Dubai: Business conditions in Dubai’s private sector improved at a slowest rate in three months, with growth moderating in each of the three broad sectors surveyed. Nonetheless, output continued to improve, stimulated by a further expansion in new orders. Business confidence towards future growth prospects remained strongly positive, but also softened to a three-month low.

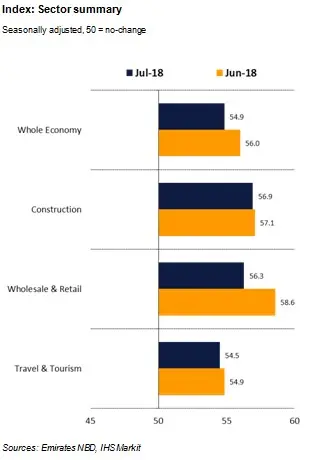

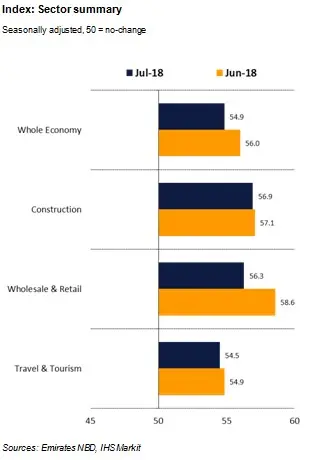

The seasonally adjusted Emirates NBD Dubai Economy Tracker Index – a composite indicator designed to give an accurate overview of operating conditions in the non-oil private sector economy – registered 54.9 in July, down from 56.0 in June. The figure indicated a slower expansion in Dubai’s private sector that was below the long-run average.

At the sector level, construction companies reported the sharpest growth in July (56.9), followed by wholesale & retail (56.3) and travel & tourism (54.5) respectively. However, all three sectors posted softer growth in July relative to June.

A reading of below 50.0 indicates that the non-oil private sector economy is generally declining; above 50.0, that it is generally expanding. A reading of 50.0 signals no change.

The survey covers the Dubai non-oil private sector economy, with additional sector data published for travel & tourism, wholesale & retail and construction.

Commenting on the Emirates NBD Dubai Economy Tracker, Khatija Haque, Head of MENA Research at Emirates NBD, said:

“While firms reported higher output and new orders in July, this was on the back of extensive price discounting, with average selling prices falling at the sharpest rate since January 2017. At the same time, input costs continued to rise, further squeezing margins. Against this background, it is unsurprising that employment growth so far this year has been the softest on record.”

Key Findings

- Output growth eases to three-month low, but remains solid overall

- Firms continue to stimulate client demand through price discounting

- Job creation ticks up, led by the construction sector, but remains relatively subdued by historical standards

Business activity and employment

Business activity increased once again in July, although the rate of expansion eased to a three-month low. Companies that reported higher output frequently linked the increase to stronger inflows of new business.

Reflecting increased output requirements, firms hired additional staff in Dubai’s private sector. The rate of growth accelerated in July, but remained weak in the context of historical data.

Incoming new work and business activity expectations

Private sector businesses in Dubai reported a sharp improvement in incoming new work during July amid reports of robust domestic client demand and promotional activity. Construction companies reported the strongest expansion in new order books.

Business activity expectations remained strongly optimistic, despite easing to a three-month low in July. Companies pinned hopes on new projects relating to Expo 2020 and successful marketing efforts.

Input costs and average prices charged

Input price inflation across Dubai’s private sector accelerated to a three-month high in the latest survey. The rate of inflation was marked overall, reflecting higher wage and raw material costs.

Promotional activity led to the greatest fall in selling prices across the private sector since January 2017. Price discounting has been recorded for three months running.

Emirates NBD Dubai Economy Tracker Index: Sector summary

-Ends-

The next Dubai Economy Tracker Report will be published on 10th September 2018 at 08:15 (DUBAI)

For further information, please contact:

Ibrahim Sowaidan

Head - Group Corporate Affairs

Emirates NBD

Telephone: +971 4 609 4113 / +971 50 6538937

Email: ibrahims@emiratesnbd.com

Tricia Kaul

ASDA’A Burson-Marsteller; Dubai, UAE

Tel: +971 566032673

Email: tricia.kaul@bm.com

Joanna Vickers

Corporate Communications

IHS Markit

Tel: +44-207-260-2234

Email: joanna.vickers@ihsmarkit.com

The Emirates NBD Dubai Economy Tracker™, produced by IHS Markit, is based on data compiled from monthly replies to questionnaires sent to senior executives in approximately 600 private sector companies, which have been carefully selected to accurately represent the true structure of the Dubai economy, including manufacturing, services, construction and retail.

The panel is stratified by Standard Industrial Classification (SIC) group, based on industry contribution to GDP. Survey responses reflect the change, if any, in the current month compared to the previous month based on data collected mid-month.

For each of the indicators the ‘Economy Tracker report’ shows the ‘diffusion’ index. This index is the sum of the positive responses plus a half of those responding ‘the same’. Diffusion indexes have the properties of leading indicators and are convenient summary measures showing the prevailing direction of change. An index reading above 50 indicates an overall increase in that variable, below 50 an overall decrease.

The Dubai Economy Tracker Index is a composite index based on five of the individual indexes with the following weights: New Orders - 0.3, Output - 0.25, Employment - 0.2, Suppliers’ Delivery Times - 0.15, Stock of Items Purchased - 0.1, with the Delivery Times index inverted so that it moves in a comparable direction. The Dubai Economy Tracker Index is comparable to the UAE Purchasing Managers’ Index.

IHS Markit do not revise underlying survey data after first publication, but seasonal adjustment factors may be revised from time to time as appropriate which will affect the seasonally adjusted data series.

About Emirates NBD

Emirates NBD is a leading banking Group in the region. As at 30th June 2018, total assets were AED 477.5 Billion, (equivalent to approx. USD 130 Billion). The Group has a significant retail banking franchise in the UAE and is a key participant in the global digital banking industry, with over 90 per cent of all financial transactions and requests conducted outside of its branches. The bank was declared the Most Innovative Financial Services Organization of the Year at the 2017 BAI Global Innovation Awards.

The bank currently has 227 branches and 1065 ATMs and SDMs in the UAE and overseas and a large social media following, being the only bank in the Middle East ranked among the top 20 in the ‘Power 100 Social Media Rankings’, compiled by The Financial Brand. It is a major player in the UAE corporate and retail banking arena and has strong Islamic Banking, Global Markets & Treasury, Investment Banking, Private Banking, Asset Management and Brokerage operations.

The Group has operations in the UAE, the Kingdom of Saudi Arabia, Egypt, India, Singapore, the United Kingdom and representative offices in China and Indonesia.

The Group is an active participant and supporter of the UAE’s main development and community initiatives, in close alignment with the UAE government’s strategies, including financial literacy and advocacy for inclusion of People with Disabilities under its #TogetherLimitless platform. Emirates NBD Group is an Official Premier Partner of Expo 2020 Dubai. For more information, please visit: www.emiratesnbd.com

About IHS Markit ( www.ihsmarkit.com )

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd. All other company and product names may be trademarks of their respective owners © 2018 IHS Markit Ltd. All rights reserved.

The intellectual property rights to the Emirates NBD Economy Tracker provided herein are owned by IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies, omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. IHS Markit is a registered trade mark of IHS Markit Limited and/or its affiliates.

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.