PHOTO

GCC corporate earnings will be negatively impacted in the first half of the year as businesses and the economy have been severely hit by the COVID-19 pandemic, analysts said.

“Though many GCC countries have introduced strong measures to contain the coronavirus outbreak, we expect corporate earnings to take a meaningful hit in the first half of the year,” Salah Shamma, Head of Investment, MENA, Franklin Templeton Emerging Markets Equity told Zawya.

“That being said, even a severe decrease in near term profitability should not alter the long-term prospects for larger corporates in the GCC, who can absorb the current shock,” Shamma noted.

As production disruptions and travel restrictions emerge, earnings for many corporates around the globe are expected to weaken.

Richard Lee, Senior Fund Manager at Emirates NBD told Zawya that the global coronavirus spread continues to add significant volatility to asset prices.

“In our view, it has two stages, the first stage is the spread of the virus and the corresponding measures taken by various countries are likely to bring global economies to a standstill,” Lee said.

“The second stage is its subsequent impact on real economy and corporate earnings/balance sheet that could be significantly negative,” he added.

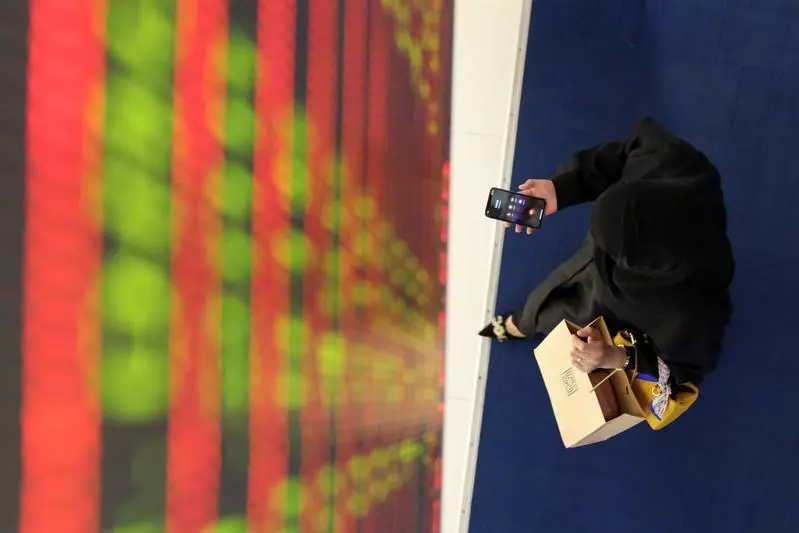

Stock markets in the region fell sharply in March following a slump in global markets, as uncertainty triggered by COVID-19 weighed on investor sentiment worldwide.

Nishit Lakhotia, Head of Research at Bahrain-based bank SICO, said: “Despite the steep correction in the month of March we still see elevated downside risks in (the) GCC as Q2 will see a much larger earnings impact from ongoing lockdown and social distancing measures being adopted to fight Covid-19 epidemic.”

Stocks were also hammered by a historical plunge in oil prices as OPEC failed to strike a deal with its allies to cut the production of oil.

“Further, the current weakness in oil led by demand destruction and limited storage capacity implies oil will remain at significantly lower levels YoY (despite the OPEC+ cut) resulting in higher deficit, increased borrowings and stringent austerity measures being adopted,” Lakhotia said.

OPEC+ agreed earlier in April to cut their output by 9.7 million barrels per day (bpd) for May-June. Brent Crude prices closed at the $25.5 per barrel level on Monday.

“We expect regional markets to continue to remain at a state of heightened volatility,” Lee said.

“Stock selection will make a difference between winners and losers, especially when some high-quality names have significantly corrected beyond what is warranted by deterioration of business prospects,” he noted.

Saudi-UAE focus

Both Saudi Arabia and the UAE stock markets have seen sharp declines, reflecting the current state of uncertainty and risk felt by investors.

“We are operating under the assumption that the GCC’s stock markets have lost between two to three quarters of growth, depending on the sector,” Franklin Templeton’s Shamma said.

According to data from Refinitiv’s Eikon, the Tadawul index has dropped 21.31 percent since the start of 2020 (until Monday’s closing), while Dubai’s index lost 31.73 percent and Abu Dhabi’s index fell 21.8 percent.

“Our view is that these challenges are transient in nature, and that regional markets will eventually revert to trading based on fundamentals and operational performance. Longer term investors should try to look past the current crisis and not base their investment decisions solely on current events,” Shamma said.

Last week, Saudi Arabia announced an additional 50 billion riyal ($13.3 billion) stimulus package to mitigate the economic fallout from the coronavirus on the private sector.

Nishit Lakhotia, Head of Research at Bahrain-based bank SICO, said: “Saudi markets could remain sideways this quarter waiting for oil to show some signs of recovery from current levels. In case it does not happen, we remain bearish on the market outlook given the earnings impact on key sectors such as petrochems and banks.”

The UAE Central Bank boosted in April its stimulus package to $70 billion from a previously announced $27 billion package in the face of the coronavirus pandemic.

The Targeted Economic Support Scheme (TESS), includes a liquidity relief tool of 50 billion dirhams ($13.6 billion) offered by the CBUAE through banks to eligible customers affected by the coronavirus pandemic who wish to apply for a deferment.

“While UAE stocks are not directly impacted by weak oil price mostly because of the mix of index constituents, UAE stocks could face a second order impact from a soft real estate environment, lower loan growth and higher cost of risk for the banking sector,” Emirates NBD’s Lee said.

(Reporting by Gerard Aoun, editing by Seban Scaria)

#GCC #EARNINGS #CORONAVIRUS #MARKETS

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020