PHOTO

Doha – the Board of Directors of Aamal Company Q.P.S.C. (Aamal), one of the Gulf Region’s leading diversified companies, today announces its financial results for the six months ended 30 June 2021.

Highlights

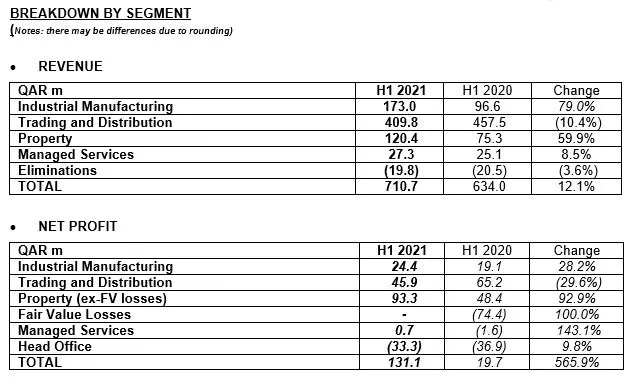

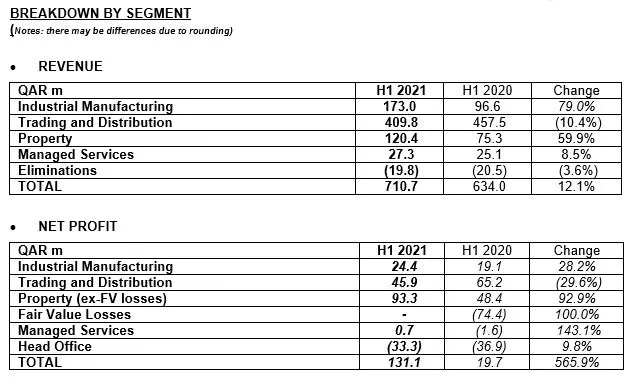

- Total revenue up 12.1% to QAR 710.7m (H1 2020: QAR 634m)

- Gross profit up 24.3% to QAR 192.4m (H1 2020: QAR 154.8m)

- Net Underlying Profit (profit before share in results of associates and joint ventures accounted for using the equity method) increased to QAR 109.4m (H1 2020: QAR 8.8m loss)

- Net underlying profit margin increased to 15.4% (H1 2020: -1.4%)

- Reported Total Net Profit1 up 566% to QAR 131.1m (H1 2020: QAR 19.7m)

- Reported earnings per share increased to QAR 0.021 (H1 2020: QAR 0.003)

- Net capital expenditure of QAR 40.9m (H1 2020 QAR 25.5m)

- Gearing remains low at 4.8%

1 Total Company net profit is before the deduction of net profit attributable to non-controlling interests

H.E. Sheikh Faisal Bin Qassim Al Thani, Chairman of Aamal, said:

“Aamal performed strongly over the first half year, translating improved top-line revenues into net profit and earnings per share growth. This performance reflects the resilience of Aamal’s diversified business strategy and our focus on operational efficiency, production base optimization and financial discipline as we navigated through the pandemic to date. As a result we have restored all business segments to profitability in the half year and increased capital investment while maintaining a strong balance sheet and low gearing. Aamal is therefore well positioned, both to weather any future impacts of the pandemic and to benefit from the continued recovery of the wider economy.

“All segments performed well and Industrial Manufacturing, Property and Managed Services each delivered year-on-year revenue, profit and margin improvement as restrictions eased, enabling infrastructure project order flows and retail and other business operations to start to normalize.

“Looking ahead, Aamal is in excellent shape, with the right strategy, market diversification, operational efficiency and financial strength and resilience to continuing to deliver growth and value for all stakeholders while contributing to the continuing development of the Qatar economy. We look forward to the second half of the year with confidence.”

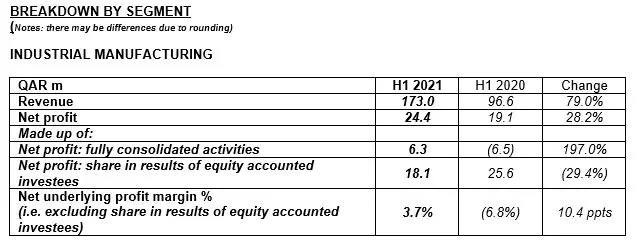

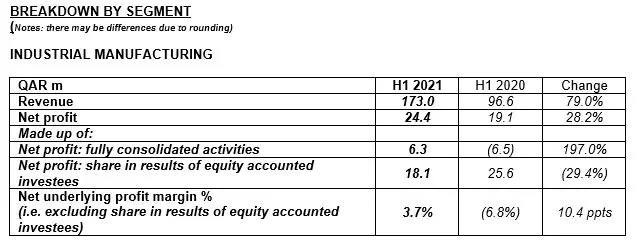

The Industrial Manufacturing segment performed well in the first half with revenue increasing 79% to QAR 173 million and net profit up 28.2% to QAR 24.4 million.

New contract wins contributed to revenue growth at Aamal Readymix and Aamal Cement of 6.1% and 27.5% year-on-year respectively. Aamal Cement increased profit by 203.6% to QAR1.4million, while Aamal Readymix improved profitability, reducing its net loss by 51.3% to QAR 1.9 million as ongoing measures were implemented to protect margins, reduce costs and improve pricing and product mix as the readymix market continued to see intense price competition.

All business units benefitted from the trend towards normalization in demand levels related to infrastructure projects. Advanced Pipes and Casts continued to convert its healthy order backlog and production of the new Glass Reinforced Pipe product is expected to start during the last quarter of 2021. Ci San’s subsidiary, Aamal Maritime Services benefited from sharply increased demand for maritime shipping services in the second quarter.

As demand continues to track the increasing flow of contracts relating to the FIFA World Cup 2022 and Qatar’s pipeline of other major infrastructure projects continues to come on stream, volumes are expected to increase, supporting gradual margin improvement over the course of the second half of 2021 and beyond.

Ebn Sina and Aamal Medical continued to perform well financially and operationally, retaining a significant proportion of the elevated H1 2020 revenue and profit levels. Ebn Sina introduced a new warehouse delivery system, “Digisal”, to automate the warehouse supply process by digitalizing the receipt of orders at the warehouse, processing and delivery to customers. It also received two robots for its warehouse for installation in the third quarter of 2021. The construction of Ebn Sina's new warehouse at Manateq is underway and this is expected to be operational during the second quarter of 2022.

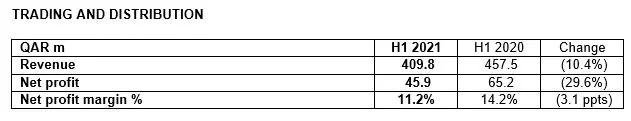

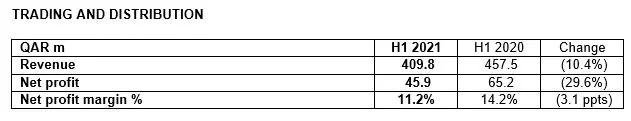

Aamal Trading & Distribution’s automative businesses including Bridgestone Tyres performed well in the second quarter, delivering enhanced revenue growth and profitability as it benefitted from increased operational hours as restrictions started to ease. Further progress is expected in the second half as restrictions continue easing, through enhanced sales and marketing activities and greater availability of stock to meet customer demand.

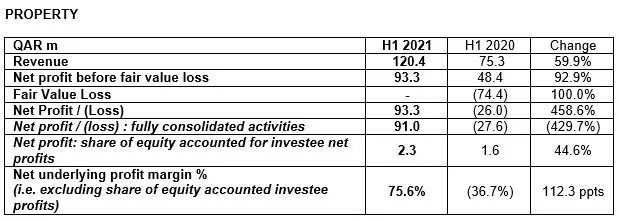

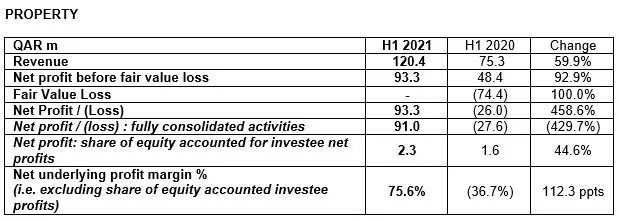

Property segment revenue increased 59.9% year-on-year to QAR 120.4 million, while net profit rose 458.6% to QAR 93.3 million, reflecting the ongoing normalizing of rental revenues in the first half and the elimination of negative fair value adjustments made in H1 2020 at the height of the pandemic restrictions.

A growing number of new retail outlets opened at City Center Doha over the course of the first half year. Work continues with the development of the City Center frontage which will see the launch of new outdoor cafes and restaurants, as well as landscaping and work on two bridges connecting the mall to the metro station and the central business district, all initiatives which will further improve the customer experience at City Center.

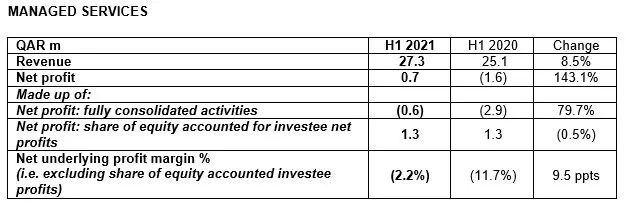

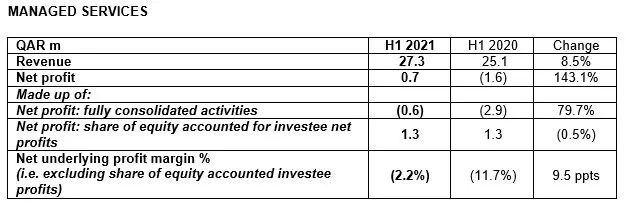

The first half of 2021 saw a gradual return to normal for parts of the Managed Services segment. Revenue was up 8.5% year-on-year to QAR 27.3 million and net profit up 143.1% to QAR 0.7 million.

Despite the continued challenges facing businesses within this segment, Aamal Services benefitted from increasing demand as restrictions eased over the period. Aamal Travel’s performance also improved following the easing of restrictions relating to the global travel industry.

Although Winter Wonderland and Fun City remained closed for the majority of the period, Fun City reopened during June 2021 following the easing of COVID-19 restrictions.

SUMMARY AND OUTLOOK

H.E. Sheikh Mohamed Bin Faisal Al Thani, Chief Executive Officer and Managing Director of Aamal, said:

“Our half year performance represents an inflection point for Aamal. The initiatives undertaken to navigate the pandemic and target growth and operational efficiency have restored the profitability of all business segments and delivered good revenue and profit growth. This performance also demonstrates the strength of our diversified business strategy with significant contributions made by all subsidiaries, ranging from the opening of new stores at City Center Doha, the impressive performances of Aamal Maritime Transportation Services and the new contract wins by Aamal Readymix and Aamal Cement Industries to Ebn Sina’s and Aamal Medical’s continuing strong results against moderating demand as the pandemic recedes, and the agility of our Managed Services subsidiaries to meet increasing demand as the restrictions which had so affected their services have started to ease.

“This outcome is down to our successful business strategy, our strong financial position and discipline, our commitment to the highest standards of governance, our outstanding management team and the dedication of all our employees who have worked so tirelessly to overcome the challenges of the pandemic.

“The momentum of our performance in the first six months has carried into the start of the second half year and we look forward to the remainder of 2021 with confidence as we continue to meet the growing demand for our high-quality products, bring new and innovative products and services to the market and explore new opportunities for incremental growth and value creation.”

A conference call to discuss the results will be held on 11 August 2020 at 14.00 Doha / 12.00 UK. The details for the conference call are as follows:

Date:

Wednesday, 11 August 2021

Time:

14.00 Doha / 12.00 UK

Conference Link:

https://us06web.zoom.us/j/88138849567

Dial-In Numbers:

UK & International:

+44 330 088 5830

USA:

+1 646 876 9923

Conference ID:

881 3884 9567

Please join the event conference 5-10 minutes prior to the start time.

FURTHER ENQUIRIES

Aamal Company

Laura Ackel – Corporate Communications Officer

E : laura.ackel@aamal.com.qa

Citigate Dewe Rogerson (IR/PR Advisor)

Andrew Hey

E: andrew.hey@citigatedewerogerson.com

Toby Moore

E: toby.moore@citigatedewerogerson.com

Kieran Farthing

E: kieran.farthing@citigatedewerogerson.com

Laura Banks

E: laura.banks@citigatedewerogerson.com

Ramiz Al-Turk (Arabic media)

T: ramiz.al-turk@citigatedewerogerson.com

About Aamal Company Q.P.S.C.

Aamal is one of the Gulf region’s leading diversified conglomerates and has been listed on the Qatar Stock Exchange since December 2007. As at 9 August 2021, the Company had a market capitalisation of QAR 6.43bn (US$ 1.77bn).

Aamal’s operations are widely diversified and comprise 27 active business units (subsidiaries and joint ventures) with market leading positions in the key industrial, retail, property, managed services, and medical equipment and pharmaceutical sectors, thereby offering investors a high quality and balanced exposure to Qatar’s wider economic growth and development. Aamal is focused on self-financed and profitable growth, delivering an average increase in underlying profits.

For further information on Aamal Company, please refer to the corporate website: http://www.aamal.com.qa

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.