PHOTO

The total value of contract awards in Saudi Arabia in 2022 reached about 192.4 billion Saudi riyals ($51.3 billion), a 35 percent surge year-on-year (YoY), the US-Saudi Business Council (USSBC) said in its latest report.

Contracts awarded in the fourth quarter of 2022 touched SAR 71.5 billion ($19.1 billion), marking a 2 percent increase YoY.

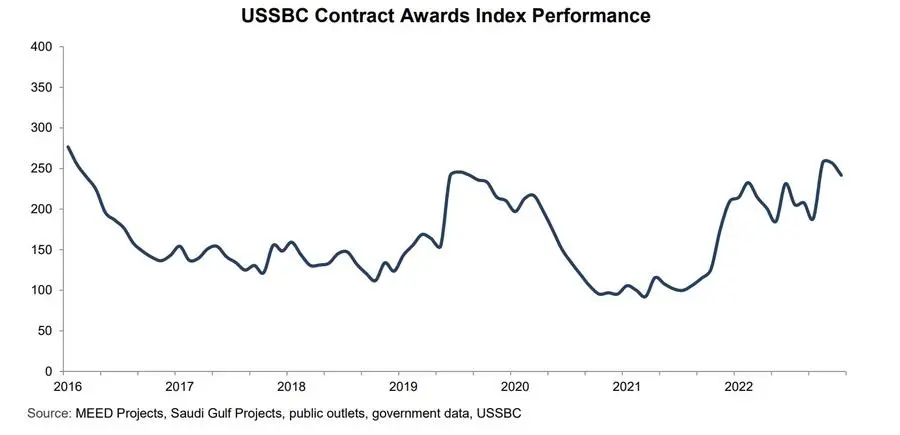

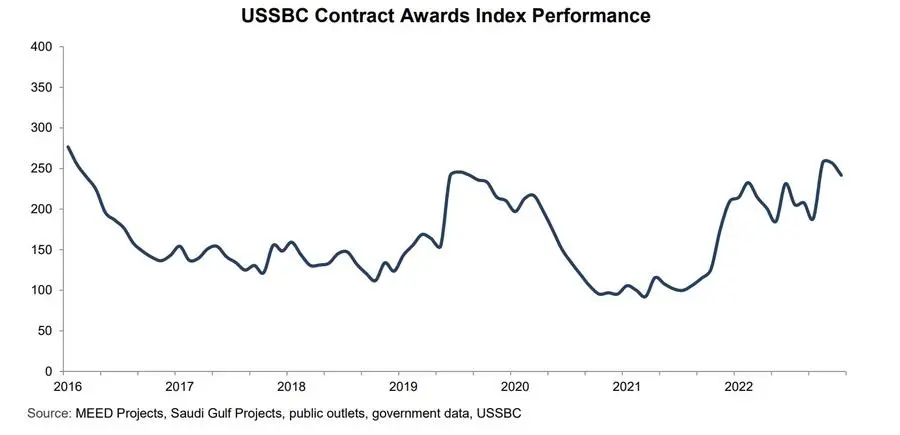

The USSBC Contract Awards Index (CAI) for 2022 grew by 16 percent Year-on-Year (YoY). It climbed to 241.71 points at the end of the fourth quarter of 2022, staying above 200-point mark in 11 out of the 12 months in 2022.

The CAI grew by 52.92 points or 28 percent Quarter on Quarter (QoQ) while growing by 32.66 points or 16 percent YoY on the back of numerous giga-projects following the pandemic induced slowdown that hampered the construction sector.

Top sectors in 2022

The real estate sector reached the highest value of awarded contracts at nearly SAR 38.9 billion ($10.4 billion) for the fourth quarter of 2022 fuelled by the residential real estate market. The real estate sector achieved the highest tally in awarded contracts in 2022 with SAR63.1 billion ($16.8 billion), which was SAR42.2 billion ($11.3 billion) or 202 percent greater than 2021.

The sector accounted for 33 percent of the total value of awarded contracts during 2022.

The second spot went to power sector as the value of awarded contracts rose to roughly SAR 16.4 billion ($4.4 billion) in the fourth quarter, a significant chunk of the value attributed to the Shuaibah 2 solar PV power plant. For the year, the power sector garnered the third highest value of awarded contracts by sector with SAR30 billion ($8 billion), which was SAR383 million or 1 percent higher than 2021.

The power sector accounted for 16 percent of the total value of awarded contracts during 2022.

The transportation sector awarded about 16 contracts worth SAR 6 billion ($1.6 billion) in the fourth quarter, the report said. Contract awards declined by 85 percent Quarter on Quarter but grew by 30 percent YoY. For 2022, the transportation sector received the second highest value of awarded contracts with SAR38.6 billion ($10.3 billion), which was SAR29.1 billion ($7.8 billion) higher than 2021.

The sector accounted for 20 percent of the total value of awarded contracts during 2022.

Top regions in 2022

The Tabuk region registered the highest tally of awarded contracts at it attracted SAR27.4 billion ($7.3 billion) or 38 percent of the total. NEOM accounted for a majority of the contracts as it awarded SAR25.7 billion ($6.9 billion) or 94 percent of all contracts during the quarter. NEOM’s contract awards were in the real estate and transportation sectors. The remaining SAR1.8 billion ($468 million) contracts were awarded by Red Sea Global, SEVEN, and Tabuk Municipality also across the real estate and transportation sectors.

The Riyadh region captured the second highest value of awarded contracts with SAR13.8 billion ($3.7 billion) or 19 percent of the total. The Makkah region rounded the top three regions by awarded contracts with SAR12.7 billion ($3.4 billion) or 18 percent of the total.

“The surge in contract awards continues unabated on the back of a growing economy that was fuelled by significant oil revenues and the acceleration of giga-projects following the COVID-19 slowdown”, said Albara’a Alwazir, Director of Economic Research at the U.S.-Saudi Business Council. “Furthermore, the private sector’s increasing contribution to the Kingdom’s diversification strategy is aiding in the rebound of the construction sector to pre-pandemic periods.”

Oil GDP’s YoY growth of 15.3 percent in 2022 was the highest since 2003 when it reached 17.4 percent. The windfall in oil revenues strengthened the Kingdom’s position to support the funding of national diversification strategies while accelerating the development of its non-oil sector.

The private sector’s contribution to GDP reached an all-time high in 2022 as it accumulated SAR1.2 trillion ($325 billion), growing by 5.3 percent YoY. These developments supported construction sector GDP as it grew by 4.5 percent, the highest rate since 2014 when it reached 6.6 percent.

The growth in the Kingdom’s construction spending was evident in part by the government’s increase in state capital expenditures (capex). Capex surpassed the budgeted SAR92 billion ($24.5 billion) for 2022 by 56 percent to reach SAR143 billion ($38.3 billion). Furthermore, capex grew by SAR26 billion ($7 billion) or 22 percent compared to 2021.

The Kingdom’s Gross Fixed Capital Formation (GFCF) rebounded strongly in 2022 as construction activities picked up causing demand for demand for machinery, land improvements, investments in unfinished dwellings, and non-residential building to surge. GFCF grew to SAR800 billion ($213 billion) in 2022, marking a 24.1 percent increase YoY, the highest in decades.

The private sector accounted for 87 percent of total GFCF, reinforcing its role as growing contributor to the economy.

Read more: Saudi Arabia awarded contracts worth $6.7bln in Q3 2022

(Writing by P Deol; Editing by Anoop Menon)

(anoop.menon@lseg.com)