PHOTO

The global sukuk market is set to grow at a compound annual rate of around 15 percent to reach $2.7 trillion by 2030, according to investment management firm Franklin Templeton.

In a media briefing at its Dubai office last week, the company’s chief investment officer of global sukuk and Middle East and North Africa (MENA) head of fixed income, Mohieddine Kronfol, described its forecast as a “base case”, stating that growth could be faster if there is more widespread adoption of shariah-compliant debt instruments, particularly in more mature markets. However, it could also slow if forecasted growth in emerging markets such as Nigeria, Pakistan and Turkey fails to materialise, Kronfol said.

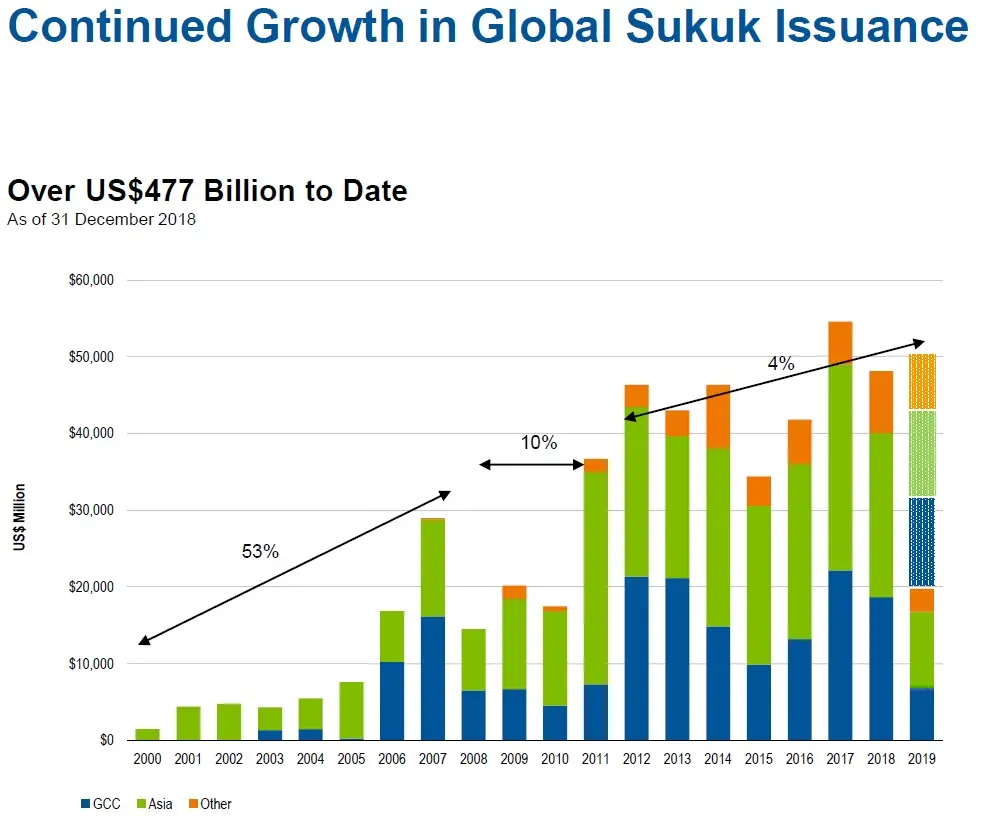

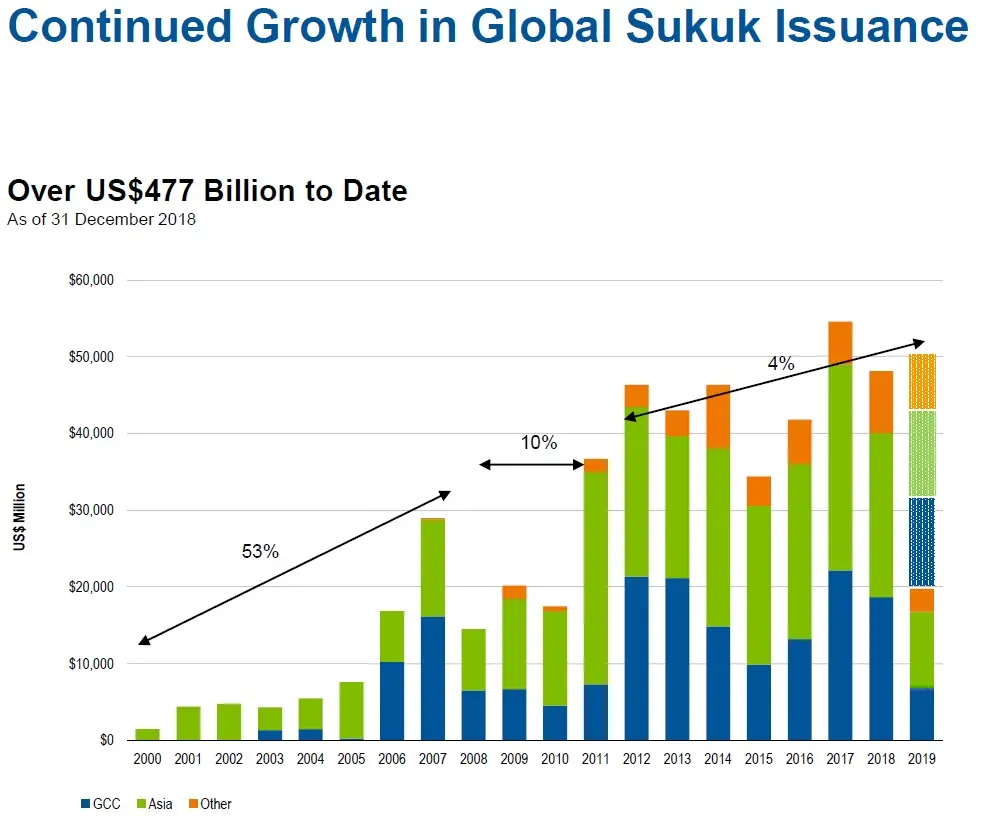

Global sukuk issuance stood at over $477 billion at the end of last year, but has slowed somewhat in recent years following a boom in the early part of this century. Figures published by ratings agency S&P Global in January described sukuk issuance as ‘mild’ in 2018, as the total amount of sukuk issued dropped by 5 percent to $114.8 billion. It forecast issuance of $105 billion-$115 billion for 2019, although this prediction was made assuming an average Brent oil price of $55 per barrel. Prices closed last week at $70.85 per barrel.

“The global sukuk market today is close to $500 billion – it has already reached critical mass,” Kronfol said. “That is more than, say, European high-yield. Our forecast is that the growth continues at a relatively rapid pace – maybe not as fast as the past 15 years but fast enough to exceed $2.7 trillion by 2030.”

Kronfol acknowledged that the overall share of sukuk is still just 0.5 percent of a global debt securities market worth around $100 trillion but he highlighted a number of reasons for why he expects this to grow. One is the generally higher level of demand for shariah-compliant financial instruments.

Source: Franklin Templeton

Click image to enlarge

“We think global AUMs (assets under management) in the sukuk space could exceed $175 billion by 2030. Most of that will continue to be in the institutional space, but we think there is room also to see the growth of shariah-compliant funds and mutual funds, and the sukuk within those also to grow,” he said.

Another is the enhanced returns that both Islamic and conventional bonds issued by Gulf Cooperation Council (GCC) entities offer for typically lower levels of riskthan comparable emerging market debt securities.

Thirdly, he argued that sukuk issuance “highlights a wider trend of socially-responsible investing”.

New arrivals

Despite the lower levels of issuance in global sukuk markets last year, there have been signs of progress in GCC markets, with several corporate entities issuing debut sukuk in recent months. Saudi Telecommunications Company issued its debut $1.25 billion sukuk on Sunday, following on from Saudi food company Almarai’s first $500 million sukuk in February, Abu Dhabi industrials conglomerate Senaat’s $300 million sukuk in December, NMC Healthcare’s $400 million sukuk in November and district cooling company Tabreed’s debut $500 million sukuk in October, among others. (Read more here).

In terms of sovereign issuers, Saudi Arabia’s debt management office has also continued a programme of issuance of Saudi riyal-denominated sukuk of varying tenors in recent months, helping the country to build a yield curve for domestic sukuk. Last month, it issued more than 11.6 billion Saudi riyals ($3.1 billion) worth of domestic sukuk, including a 9.247 billion riyal tranche with a 30-year tenor. (Read more here).

Saudi Arabia’s state press agency also announced that the debt management office had reduced the par value for government-denominated sukuk from one million riyals to just 1,000 riyals, with a view to facilitating the purchase of sukuk by retail investors. (Read more here).

In a note published last week, another emerging markets investment management firm, London-based Ashmore Group, said that the development of local fixed income markets were important for two reasons. One was that it helps to establish a local institutional investor base and the second was that a local currency yield curve, as opposed to one denominated in U.S. dollars, was “key to achieving self-sufficiency in funding, which is still highly desirable in EM (emerging market) countries on account of the fickle nature of external funding for EM countries”.

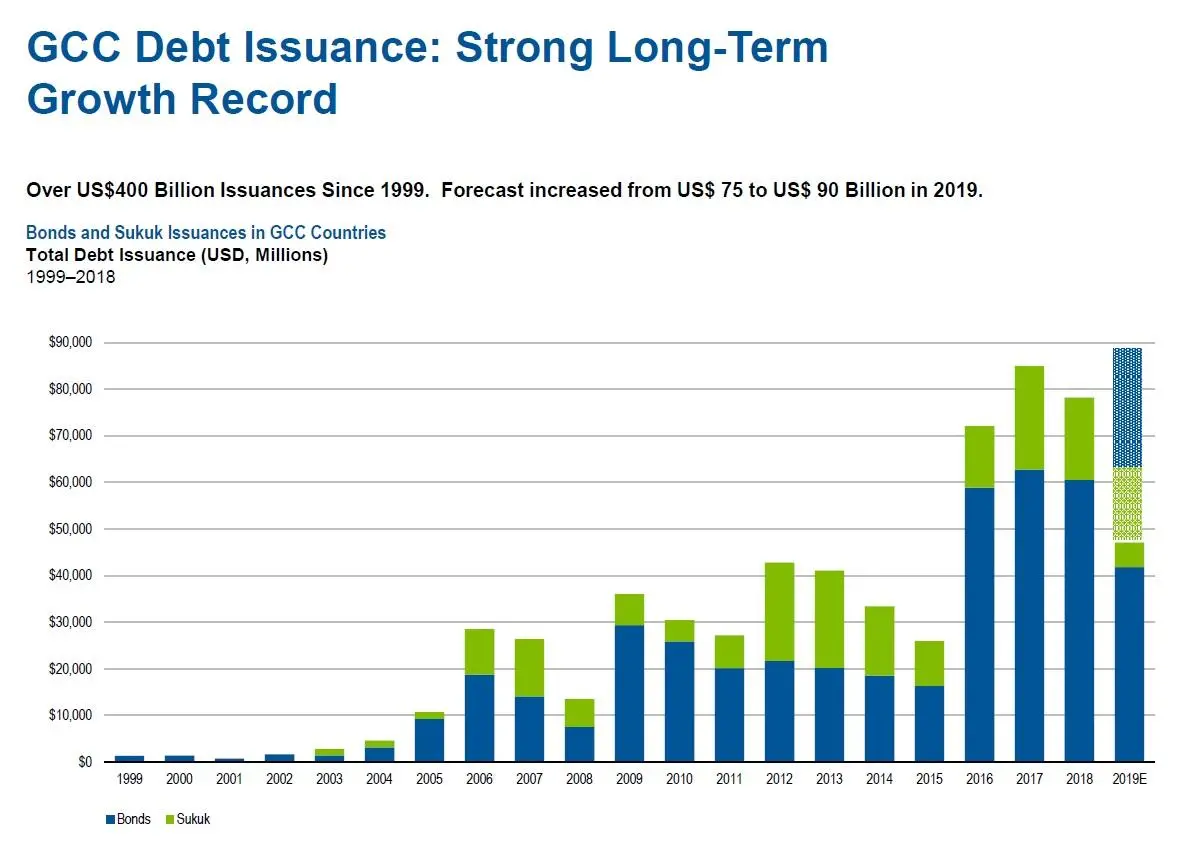

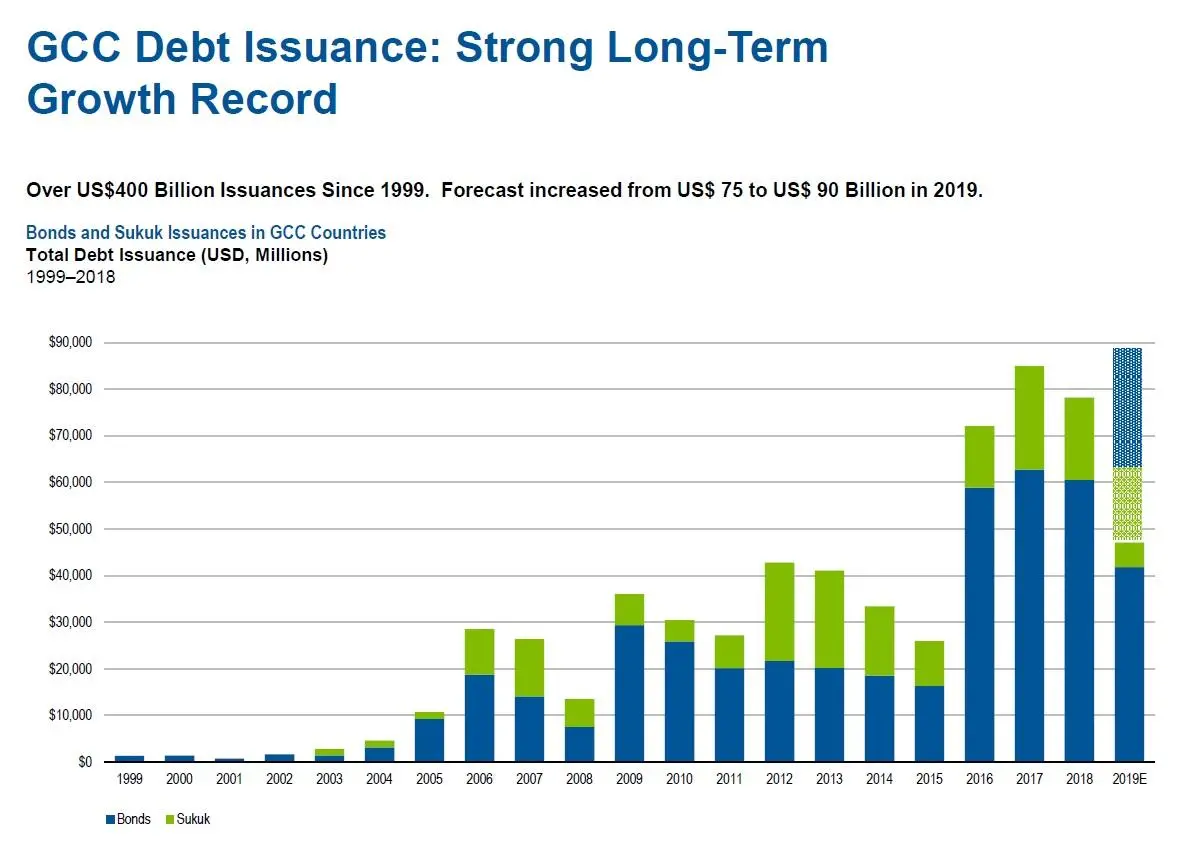

Kronfol said that the ratio of total debt issued by GCC corporate entities via capital markets (either through sukuk or conventional bonds) continues to climb, which he said was partly a reaction to the global financial crisis, but was also a result of the development of local capital markets.

“But also, I think it’s a growing maturity amongst many corporate issuers who now value and see the need to really diversify sources of funding,” he said, adding that the share of loans raised via capital markets has climbed to around 50 percent, up from 25 percent a decade ago.

“We expect that trend to persist going forward and to generally help with the overall health of the market,” he said.

Within the past five years, overall GCC bonds and sukuk issuance has climbed to $75-$80 billion per year, up from $35-$40 billion, Kronfol said.

Source: Franklin Templeton

Click image to enlarge

Franklin Templeton had forecast a slight decline in GCC fixed income (both Islamic and conventional) issuance of around $75 billion this year, but the debut $10 billion Saudi Aramco bond last month led it to lift its targets. (Read more here).

“Our expectations now are that we get close to issuance of $90 billion this year,” Kronfol said.

In terms of demand, Kronfol said the inclusion of GCC bonds into JP Morgan emerging market bond indices will lead to international investors improving their “chronically underweight” positions in GCC fixed income instruments.

“We think that the large deals that we’ve seen like Aramco or like the big, sovereign deals... those are typically good opportunities for people to reduce that underweight,” he said.

In terms of performance, a chartbook produced by KAMCO Research tracking monthly bond performance showed that total returns for MENA sukuk for the first four months of 2019 is 4.14 percent, which is slightly lower than the year-to-date return for conventional MENA bonds of 5.31 percent. An index of U.S. dollar-denominated sukuk from GCC issuers returned a slightly higher 4.83 percent since the start of the year, and both outperformed a global sukuk index, which returned 3.11 percent. By comparison, an index of global investment-grade debt bonds returned just 1.90 percent.

(Reporting by Michael Fahy; Editing by Mily Chakrabarty)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019