PHOTO

It’s been an eventful six months for the Gulf’s equity capital markets, especially for Saudi Arabia, where reform efforts paid huge dividends in terms of a pair of upgrades from index compilers FTSE Russell and MSCI to emerging market status, which analysts’ consensus estimates predict will lead to both active and passive investors allocating around $40 billion worth of investment into Saudi equities.

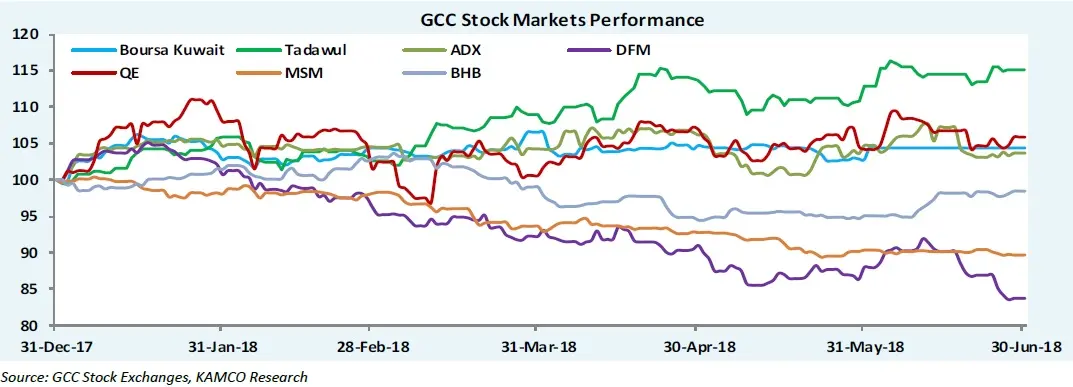

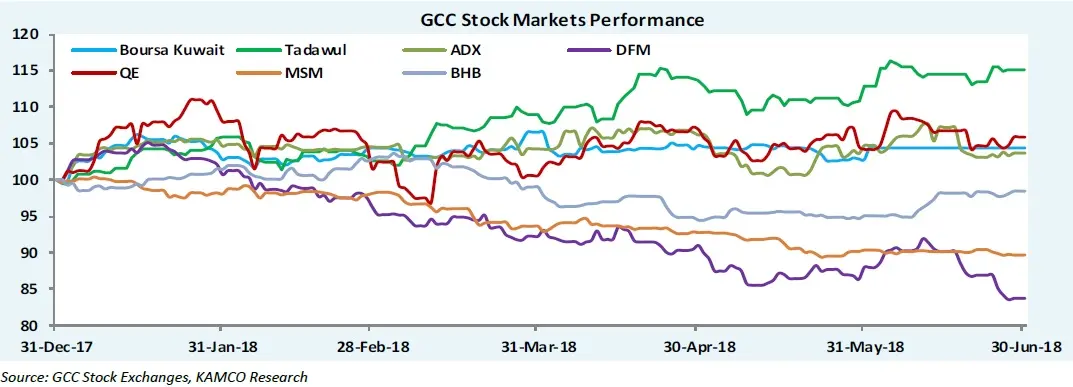

Although the stocks earmarked for inclusion won’t be added to benchmark emerging market indices until next year, active investors are already beginning to take positions in some of the country’s biggest shares, with a view to selling them on next year, meaning that the Saudi market was the region’s best-performing in the first half of the year, posting a gain of over 15 percent, according to data from Thomson Reuters Eikon.

“With MSCI, everybody knows that passive funds will allocate in the Saudi market during 2019, through five steps with FTSE and through two steps with MSCI. So active funds you will see at the end of 2018 come into the market and take locations to re-sell to passive funds and gain from this restructure,” Mazen Al-Sudairi, head of research at Al Rajhi Capital told Zawya in a telephone interview.

“This will create volatility in the market because I believe so many active hedge funds like to play this game – they take exposure and re-sell it.”

Investors have also responded positively to the news that Boursa Kuwait has been placed on a watch list by MSCI for a potential upgrade, with a decision due next June for a potential inclusion of nine stocks into emerging market benchmarks in 2020.

Moreover, in Qatar decisions taken to increase foreign ownership limits of many of the market’s biggest companies, including Qatar National Bank, Industries Qatar and Qatar Petroleum, among others, led to net investor inflows worth around $1.3 billion, according to Akber Khan, a senior director of asset management within Doha-based Al Rayan Investment.

These three events combined helped to shape investor decisions on GCC allocations during the first half, meaning that other markets either experienced limited growth (Abu Dhabi’s index climbed 2.7 percent) on lower trading volumes, or decline (Bahrain fell by 1.6 percent, Oman by 10.4 percent and Dubai by 17.3 percent).

“If you look at MENA markets this year, specifically in the GCC, it hasn’t been so much about fundamentals as index inclusion and index flow stories,” Mohamad Al-Hajj, vice-president and head of MENA strategy at EFG Hermes, told Zawya in a telephone interview.

“If we look at flows year-to-date into the MENA region, I think the UAE is the only major market that has seeing both net foreign and GCC outflows,” Al Hajj explained. “Both investor classes have been selling the UAE year-to-date, and I would assume that this is partly to allocate capital to Egypt, Kuwait and Saudi Arabia – looking at other stories that have catalysts in the short-term,” he added.

Although likely rate rises in the United States and increasing global trade tensions are causing investors to withdraw funds from emerging markets (EMs) in greater numbers (figures from the International Institute of Finance show investors withdrew $8 billion from EMs in June, following a $6.3 billion withdrawal in May) Husayn Shahrur, the managing director of MENA Asset Management for NBK Capital, argued that there were “a lot of advantages to owning GCC equities”.

“Oil prices are up, which should be supportive to spending programmes going forward and ease the urgency for austerity,” Shahrur said in an emailed response to questions from Zawya.

“Also, given the US$ pegs in place, GCC markets are not plagued by the current worries for a US$ investor around weak EM currencies.”

Shahrur also argued that the impact of a trade war on the region’s economies was likely to be limited to the impact on oil demand, “but that has its own driving supply/demand dynamics that are, to some extent, independent from trade wars, at least on the supply side,” he added.

Click through the links below to read how markets in each country fared.

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018