PHOTO

Net Profit increased by 75% year on year

Dividend of 85 fils recommended

Kuwait City, Kuwait, 20 February 2017

National Mobile Telecommunications Company K.S.C.P – Ticker: NMTC (Ooredoo), a member of Ooredoo Group, announced today its financial results for the year 2016:

Financial Highlights:

Financial Highlights:

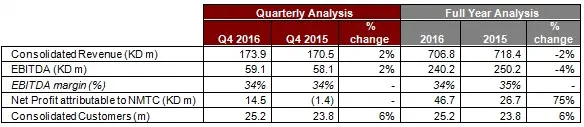

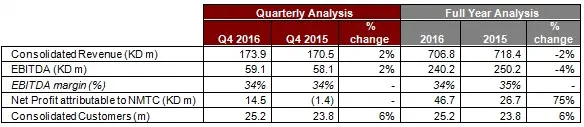

- Total customer base increased by 6% to 25.2 million in 2016, compared to 23.8 million in 2015.

- Revenues for 2016 stood at KWD 706.8 million, compared with KWD 718.4 million for the same period in 2015, a decrease of 2%.

- EBITDA for 2016 was KWD 240.2 million, compared to EBITDA of KWD 250.2 million for the same period in 2015.

- The Net Profit attributable to NMTC in 2016 stood at KWD 46.7 million compared with a Net Attributable Profit of KWD 26.7 million for the same period in 2015. Good performances in the Maldives supported the increase. Additionally Net Profit in 2015 contained a non-cash KWD 16.7 million impairment loss on investment in Tunisia due to the economic challenges in the market.

- The consolidated Earnings per Share was 93 fils compared to 53 fils per share earned for the same period last year.

- Ooredoo Kuwait (NMTC) acquisition of “FASTtelco”, a Kuwait based ISP, to offer advanced fixed broadband and mobile services finalized in October 2016.

- Ooredoo Maldives is preparing for an IPO on the local Stock Exchange in 2017.

Sheikh Saud Bin Nasser Al Thani, Chairman of the Board of Directors commented:

“During the year 2016, Ooredoo consolidated its leading position across key markets, with customer base increasing 6% to reach more than 25 million. Ooredoo maintained a stable EBITDA of KWD 240 million for the year ended 2016. In a highly competitive market, Ooredoo Kuwait cemented its position as a leading ICT company with the acquisition of “FASTtelco”, a Kuwait based ISP, through which it can expand its offer of advanced fixed broadband and mobile services. Ooredoo Kuwait delivered a 5% increase in Revenues and maintained a healthy EBITDA of KWD 51 million. A significant development for the year, Ooredoo Kuwait deployed more LTE sites and by the end of 2016 it had successfully covered the entire populated area of Kuwait. In Algeria the 6% growth in our customer base was supported by successful marketing strategies, network upgrades and deployments. With the launch of 4G and continued expansion of the 3G network, Ooredoo Algeria covered a vast majority of the population by the end of the year. Due to continued currency depreciation and challenges associated with the slowdown of tourism, Ooredoo Tunisia saw a slight decrease in Revenue. Despite these challenges, we maintained our market leadership and grew our customer base by 6% to 8 million at the end of 2016. In local currency terms Revenue actually increased by 4% year on year. Ooredoo Maldives increased Revenues by 33% to reach KWD 32 million and showed significant growth in profitability, EBITDA increased 56% to KWD 17 million in 2016. Ooredoo Maldives is well positioned to continue delivering growth as it is preparing for the public listing in 2017 on the local stock exchange. Wataniya Palestine also strengthened its market position, growing customer numbers by 10% number serving now more than three quarters of a million customers. Wataniya Palestine maintained profitability and delivered Revenues of KWD 25 million for the year ended 2016.”

The Chairman of the Board of Directors declared that the Board decided to submit a recommendation to the AGM to distribute cash dividends to the Company Shareholders valued 85% of the nominal value of share, which is equivalent to 85 Fils.”

Review of Operations

The Group’s operational performance can be summarized as follows:

Ooredoo - Kuwait

Ooredoo's customer base in Kuwait stood at 2.3 million at the end of 2016 a 3% increase over the previous year. Revenues for 2016 were KWD 197.8 million, an increase of 5% compared to KWD 188.1 million in 2015. EBITDA was KWD 51.0 million versus EBITDA for 2015 of KWD 51.3 million.

Ooredoo - Tunisia

Ooredoo’s Tunisia customer base stood at 8.0 million at the end of 2016, an increase of 6% on the same period in 2015. The Tunisian economy is still suffering from slow tourism and the KWD results were impacted by the depreciation of the Tunisian Dinar. Revenues for 2016 were KWD 142.3 million compared to revenues for the same period in 2015 of KWD 149.0 million. However, in local currency terms revenue increased by 4%. EBITDA was KWD 57.0 million compared to KWD 61.6 million for the same period in 2015.

Ooredoo – Algeria

Ooredoo’s customer base in Algeria at the end of 2016 was 13.8 million customers, an increase of 6% compared with the same period in 2015. The Algerian Dinar depreciated significantly compared with the same period last year, impacting the results reported in KWD. Revenues for 2016 were KWD 309.8 million compared to revenues of KWD 332.5 million for the same period in 2015. Revenue in Algerian dinar terms increased slightly (+1%). EBITDA for 2016 was KWD 108.5 million, a decrease of 11% on KWD 121.8 million for the same period in 2015.

Wataniya - Palestine

The total customer base for Wataniya Mobile Palestine at the end of 2016 was 0.8 million, an increase of 10% from the same period in 2015. Revenues for 2016 were KWD 25.4 million, an increase of 2% compared to KWD 25.1 million for the same period in 2015. EBITDA for 2016 was KWD 6.6 million compared to an EBITDA of KWD 6.5 million for 2015.

Ooredoo - Maldives

At the end of 2016 Maldives total customer base stood at 0.4 million, an increase of 14% from the same period in 2015. Revenues for 2016 were KWD 31.6 million, an increase of 33% compared to KWD 23.8 million for the same period in 2015. EBITDA for 2016 was KWD 17.1 million, an increase of 56% compared to an EBITDA of KWD 11.0 million for the same period in 2015.

For more information, please visit www.ooredoo.com.kw

-Ends-

For Media Inquiries:

Ooredoo (NMTC)

Fatemah Dashti, PR & Media

PO Box 613, Safat 13007, Kuwait

E-mail: fdashti@ooredoo.com.kw

About Ooredoo Kuwait (NMTC)

Commercially launched in December 1999, the Company’s share price as of 31 December 2016 was KWD 1.2, giving a market valuation for Ooredoo (NMTC) of KWD 0.6 Billion.

© Press Release 2017