PHOTO

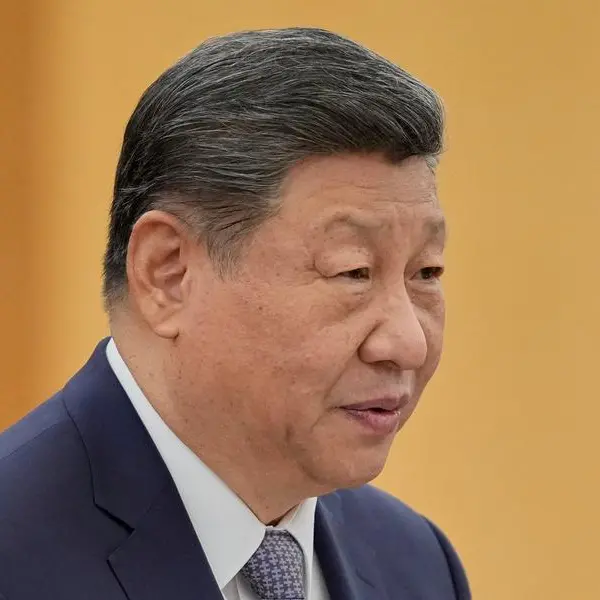

China’s Greater Bay Area (GBA) boasts a significant number of innovative, growing and profitable private enterprises which together comprise what is referred to as the ‘Factory of the World’ and present great investment potential.

China is aiming to close the gap in advanced technologies which will boost GBA as a high-tech region, said Investcorp, a leading global alternative investment firm, which has published a white paper that looks at the potential of GBA – encompassing most of the Guangdong Province and the two Special Administrative Regions Hong Kong and Macau.

China has created a globally competitive industrial and technology cluster with Hong Kong (an internationally leading capital market) and Shenzhen (one of the world’s most innovative technology urban centres) at its core, surrounded by world-class manufacturing and R&D capabilities, highly efficient transportation and logistics links, and a continuous influx of well-educated skilled workforce, altogether enabling the region to churn out thousands of successful SMEs each year.

$500 million Fund

Investcorp and Hong Kong-based partners Fung Capital recently announced a new $500 million Fund focused on the GBA during the Future Investment Initiative in October.

The white paper, entitled ‘The Emergence of China’s Greater Bay Area’ tracks the development of the region into an economy that is the 10th biggest globally, the transformation of Shenzhen into an economic powerhouse following Deng Xiaoping’s reform and opening policies of the 1980s, and the growth trajectory of the region following increased investment in infrastructure and pro-innovation policies.

“The GBA offers huge scope for growth in comparison with other Bay Area industrial clusters around the world, which are currently far ahead in Per Capita GDP. Pro-Innovation Chinese policies, world-class modern infrastructure, a dynamic ecosystem and millions of highly educated and skilled technology engineers now present in the region represent enormous potential for the GBA to close that gap. With the launch of our new buy-out focused $500 million GBA-focused Fund with Hong Kong’s Fung Group, targeting promising mid-cap companies with proven profitability and strong growth potential, we are looking to give investors access to this evolving opportunity,” said Hazem Ben-Gacem, Investcorp Co-CEO.

Ample opportunity

“While China like other countries is facing a global economic downturn, geopolitical tensions and managing the transition to a post-Covid recovery world, it is important not to lose sight of the fundamentals that single out the GBA ecosystem as a great investment opportunity. There is ample opportunity, particularly, for GBA-centered mid-cap companies to be grown into significantly larger and global players,” said Duncan Zheng, Head of Investcorp Private Equity China.

“It’s important to remember that as China prepares to usher in its next five-year plan following the 20th Party Congress this year, GBA’s role as one of the main economic engines of China has never been more important as the country looks to rebalance its economy towards a consumption and innovation driven model with a goal of achieving carbon neutrality by 2060.”

Since launching its Asia expansion strategy, Investcorp has committed more than $1 billion of capital toward investments in China and Southeast Asia alongside its clients and partners. Investcorp invests in medium-sized companies in China and Southeast Asia in the consumer, healthcare and industrial technology sectors. These companies are profitable and growing and benefit from Asia’s expanding middle class and the digital transformation of these economies.-- TradeArabia News Service

Copyright 2022 Al Hilal Publishing and Marketing Group Provided by SyndiGate Media Inc. (Syndigate.info).