PHOTO

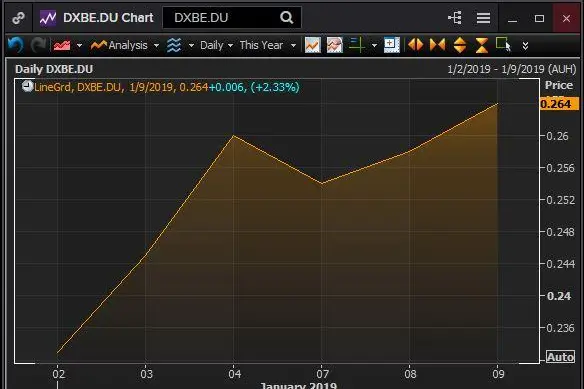

DXB Entertainments (DXBE) pushed Dubai’s stock market to close in positive territory on Wednesday, and was the most active stock in terms of volumes on the exchange, grabbing close to 27 percent of the total traded volume.

The company’s stock added 2.33 percent during today’s trading, helping the Dubai Financial Market (DFM) index finish 0.44 percent higher.

“2019 has been quite positive so far on the local markets in the UAE and particularly on the stocks listed on the DFM,” Marie Salem, director of capital markets at FFA Private Bank (Dubai) Limited, told Zawya.

Dubai’s stock market has added 0.46 percent since the start of 2019, tracking a surge in global markets and oil prices. Brent oil prices have gained 11.21 percent so far in the year, while MSCI’s world equity index, which tracks shares in 47 countries, has increased by 2.75 percent, data from Eikon showed at 14:43 GST on Wednesday.

“An eye catching stock is DXBE which was hammered back in 2018. However, with the strategic initiatives which started to be implemented in 2018, we could be looking at a new trend and a surprising performance for DXBE,” Salem added.

DXBE’s stock has surged 13.3 percent since the start of the year 2019, after dropping last year by close to 63 percent.

“Implications are looking good yet we need to keep our hopes neutral to avoid disappointments. Number of visits and revenue per cap as well as retail and hotel revenues are expected to increase in 2019, especially that the company has been working on cutting costs across the board,” Salem said.

DXB Entertainments (DXBE) announced in a statement to the exchange in October that it “attracted over 1.96 million visits during the first nine months of 2018, an increase of 33 percent compared to the same period last year”,

The company's statement said the nine month growth in visitor numbers “follows sustained growth in visits for the past three quarters”, with the number of visitors in the third quarter of 2018 increasing to over 501,000 visits, compared to 479,000 in the same period last year.

“We need to keep in mind that the company announced the expansion into a fourth park (Six Flags Dubai resort) but there is no clarity on that yet, however (that) should have a positive impact on the company. We all know that the company has been accumulating losses and this remains the major concern among analysts,” Salem said.

DXBE unveiled plans for the Six Flags Dubai resort, its phase two expansion project featuring a 3.5 million square foot park with 27 rides, in July 2016, after completing a rights issue in April of the same year to raise 1.68 billion to finance it, and borrowed a further 993 million dirhams of debt financing, although the latter remains undrawn.

A spokesman for DXB Entertainments told Zawya by email in November that "all feasible options for Six Flags Dubai are being considered and the full results of the review, including recommendations regarding the scale of the project and timing, will be presented to the board before the end of the year". (Read more)

No announcements have been made yet on the date of the next board of directors meeting, nor on its agenda.

The theme park operator reported a third quarter Q3 2018 loss of 271.4 million UAE dirhams ($73.90 million) compared to a loss of 284.1 million UAE dirhams for the same period last year, marginally missing SICO bank’s forecast of a 263 million UAE dirhams loss.

The operator’s Q3 revenue was 102.6 million UAE dirhams, compared to 115.2 million UAE dirhams for the same period last year.

According to data from Eikon, one analyst has a 'strong buy' rating on the stock, while five analysts have a ‘hold’ rating and one analyst has a “strong sell” rating.

Elsewhere in the region, Abu Dhabi’s index gained 0.53 percent on Wednesday, Qatar’s index rose 0.73 percent, Oman’s index was mainly flat, while Bahrain’s index rose 0.45 percent and Kuwait’s Premier Market index edged 0.25 percent lower.

By 15:42 GST, Saudi Arabia’s index was trading 0.98 percent higher and Egypt’s blue-chip index EGX30 was mainly flat.

(Reporting by Gerard Aoun; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019