PHOTO

Saudi Kayan Petrochemical’s shares fell sharply on Monday as the company reported a loss for the fourth quarter (Q4) of the year 2018 and missed analysts' expectations.

Saudi Kayan, an affiliate of the Middle East’s biggest petrochemicals producer, Saudi Basic Industries Corporation, reported a Q4 2018 net loss after zakat and tax of 110.9 million Saudi riyal ($29.6 million), which was around half of the loss declared in Q4 2017.

The company attributed the decrease in net loss during the quarter “to the improvement in the operating performance of company plants that contributed to (an) increase in quantities produced and sold,” it said to the Saudi bourse.

The bourse filing added that the loss reduction came “despite the decrease in the average selling prices of the products, which impacted the results of the current quarter, as well as the increase in the average feedstock price, administrative and general expenses, selling and distribution and finance charges.”

The filing noted that some of the company's plants halted work in Q4 2017 “for debottleneck projects and periodic maintenance scheduled as previously announced on Tadawul.”

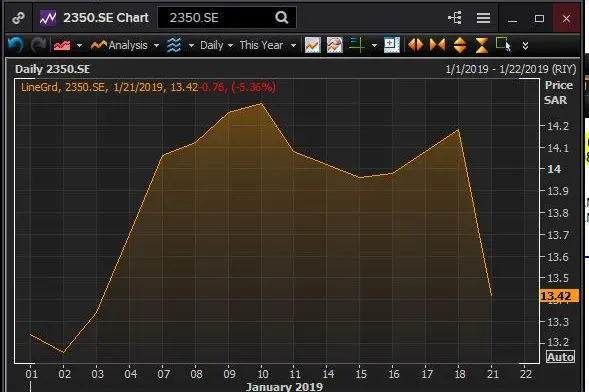

Shares in Saudi Kayan Petrochemicals dropped 5.36 percent on Monday and Tadawul’s index closed 0.22 percent higher. So far this year, the company’s shares have gained 1.82 percent.

“The strong negative reaction stemmed from the company reporting losses for the first time in 2018, after generating a record performance in the first nine months of the year 2018 (close to 1.8 billion Saudi riyal in profits) and as the numbers are well below market expectations,” Yousef Husseini, head of the chemicals team at EFG Hermes, told Zawya by email.

Q4 2018 sales recorded 2.64 billion Saudi riyals, a 14.8 percent increase on the 2.30 billion Saudi riyal sales for Q4 2017.

EFG Hermes’s Husseini said that there were three main factors behind the “massive contraction in earnings” compared to Q3 2018 (when the company reported a 472 million Saudi riyal net profit).

One of the three factors is that “saleable product prices for the company were down close to 12 percent on average following the crash in oil prices and weakening sentiment in Q4 2018,” Husseini said, noting that the price of two of the company’s most important products, polycarbonates and monoethylene glycol, dropped respectively 25 percent and 17 percent quarter-on-quarter.

Oil prices fell 36.69 percent during Q4 2018 on worries of oversupply and weakening demand and as trade tensions between the United States and China weighed on oil and global markets.

Another factor as per EFG Hermes’ Husseini is that “while market prices for feedstock butane had fallen quarter-on-quarter, there is typically a one-to-two month lag before feedstock prices feed into Saudi petrochemical producer earnings and as such, the company actually saw higher feedstock prices quarter-on-quarter if one accounts for a lag.”

The third factor is a slight decline in sales volumes quarter-on-quarter, as per the company’s earnings release, “which is likely a reflection of a lacklustre global market,” Husseini said.

The 2.64 billion Saudi riyal sales recorded in the fourth quarter were 21.9 percent lower than the 3.38 billion Saudi riyal sales for the previous quarter.

According to data from Eikon, one analyst has a ‘strong rating’ on the company’s stock, three analysts have a ‘buy’ rating, and four analysts have recommended a ‘hold’ rating.

Elsewhere in the region, Dubai’s index dropped 0.56 percent on Monday, Abu Dhabi’s index fell 0.39 percent, Qatar’s index dropped 0.35 percent, while Kuwait’s index was mainly flat, Oman’s index dropped 0.56 percent, Bahrain’s index edged 0.17 percent higher and Egypt's blue-chip index EGX30 rose 0.97 percent.

(Reporting by Gerard Aoun; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© Zawya 2019