PHOTO

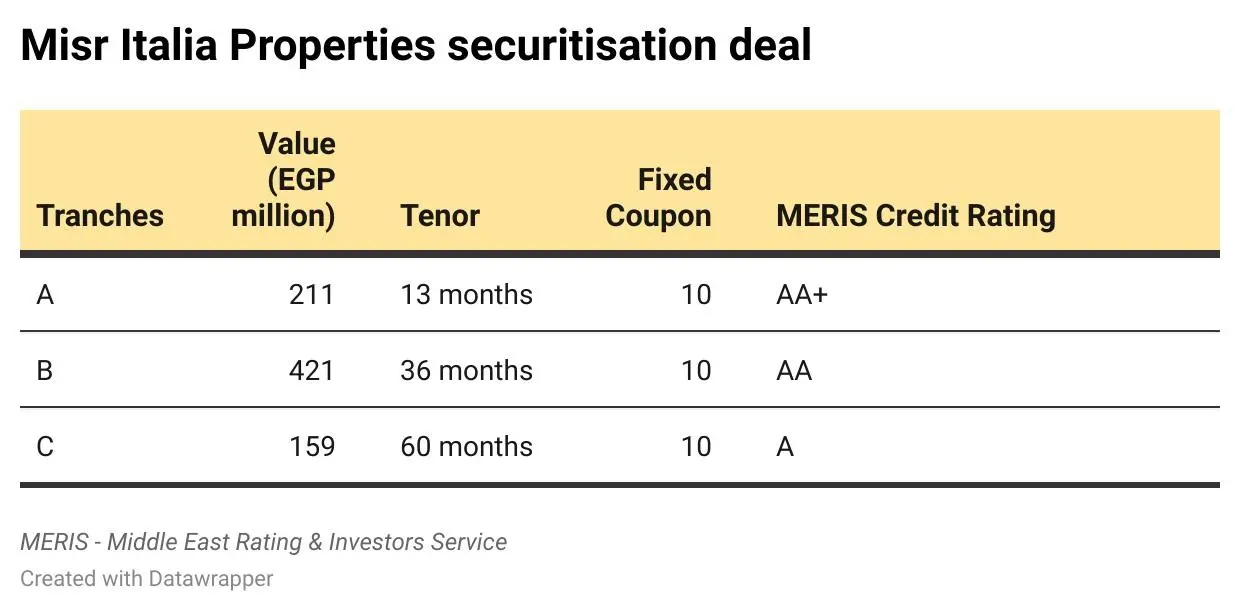

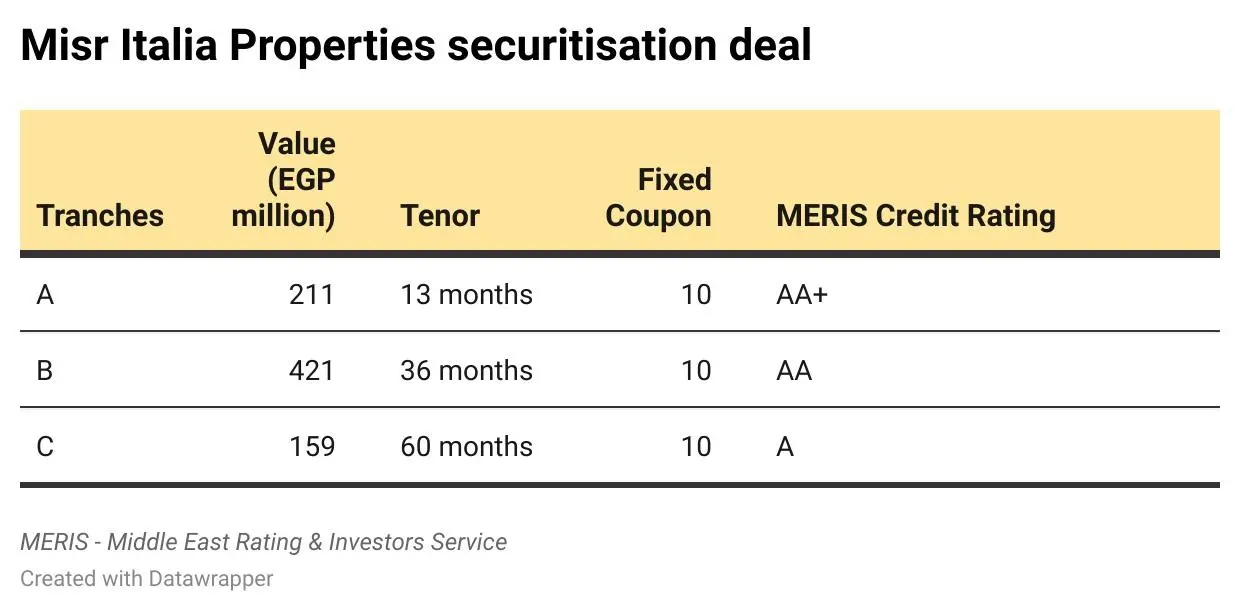

Misr Italia Properties (MIP) and EFG Hermes announced last week the close of the first issuance, worth 794 million Egyptian pounds ($51 million), in a 2.5-billion-pound ($159 million) securitisation programme.

The bond is backed by a receivables portfolio of around 1 billion pounds ($64 million) originated by two Misr Italia Holding subsidiaries, EFG Hermes said in a press statement.

The bond is comprised of three tranches, with the first divided into fixed instalments, and the second and third to be disbursed based on the proceeds of the portfolio.

Mohamed Hany El Assal, MIP’s CEO and Managing Director said the company is Egypt's first non-listed real estate developer to issue securitised bonds through EFG Hermes.

“We are honoured to have a long-term partnership with EFG Hermes, which is vital to the growth of the company’s portfolio according to our ambitious expansion plans. This issuance will reflect positively on the financial statements of the company and will contribute to our commitment toward our clients for the timely delivery of units.”

MIP’s CEO & Managing Director Mohamed Khaled El Assal added: “The company went through a rigorous operational review process by MERIS [Moody’s Egyptian joint venture], and received a very strong credit rating that we are proud of. This is the result of a very solid corporate governance and the hard work of a top-notch executive and management teams.”

Mostafa Gad, Co-Head of Investment Banking at EFG Hermes said: “The transaction was met with widespread interest from investors, capitalising on our strength in the DCM space to continue generating value for our partners and clients through flexible, alternative financial solutions.”

Last November, MIP signed an agreement with valU, the buy now pay later (BNPL) platform and a subsidiary of EFG Hermes, to provide MIP’s clients with financing programmes to cover finishing and furnishing expenses.

Additionally, MIP and EFG Hermes signed a sale and leaseback agreement worth 750 million pounds ($48 million) last October to refinance the former’s flagship commercial project in New Cairo.

EFG Hermes acted as the sole financial advisor, transaction manager, book-runner, underwriter, and arranger on the securitisation issuance. Arab Investment Bank (aiBANK) participated in this transaction alongside the Commercial International Bank (CIB), Banque du Caire (BDC), National Bank of Egypt (NBE), and Suez Bank.

(1 US Dollar = 15.71 Egyptian Pounds)

(Writing by Eman Hamed; Editing by Anoop Menon)

(anoop.menon@lseg.com)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022