PHOTO

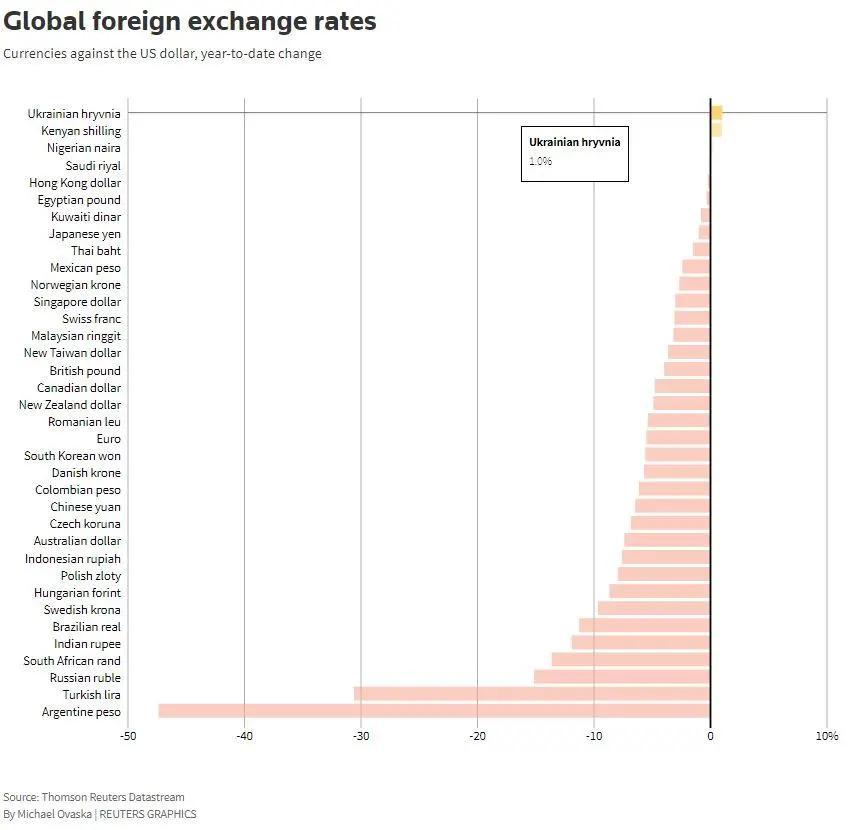

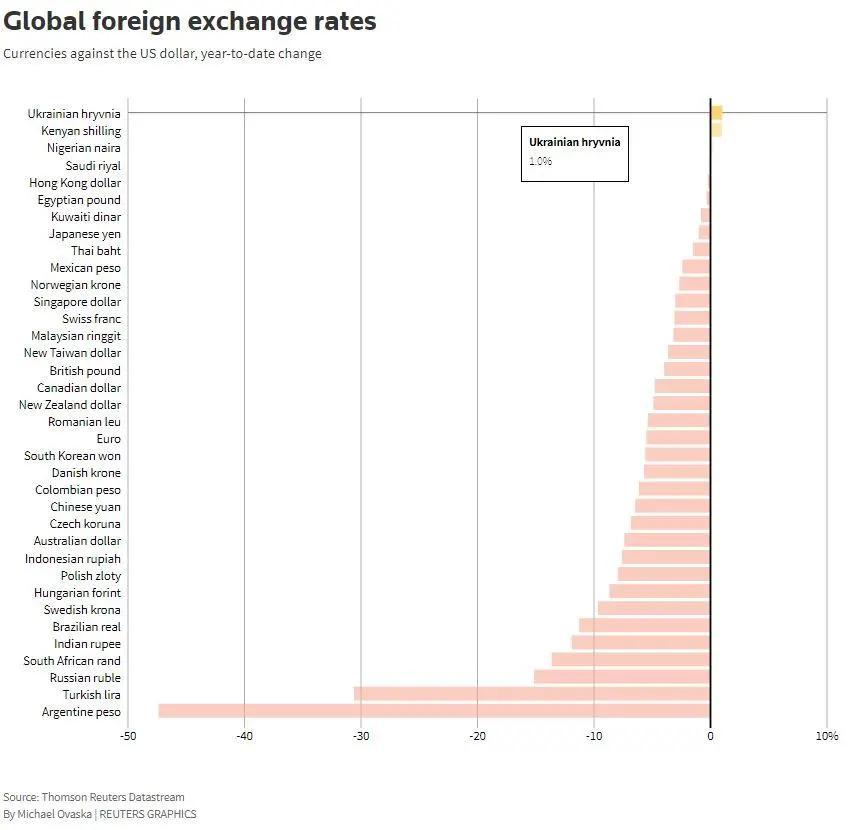

The dollar traded near a 16-month high on Monday, leading to some analysts predicting more short-term pressure for emerging markets, while the surge in the American currency is also bad news for Dubai as it makes it even more difficult to attract international interest in its already struggling key sectors of real estate and tourism.

The dollar index, a gauge of its value versus six major peers, traded at 97.60, sitting just shy of its 16-month high of 97.69 hit on Monday, Reuters reported.

“The dollar has broken out of a 17-month range on the back of safe-haven buying, led by falling equity prices as well as the heavy sell-offs in the euro and sterling,” Nick Twidale, chief operating officer at Rakuten Securities, was quoted as saying. (Read the full Forex report here).

Investor confidence has been eroded by bitter trade tensions between the United States and China, fears of a no-deal Brexit in the United Kingdom, and a standoff between Rome and the European Union over Italy’s deficit-deepening budget, Reuters reported.

“The dollar strength story has returned to the scene with a vengeance, and it represents a risk of crumbling its counterparts across the globe,” Jameel Ahmad, global head of currency strategy and market research at currency broker FXTM, said in a press statement.

“This rally in the greenback is going to ask a lot of questions over the resilience of its counterparts, but the largest risk that investors will probably be evaluating is what does this mean for emerging markets? Dollar strength was one of the key themes behind the prolonged weakness in emerging markets that took place over the summer, and this news over the greenback rallying to new highs is going to bring questions over whether another round of emerging market weakness should be expected before we conclude 2018,” he added.

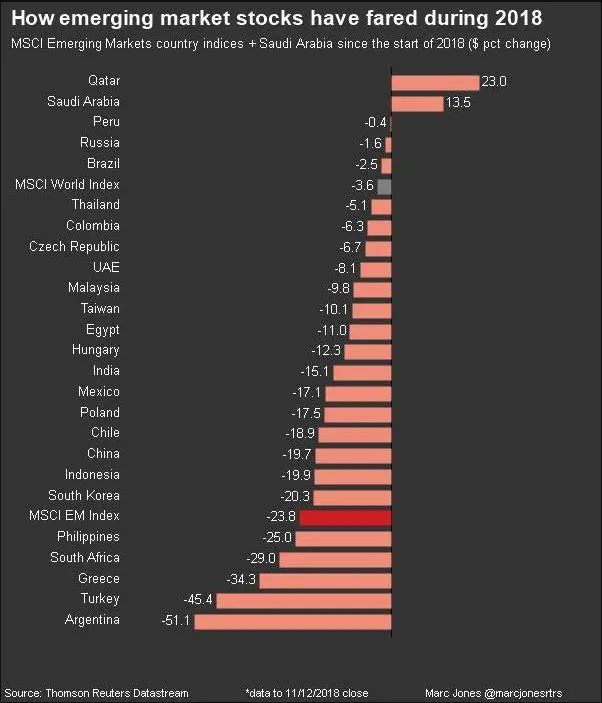

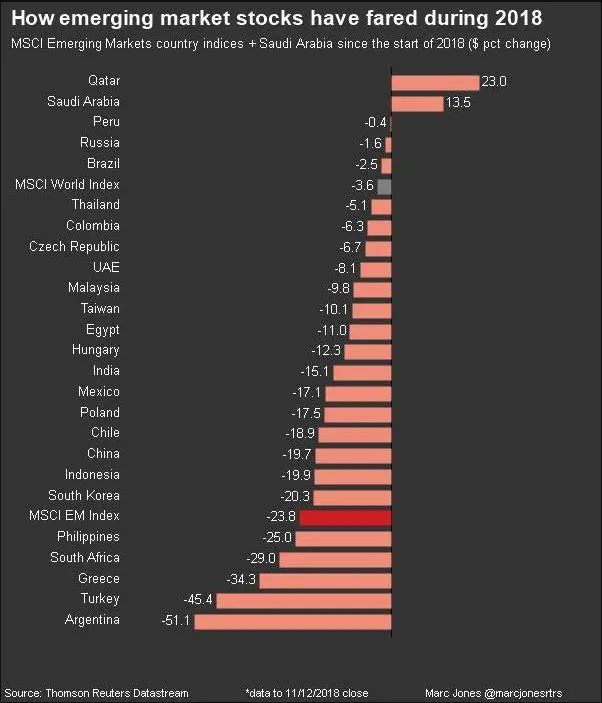

The signs are already evident. Reuters reported that emerging market stocks and currencies fell on Monday, with the MSCI index of emerging market currencies down 0.3 percent, with the currencies of net oil importers, such as the Indian rupee and the Turkish lira, hit hardest. (Read more here).

The MSCI’s benchmark emerging equity index was also down 0.6 percent to its lowest level this month as exchanges in South Korea, India and South Africa declined, Reuters reported.

With the Emirati dirham pegged to the dollar, the continued strengthening of the American currency is bad news for Dubai and its two core sectors – real estate and tourism – which depend heavily on international interest and will now become more expensive for overseas property investors and visitors.

The Dubai Land Department (DLD) last month reported that the emirate's real estate sector recorded 39,802 real estate transactions worth 162 billion UAE dirhams ($44.1 billion) during the first nine months of this year, compared to 52,170 transactions worth 204 billion UAE dirhams during the same period last year.

"Off-plan sales, which accounted for nearly 70 percent of all transactions in 2017 are down by approximately 40 percent on a year-to-date basis. There are a plethora of reasons for this, not the least of them being the fact that incentives in the off-plan space appear to have 'maxed out' and developers have been matching incentives in the ready space," Hussain Alladin, head of investor relations and research at Global Capital Partners, told the Khaleej Times newspaper. (Read the full report here).

In the midst of the surge in the dollar, the DLD reported two days ago that it had opened a real estate promotion office in New York in a bid to attract more interest from potential American investors.

"The office will also work closely with real estate brokers in the United States to encourage them to promote Dubai real estate projects among American investors," Majida Ali Rashid, CEO of the real estate promotion and investment management sector at DLD, was quoted as saying. (Read the full report here).

Despite the challenges in the Dubai real estate sector, a prominent real estate developer forecast this week that the slowdown will continue next year but will recover by “end of 2020 or (20)21”.

Speaking at a press conference on Monday during the World Economic Forum’s Global Future Councils event, Hussain Sajwani, chairman of Dubai’s Damac Properties, said that the real estate market has been undergoing a slowdown since 2016 after a prior good performance in the period from 2012 to 2015.

“We had good four years, at the (20)16 we started seeing some slowdown with the oil prices coming down. But this year has been a difficult year. I think next year is going to be another difficult year, I don’t see it is going to be better than this year,” he said

“We are in that cycle of slowdown. It will take few years. I hope that by 2020 with the Expo coming in, more people are going to come to Dubai…. I would hope by end of 2020 or (20) 21 we start coming out of this slowdown,” he added. (Read the full report here).

Dubai’s other key sector which is dependent on international currencies that could be impacted by the surging dollar is the vital tourism sector.

Reuters, citing official tourism department figures, reported in August that the number of foreigners visiting Dubai grew by just 0.5 percent in the first half of 2018, a substantially slower rate than the 10.6 percent growth rate recorded a year earlier.

The emirate hosted 8.1 million international overnight tourists in the six months to June 30, while it previously reported 8.06 million tourists for the first half of 2017, the report said.

The tourism sector was worth 109 billion dirham ($29.7 billion) at the end of 2017, according to the tourism department.

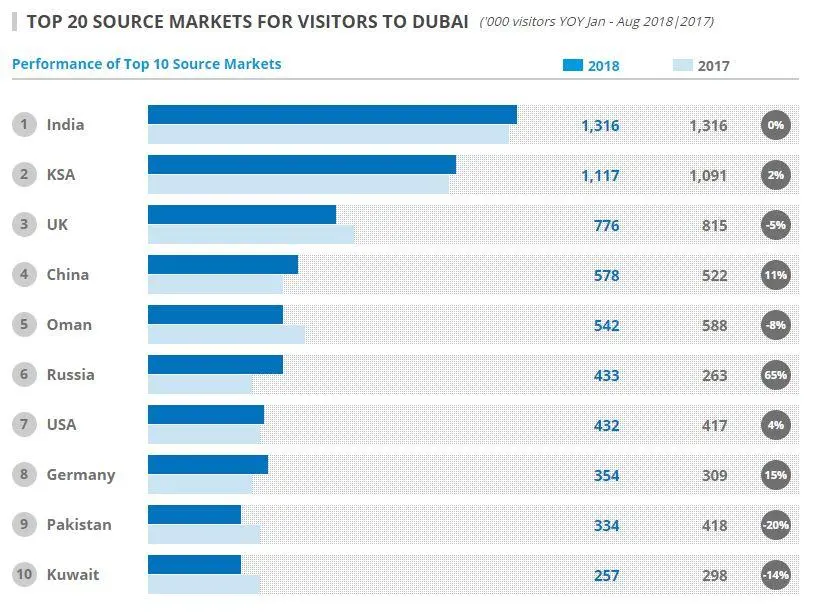

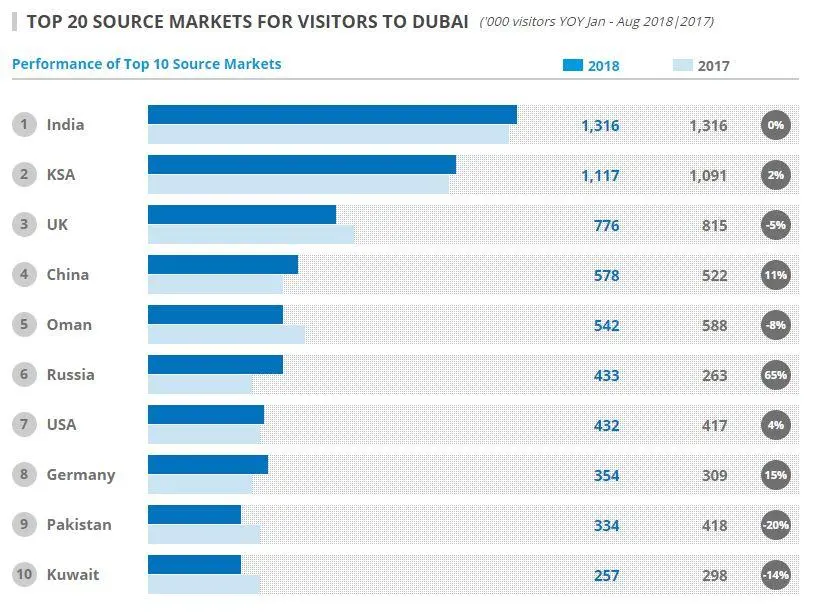

India, which has seen its currency hit hard by the rise in the dollar, remained Dubai’s top overseas market in 2018, with the number of visitors from there rising 3 percent to over 1 million in the first six months — compared with an increase of 21 percent in Indian visitors a year earlier. (Read more here).

(Graph from VisitDubai.com, a website maintained by Dubai Corporation of Tourism & Commerce Marketing).

So what is pushing the dollar even higher in the short-term? “Pointing the finger towards the Federal Reserve and central bank divergence regarding ambitious interest rate policy in the United States is the easy answer, but not necessarily the right one when you consider that the Fed has been consistent with its communications to raise US interest rates further for a long time,” said Ahmad.

“I would personally attribute the move to growing skepticism over whether President Trump was sincere with his narrative that a trade deal with China might be close. While we haven’t seen any drastic changes to this narrative, we haven’t seen a continuation of this optimism either, which does suggest that this could have been a strategic ploy to put the pressure on China before the scheduled meeting at the G-20 summit in Argentina later this month. We do overall maintain the view that a trade deal needs to be announced soon, otherwise it is very difficult to pinpoint when emerging markets can really bounce back,” he added.

Further reading:

• FOREX: Dollar hits 16-month high, yen boosted by risk-off sentiment

• Precious Metals: Gold prices inch up after hitting 1 month low

• EMERGING MARKETS: Emerging currencies slide on higher oil, strong dollar

• Dubai property nets $44bln in first 9 months of 2018

• Dubai real estate markets slowdown to continue in 2019, expected to pick up towards end 2020 - DAMAC chairman

• Dubai tourism growth slows in first half of 2018

• Dubai Land Department opens real estate office in New York

(Writing by Shane McGinley; Editing by Michael Fahy)

(shane.mcginley@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018