- OPEC achieved 106% production compliance in February, led by Saudi Arabia, Kuwait and the UAE

- Prices forecast to firm up during next two quarters

Kuwait City: Oil prices for the first quarter of 2019 have posted their best quarterly performance since 2009. Buoyed by signs of a tightening market, with Saudi Arabia taking the lead in curbing production, and a decline in production from the US, Russia, Canada, Libya and Iran, among others, oil prices are expected to firm up during second and third quarter of the year. In research published today, National Bank of Kuwait (NBK) evaluated the state of oil markets for 1Q19 and provided an outlook for the second and third quarters.

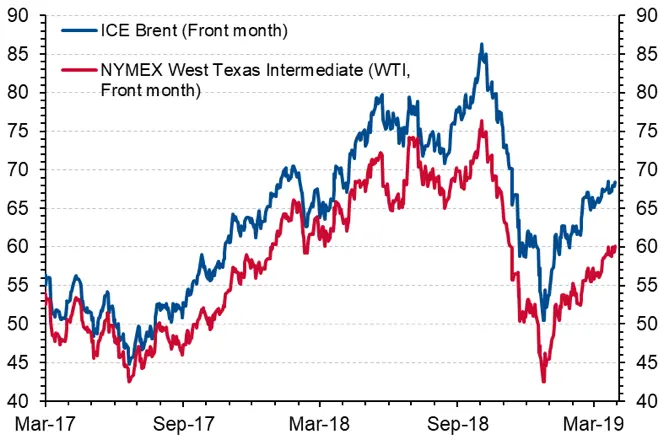

Chart 1: Crude Oil Prices

Chart 1: Crude Oil Prices

A tightening market

Improving oil prices have been driven by a tightening market, with production cuts across a number of global producers. OPEC’s efforts to set production limits, in addition to commitments to the Vienna Agreement, have resulted in significant reductions in output by leading oil producers.

OPEC-11 compliance reached 106% in February, with aggregate production falling by 812 kb/d. Non-OPEC compliance improved to 52% in February, from 25% in January of this year. Russia recently reiterated that it intends to fully comply soon.

Political turmoil has resulted in a supply adjustment, with output from Venezuela, Libya and Iran falling. Even in the US, supply has been less bullish. While US crude production continues to break new ground, the number of oil drilling rigs has fallen for six consecutive weeks, by 7.8% in 2019.

NBK Group Chief Economist, Dr. Saade Chami, commented:

“We expect oil prices to firm up over the second and third quarter of this year, as estimated global oil demand remains unchanged and the demand/supply balance flips into deficit for the second and third quarter of the year. The possible non-renewal of the 180-day US sanctions waivers on Iran expiring in early May will have a significant impact on oil markets, with a potential reduction in supply of several thousand barrels. However, experience taught us that oil prices are subject to large swings as we have witnessed recently”

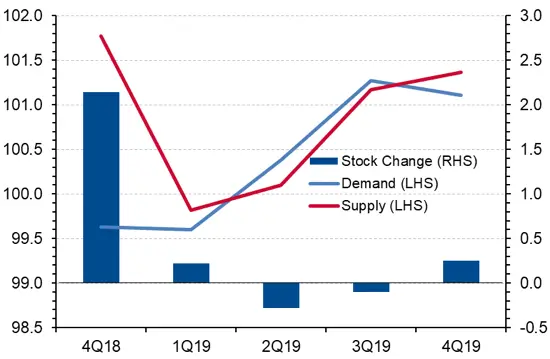

Chart 2: Demand/supply balance until 4Q18

The report indicates that a more aggressive response vis-à-vis Iran in the context of falling Venezuelan production could lead to an even tighter market, especially in heavy crude, and propel crude prices above what US president Donald Trump would be comfortable with. Extending the waivers for another six months or slowly tightening the criteria, by reducing the list of countries eligible for waivers, might become an attractive middle way for the US.

Dr. Chami continued:

“Of course, the oil price outlook rests on several moving parts, both economic and political, and not all of which will necessarily come into play to the extent envisaged – or at all – during the remainder of the year. Policy changes, global geopolitical conditions and market dynamics will continue to affect a rapidly shifting price environment.”

Downside risks to oil prices could include greater-than-expected US shale-led supply gains; termination of the OPEC+ supply agreement in June, or under-compliance by a few members; and a further weakening of global economic growth.

The International Maritime Organization’s 2020 regulations, set to come into effect next year, will put upward pressure on diesel and crude oil prices. With maritime shipping accounting for 3% of demand for oil, ships will now be required to shift from high-Sulphur fuel oil to low-Sulphur diesel/gasoil. The oil price impact of this development could be asymmetrical, with upward price pressure on light sweet crudes such as Brent, which are low in Sulphur, and downward pressure on higher levels of Sulphur.

The full oil markets report can be downloaded at NBK’s Economic Report website.

-Ends-

About National Bank of Kuwait (NBK):

NBK was founded in 1952 as the first indigenous bank and the first joint stock company in Kuwait and the Gulf Region. NBK reported net profits of USD 1.2 billion (KD 370.7 million) for 2018. NBK's total assets were USD 90.4 billion (KD 27.4 billion) at the end of 2018, while shareholder equity stood at USD 9.7 billion (KD 2.9 billion).

NBK is the largest financial institution in Kuwait with effective market dominance in the commercial banking market and has been consistently awarded the highest credit rating of all banks in the region from Moody's, Standard & Poor's, and Fitch Ratings. NBK also stands out in terms of its local and international network, which includes branches, subsidiaries and representative offices in China, Geneva, London, Paris, New York, and Singapore alongside its regional presence in Lebanon, Jordan, Egypt, Bahrain, Saudi Arabia, Iraq, Turkey, and the UAE.

To find out more visit: www.nbk.com

Media enquiries:

Diana Estupinan

Instinctif Partners

Diana.Estupinan@instinctif.com

+971 4369 9353

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.