PHOTO

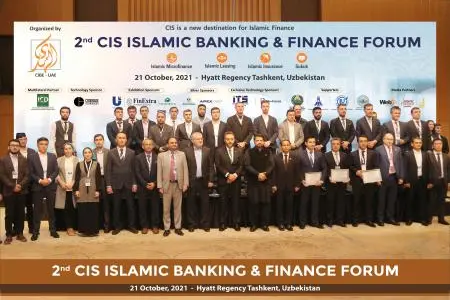

Dubai: AlHuda Centre of Islamic Banking and Economics UAE has conducted 2nd CIS Islamic Banking and Finance Forum with its multilateral partner ICD - Islamic Corporation for the Development of Private Sector on October 21, 2021 at Hyatt Regency Tashkent, Uzbekistan. This event was organized with the support of the Uzbekistan Banking association, Leasing Association of Uzbekistan and International Islamic Academy of Uzbekistan. The Technology partner for this event was Codebase Technologies and exclusive technology sponsors were International Turnkey Systems group and Fido-Biznes. The exhibition sponsors were Uzcard, Finextra, and Caiz Holding AG. Apex Insurance LLC & Islamic Finance and Takaful Association were the Silver Sponsor. The media partners were Proshare WebTV, Islamic Finance Weekly and AzonUz. More than 15 countries participated in this prestigious event including South Africa, Kazakhstan, Tajikistan, Malaysia, USA, Canada, UAE, The Gambia, Switzerland, Pakistan, Bangladesh, Oman, Kingdom of Saudi Arabia, Portugal and Uzbekistan etc.

The platform was an ideal support to discuss Islamic Finance industry future directions as new destination in CIS Countries. The theme of the forum was to explore the untapped potential of Islamic Finance market of CIS countries and to adopt the latest trends, address the challenges and discover the opportunities in Islamic financial industry of Central Asia.

In the inaugural session, the Chief Guests were H.E. Badriddin Abidov, Deputy Minister, Investments and Foreign Trade, Uzbekistan and H.E. Syed Ali Asad Gillani, Ambassador of Pakistan in Tashkent, Uzbekistan, talked about growth of the Islamic Finance industry in Uzbekistan, its future potential. Further Mr. Syed Ali Asad Gillani said that Pakistan and Uzbekistan have strong relationship, both of the countries can collectively work for betterment of Islamic Finance as Pakistan itself is gradually moving towards it. Guest of Honors for said event were Professor Dato’ Azmi Omar (President & Chief Executive Officer, International Centre for Education in Islamic Finance (INCEIF), Malaysia), Mr. Bakhtiyar Hamidov (General Director, Uzbekistan Banking Association (UBA), Mr. Zafar B. Mustafaev (Chairman, Leasing Association of Uzbekistan) and Mr. Bakhrom Numonov (Chairman, Islamic Finance and Takaful Association, Uzbekistan).

Mr. Muhammad Zubair Mughal, Chief Executive Officer, AlHuda CIBE - UAE echoed his thoughts, and said that Islamic finance is fastest growing area in CIS countries, Islamic finance is not only developing its roots in Muslim countries but many non-Muslim countries are getting benefit from it. Alhuda Centre of Islamic Banking and Economics (CIBE) is committed to providing specialized Training, Advisory and Research globally with commitment, dedication, and aspiration in Central Asia. Keeping the above vision in mind, Alhuda CIBE with its vibrant staff has been working with full dedication since 2006 for strengthening Islamic Financial System. He further said that Islamic banking and finance total volume has crossed $2.6 trillion globally. The total Muslim population of CIS countries is estimated 75 million which is good news for growing Islamic banking and finance industry.

AlHuda arranged an impressive lineup of speakers from Industry leaders around the globe with the revealing sessions on the Islamic financial system. Our worthy guest speakers including Dr. Amjad Saqib (Founder of Akhuwat- Pakistan), Mr. Paul Nilsen (Commercial Director, Codebase Technologies, South Africa), Ms. Nargis Dustmatova (Managing Director Uzbekistan/CIS Countries, Financial Technology, FinExtra, Uzbekistan) Mr. Ali Cihan Kestir (CEO of Turkey & EMEA Region, Caiz Holding AG, Switzerland) Mr. Farrukh Ziyaev (General Manager, Uzcard), and Mr. Olimjon Zakirov (Deputy General Manager, Uzcard, Uzbekistan) and many other speakers spoke over different emerging topics of Islamic banking, Takaful, Ijarah, Waqaf and global development of Islamic finance along with the opportunities in the industry by many well know international imminent speakers.

About AlHuda CIBE: AlHuda Center of Islamic Banking and Economics (CIBE) is a well-recognized name in Islamic banking and finance industry for research and provide state-of-the-art Advisory Consultancy and Education through various well-recognized modes viz. Islamic Financial Product Development, Shariah Advisory, Trainings Workshops, and Islamic Microfinance and Takaful Consultancies etc. side by side through our distinguished, generally acceptable and known Publications in Islamic Banking and Finance.

We are dedicated to serving the community as a unique institution, advisory and capacity building for the last twelve years. The prime goal has always been to remain stick to the commitments providing Services not only in UAE/Pakistan but all over the world. We have so far served in more than 35 Countries for the development of Islamic Banking and Finance industry. For further Details about AlHuda CIBE, please visit: www.alhudacibe.com

For Media Contact:

Ms. Shaguftta Perveen

Manager Communications,

info@alhudacibe.com

Call: +92 42 35913096 - 98

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.