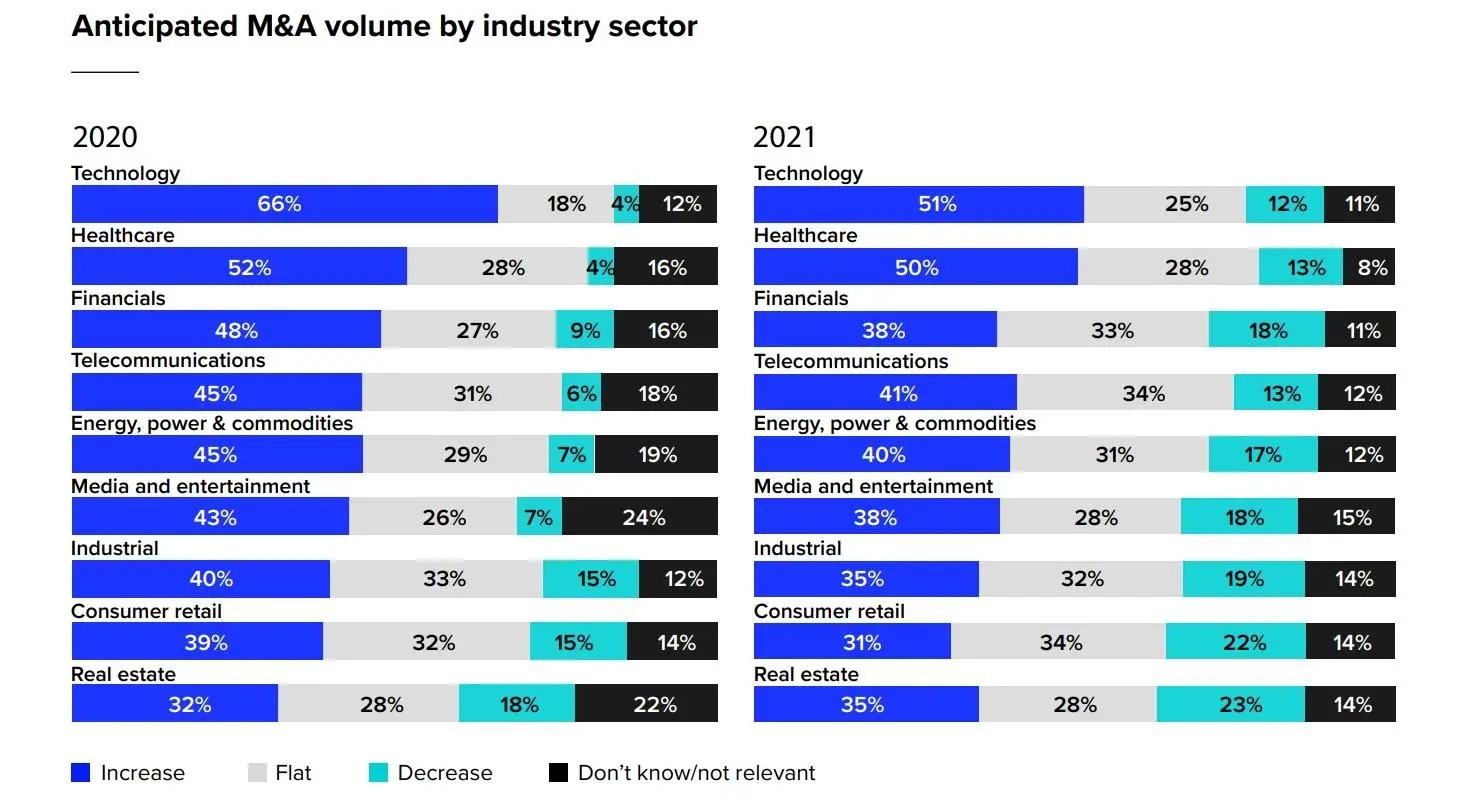

In terms of sectors, Technology and Healthcare topped, with average predicted growth rate of 9.6 percent and 8.1 percent respectively during 2021. With social-distancing protocols set to continue, Telecommunication is also seen as a potential winner with a 6.4 percent predicted rise in deal making activity.

Financials was expected to see only 2.9 percent this year compared with 6 percent in 2020, and Consumer Retail also fell in comparison.

By country, the US is the most favoured country for M&A targets at 43 percent, followed by China at a distant second of 25 percent.

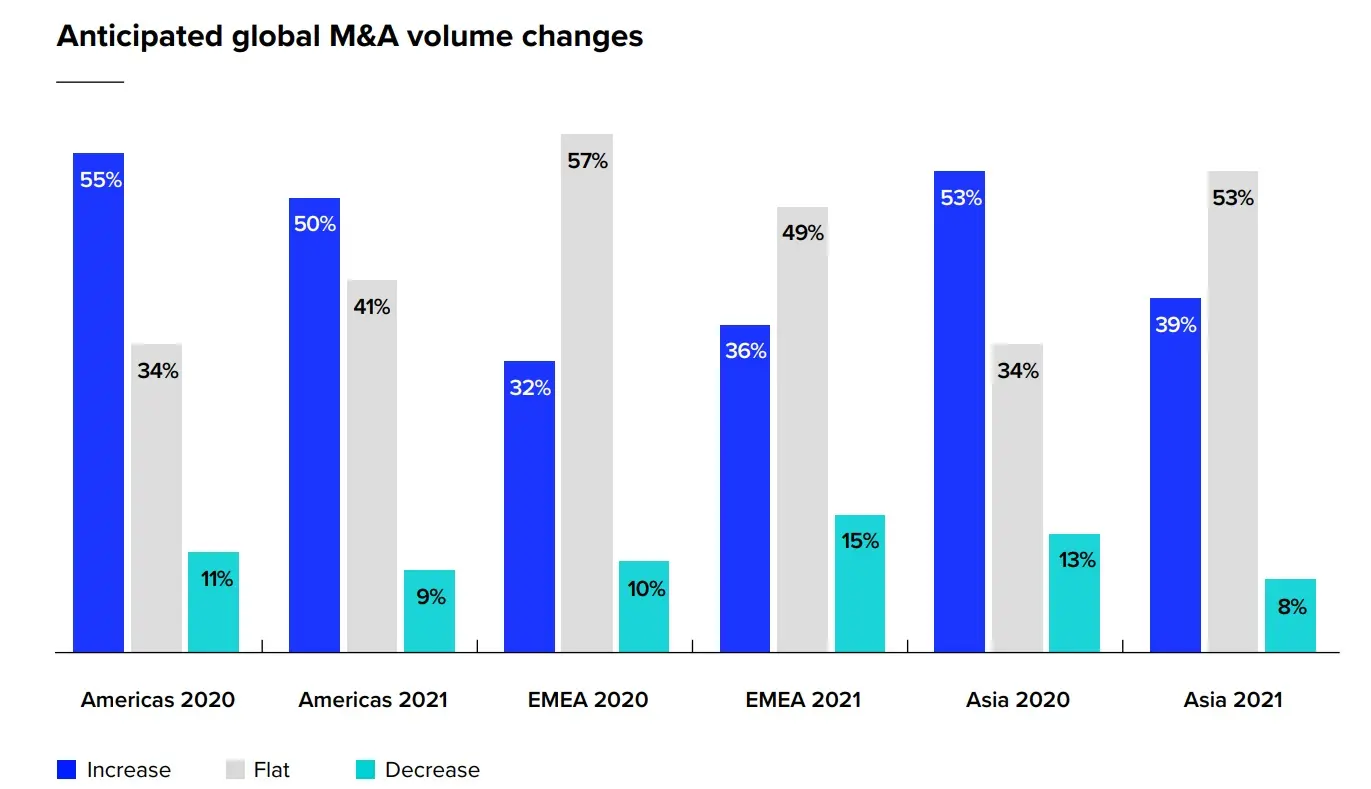

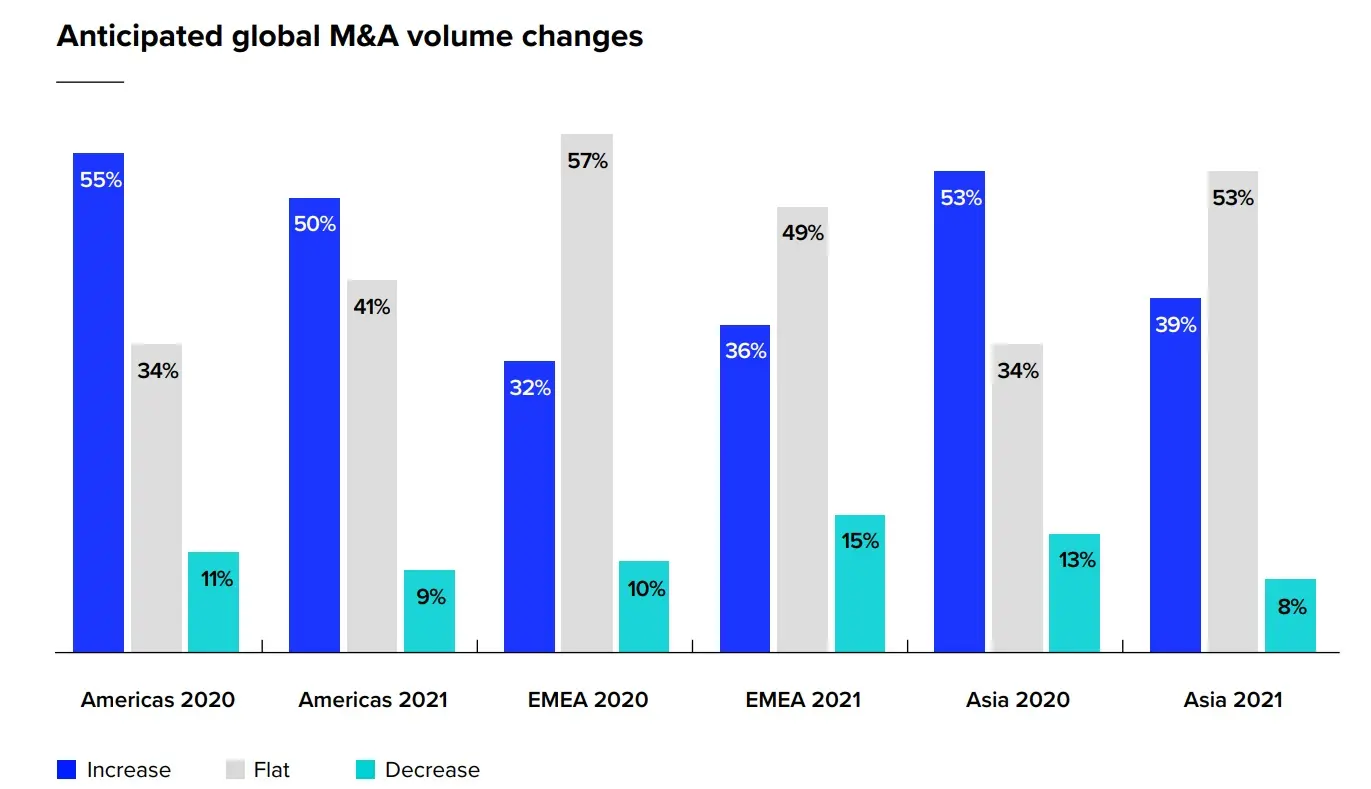

Americas-based deal makers are by far the most optimistic about 2021, with an average predicted growth rate of 7.7 percent, compared with 2020 prediction of 2.7 percent growth. By contrast, Asian deal makers predict a 5 percent increase during 2021. They had anticipated global growth of 10 percent last year but saw a 5 percent fall instead.

(Reporting by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021