PHOTO

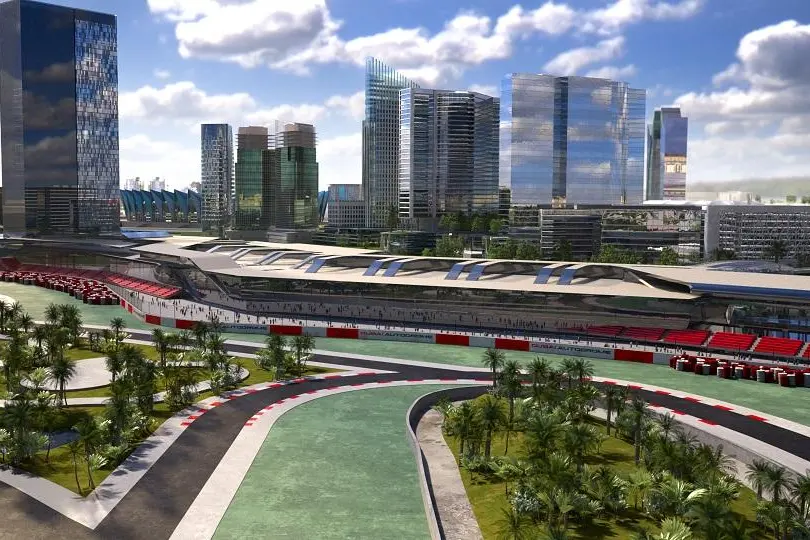

Dubai-based real estate developer Union Properties has gained approval from shareholders to buy back and re-sell up to 10 percent of its shares with a view to improving its share price.

The company, which is best known for its Motor City master development, announced in a statement to the Dubai Financial Market on Sunday that shareholders had approved a special resolution allowing the company to buy back up to 10 percent of its share capital with the purpose of re-selling them, and to secure the necessary approvals from the Securities and Commodities Authority (SCA) to allow it to cancel any purchased shares if it is unable to re-sell them before any deadline set by the SCA.

In a statement to Zawya on Wednesday, a company spokesperson said that the purchase of any shares would be “financed internally”.

“This is part of the company's strategic plan to achieve profitability within a short period with a safe and secure investment, considering that the company's stock is traded at less than 40 percent of the book value,” the statement said.

Union Properties saw its shares decline by 58.8 percent in 2018 as property stocks fell out of favour with investors concerned about an oversupply of properties in the Dubai market.

Its shares have largely traded sideways this year, closing at 40.5 fils ($0.11) on Wednesday, giving it a market capitalization of 1.75 billion UAE dirhams ($476.5 million).

Last month, Union Properties filed accounts for 2018 which showed that the company’s net equity stood at 3.1 billion dirhams as of December 31, 2018.

Accounts showed that the company earned a 62.4 million dirham profit attributable to shareholders on revenue of around 501 million dirhams in 2018, compared to a 2.4 billion dirham loss in the prior year when it wrote down the value of its portfolio by almost 2.1 billion dirhams after an updated masterplan for the Motor City project found that only around 12 million sq ft of the 14.33 million sq ft of land at the site was usable. (Read more here).

The 2018 accounts also showed a 180 million UAE dirham increase in Union Properties’ bank overdraft, as the current portion of its bank loans grew by just over 380 million dirhams, to 982 million dirhams.

Shareholders at Union Properties’ general assembly last week also granted a 12-month extension to a resolution passed last year allowing its board to issue sukuk, or Islamic bonds, worth up to 1 billion dirhams via a private placement.

The spokesperson said the objective of raising sukuk would be to “realign the company's liabilities with its medium-term assets”.

This would provide “medium-term funding sources with convenient financing rates to ensure the successful delivery of the company’s projects and investments”.

(Reporting by Michael Fahy; Editing by Brinda Darasha)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019