Kuwait: Kuwait Financial Centre “Markaz” recently released its Monthly Markets Review report for the month of June 2020. Markaz report stated that, GCC markets extend their recovery, registering gains for the third straight month in June. Undervalued Dubai equities topped gainers among the GCC while oil prices breached the USD 40/bbl. level.

Markaz report stated that Kuwait markets were positive, with the Kuwait All Share index registering gains of 2.7% in June. Relaxation of curfew regulations and the rebound in oil prices contributed to the positive sentiment of investors. Morgan Stanley Capital International (MSCI) announced that they would implement the reclassification of Kuwait indices from frontier market status to emerging market in November 2020 along with the semi-annual index review. Meanwhile, Kuwait cabinet agreed to cut the government entities' budget for fiscal year 2020-2021 by at least 20% to soften the deficit caused by COVID-19 outbreak. Agility was the top gainer for the month of June among Kuwaiti Blue Chips, gaining 11.2%. During the month, Agility signed a mega agreement with the Kuwaiti Public Authority for Housing Welfare (PAHW) to develop industrial and storage zones in Sabah Al Ahmed residential city. Basic materials and Industrials were the top performing sectors in Kuwait during the month, with their indices rising 9.2% and 7.8% respectively.

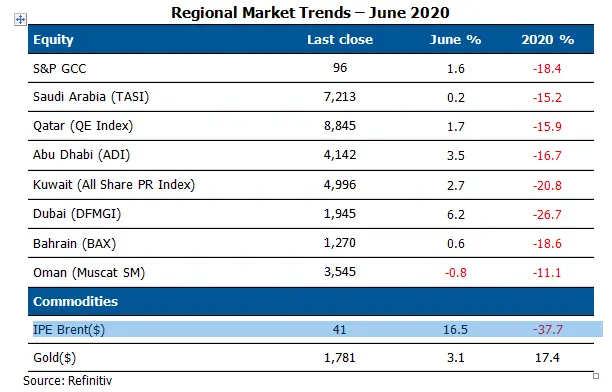

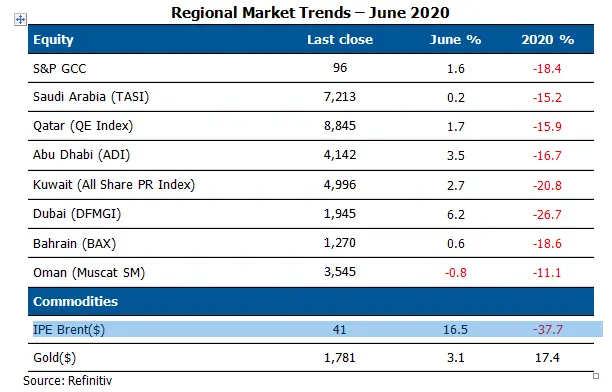

Regionally, the S&P GCC composite index rose by 1.6% in June, with all GCC markets barring Oman registering gains. Dubai was the top gainer among GCC markets, rising 6.2% for the month, followed by Abu Dhabi, Kuwait, Qatar and Saudi Arabia, which gained 3.5%, 2.7%, 1.7%, and 0.2% respectively. The World Bank in its recent report stated that GCC economies will contract 4.1% in 2020 but will bounce back in 2021 with 2.2% growth. Saudi Arabia turned to their mining industry to supplement its economic recovery. The country's cabinet approved a new mining law that facilitates investor access to financing and supports exploration and geological survey activities. The law falls in line with Saudi Arabia aims to diversify away from hydrocarbons by increasing foreign investment in the mining sector.

Markaz report also stated that among GCC Blue Chip companies outside Kuwait, Etisalat and International holding company were the top gainer for the month, increasing 5.0% and 4.9% respectively.

The performance of Global equity markets was positive for the third consecutive month, with the MSCI World Index gaining 2.5% in June. U.S. equities (S&P 500) gained 1.8% despite the second wave of cases starting to spike in several states. The Federal Reserve decided to keep interest rates unchanged during its June meeting and indicated that they would maintain rates at near zero levels until the economy recovers. The U.S. Fed expects the U.S. GDP to decline by 6.5% in 2020 before bouncing back in 2021 by 5%. In addition, the apex bank affirmed its commitment to keep buying bonds, targeting USD 80 billion a month in Treasury securities and USD 40 billion in mortgage-backed securities. The UK (FTSE 100 index) markets stayed positive, gaining 1.5% for the month. The Bank of England (BoE) during its June announcement said that it would expand its bond-buying program by USD 123 billion and keep its key interest rate at a record low of 0.1%. Emerging markets were buoyant for the month, with the MSCI EM increasing by 7.0%.

Oil prices closed at USD 41 per barrel at the end of June 2020, up by 16.5% as OPEC members and allies tightened output while the outlook for energy demand rose due to easing of restrictions on lockdowns. Gold prices continued to rise steadily, increasing 3.1% in June as fears over a second wave increased the demand for the safe haven asset.

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the Region with total assets under management of over KD 1.14 billion as of 31 December 2019 (USD 3.77 billion). Markaz was listed on the Boursa Kuwait in 1997.

For further information, please contact:

Sondos Saad

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Fax: +965 2246 7264

Email: ssaad@markaz.com

markaz.com

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.