PHOTO

Abu Dhabi: Moving into the second half of 2019, Abu Dhabi’s recent decision to open up the freehold property market has widened the pool of investors in the region. Interest has soared for freehold areas like Al Reef, Al Raha Beach and Masdar City, as per Bayut’s H1 Market report for 2019.

According to the Abu Dhabi Investment Office, the UAE currently ranks 27th globally for foreign direct investment, and with this recent change to the freehold law, we could see this figure rise in the coming years.

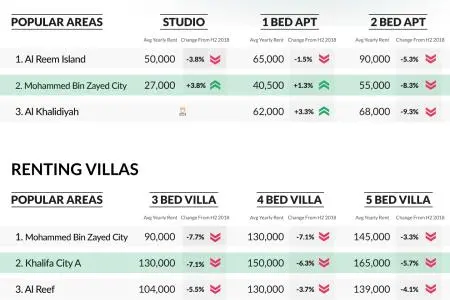

When comparing property trends from H2 of 2018 to H1 of 2019, Bayut revealed that prime areas such as Al Reem Island, Yas Island and Saadiyat Island are firm favourites for sales while affordable suburbs such as Mohammed Bin Zayed City, Khalifa City A and Al Muroor take the lead for rentals in Abu Dhabi.

In terms of ROI, Saadiyat Island delivers the highest average rental yield at 8.7% (which is subject to change based on the property type you own), proving to be a healthy option for investors.

Real estate trends for Abu Dhabi in H1 2019 show that prices for apartments sales and rentals declined on average between 4% - 11%.

As per Bayut’s data, Al Reem Island remains the most popular area in Abu Dhabi to buy and rent apartments, followed by Al Raha Beach for villa sales and MBZ City for villa rentals.

Freehold communities such as Al Reef and Al Raha Beach have witnessed decreases in prices around the 13% mark, allowing investors to buy property in these mainland areas close to Dubai at affordable price points. On the other hand, emerging areas like Al Ghadeer are seeing an uptick in prices with 2-bedroom units going up by 6.7%. This can be attributed to the recent off-plan deliveries of larger units in the neighbourhood, leading to greater price fluctuations.

Meanwhile, for apartment rentals, Al Muroor has seen a decrease of 10.7% for 1-bedroom units, followed by Khalifa City A, where prices for studios dropped by 9.7%.

For villas in Abu Dhabi, the well-connected development of Al Reef continues to be a favourite with potential investors while Mohammed Bin Zayed City leads the rental market.

Prices to buy and rent villas in Abu Dhabi have also seen declines, offering buyers and tenants the chance to upgrade to larger properties. For villa sales, the most notable decrease is seen in Al Reef, where 3-bedroom and 5-bedroom villas have dipped by 5.9% and 7.8% respectively, keeping in line with the overall trend. When it comes to villa rentals, both Saadiyat Island and Al Mushrif have seen decreases of 9.1% for certain units.

Investors looking for high rental yields in Abu Dhabi should consider Saadiyat Island for apartments, which offers an excellent average ROI of 8.7%, while Al Reef has the best rental returns for villas at an average of 7.1%, dependant on the property type.

For further details, take a look at the full H1 2019 Abu Dhabi market report by Bayut.

“In the first half of 2019, we’ve seen Abu Dhabi take significant steps to cement its position as an attractive option for global investors by opening up its freehold market. In recent years we have seen Abu Dhabi gain more global exposure by playing host to notable international events including the Specials Olympics and the Formula One. These, I believe, will lead to an increase in expat and foreign interest in investing in Abu Dhabi real estate and prime locations like Yas Island and Saadiyat Island stand to benefit.” said Haider Ali Khan, the CEO of Bayut.

“The competitive pricing of the housing market, combined with ongoing development in infrastructure and tourism will not only bolster Abu Dhabi’s position as a global investment destination but also as a place for residents to establish roots.” He concluded.

-Ends-

About Bayut

Bayut is the UAE’s most trusted property website for buying, selling and renting homes. Bayut provides detailed insights and updated statistics allowing end-users to make the best decision when searching for properties in the UAE. Bayut was established in 2008 and later became a part of the Emerging Markets Property Group (EMPG) which also operates the largest property classified sites in Pakistan, Bangladesh and Morocco. Since then, the company has seen accelerated growth, increasing not only the number of real estate partners it works with, but also attaining substantial traffic growth over the past few years. Haider Ali Khan joined Bayut in 2014 as the CEO and the company has continued to showcase very high growth over the past five years including closing multiple rounds of funding from top Venture Capital firms such as KCK, Exor, and other notable names. The funding raised till date is an impressive USD 160M, making the group the most well-funded real estate technology company in the region. In April of 2019, Bayut announced the acquisition of all GCC assets of Lamudi to expand its footprint in the region.

For media enquiries, please contact:

Khalid Yahya

PR & Communications Manager

Khalid.Yahya@Bayut.com

+971 54 455 0186

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.