PHOTO

Oil prices

Oil prices eased early on Monday on potential supply hikes as concerns about supply disruptions eased and Libyan ports resumed export activities.

Brent crude futures were down 48 cents, or 0.6 percent, at $74.85 a barrel at 0302 GMT.

U.S. West Texas Intermediate (WTI) crude was down 39 cents, or 0.6 percent, at $70.62 a barrel.

“There are mixed supply signals and I think the (Brent) price is likely to be in the low-to-mid $70s range,” Kim Kwang-rae, commodity analyst at Samsung Futures in Seoul, told Reuters.

“A summit between U.S. President Trump and Russian President Putin is also being watched in case they say something about oil,” Kim said.

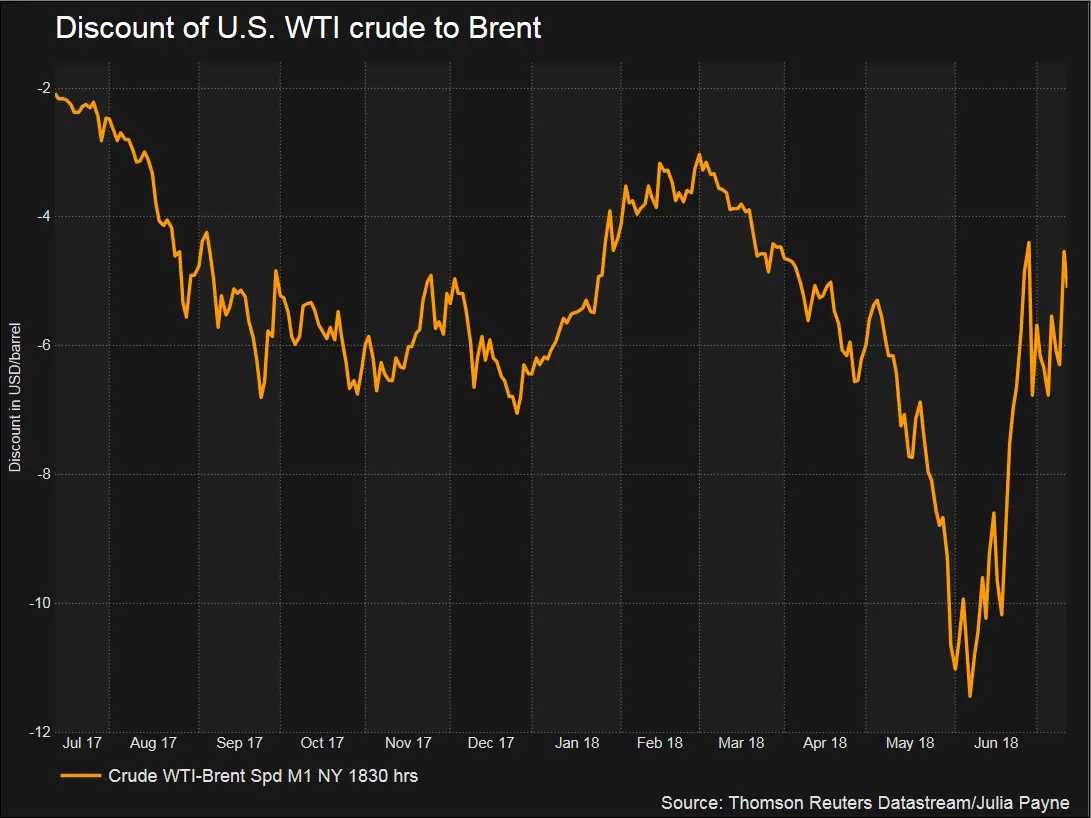

A surging United States production has doubled the price discount of U.S. light crude to benchmark Brent.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Global markets

Asian shares traded lower on Monday as trade tensions between the United States and China continued to weigh on investor sentiment and as official data showed China’s economy grew 6.7 percent in the second quarter of 2018, which was in line with market expectations but slightly lower from the 6.8 percent growth registered in each of the previous three quarters.

MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.4 percent.

On Friday on Wall Street, the Dow Jones Industrial Average rose 94.52 points, or 0.38 percent, to 25,019.41, the S&P 500 gained 3.02 points, or 0.11 percent, to 2,801.31 and the Nasdaq Composite added 2.06 points, or 0.03 percent, to 7,825.98.

Middle East markets

Most Stock markets in the Middle East closed higher on Sunday as strong oil prices boosted indices in the region.

Dubai’s index added 0.6 percent, as DXB Entertainments rose by 1.7 percent after the company said its visitor numbers in the first half of 2018 were up 46 percent compared to the same period of last year. Emaar Properties closed up 0.8 percent, while Emaar Malls rose by 1.9 percent. The company announced the appointment of Patrick Bousquet-Chavanne, a former chief marketing and digital officer for British retail chain Marks & Spencer as its new CEO after the market closed.

Neighbouring Abu Dhabi’s index closed 0.2 percent up, with First Abu Dhabi Bank climbing by 0.4 percent. Dana Gas finished 2.9 percent up.

Saudi Arabia’s index added 0.5 percent as Saudi Basic Industries Corporation (SABIC) rose 1.1 percent and Al Rajhi Bank climbed 0.5 percent.

Qatar’s index added 0.2 percent, as Qatar Islamic Bank was the main gainer, rising by 1.5 percent after the bank beat the average forecast of analysts, according to Reuters calculations, after reporting a 14.8 percent jump in second-quarter net profit on Sunday.

Egypt and Kuwait’s indices edged down 0.2 percent, while Oman’s index added 0.4 percent and Bahrain’s index rose 0.1 percent.

Currencies

The dollar held firm early on Monday as trade tensions between the United States and China kept investors on edge.

The index that tracks the dollar against six other major the currencies was barely changed at 94.750.

Precious metals

Spot gold was slightly higher on Monday, trading at $1,242.40 per ounce after dropping to seven-month lows on Friday.

In other news

China’s June factory output growth dropped to a two-year low in a worrying sign as a heated trade war with the United States threatens to knock exports.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

A new version of the Trading Middle East newsletter is being launched in late July, 2018. To keep receiving the newsletter, please subscribe using this link.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018