PHOTO

Abu Dhabi, UAE – Bayut, the UAE’s leading property portal, has released its Abu Dhabi Annual Sales and Rental Market Report for 2023, providing a comprehensive analysis of the real estate market in the UAE capital. With these comprehensive reports, Bayut reveals key insights into the current market trends, pricing dynamics and future forecasts in the sales and rental market of Abu Dhabi.

Based on the search trends observed on the platform, the prices of properties in Abu Dhabi have been on an upward trend, which could be advantageous for those looking to sell or rent out their properties. While there was an increase in sales prices in several areas driven by high demand, this trend was particularly noticeable in upscale neighbourhoods offering high-end amenities and facilities.

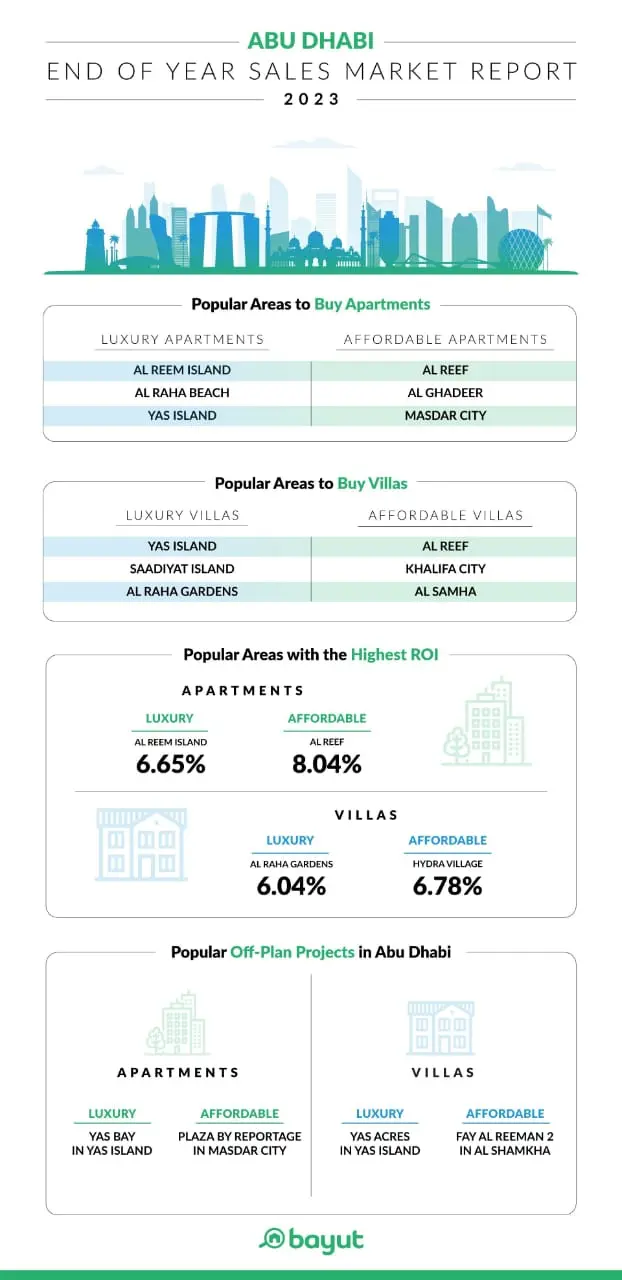

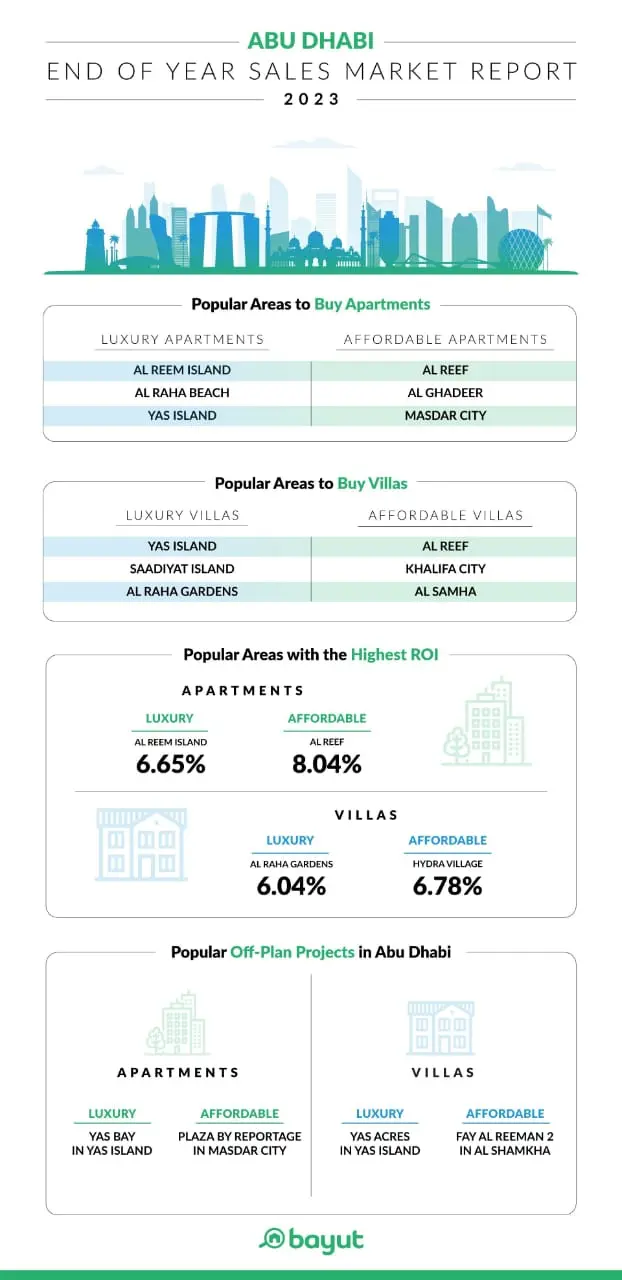

Trends for Buying Properties in Abu Dhabi

- For affordable apartments, Al Reef and Al Ghadeer have been the most searched areas. Luxury apartment seekers have also generated high search volumes for units in Al Reem Island, Yas Island and Saadiyat Island in 2023.

- Data from Bayut shows that sales prices for luxury apartments and villas in Abu Dhabi's sought-after neighbourhoods have risen by up to 13% in 2023. Saadiyat Island was a particular highlight, revealing price increases of 8.73% for luxury apartments and a massive 12.9% hike for premium villas.

- Sales price-per-square-foot for the highly searched areas featuring affordable apartments have experienced moderate declines of up to 2.05%. When it comes to affordable villas, there has been a minor increase of up to 3.95% recorded in price-per-square-foot. Most notable appreciations were seen for Al Samha, followed by Khalifa City and Al Ghadeer.

- As per DARI, Abu Dhabi’s trusted digital real estate ecosystem, there were over 14,000 residential property (ready and off-plan) sales transactions valued at over AED 52B in 2023.

- In terms of projected ROI for apartments, Al Reef stood out with an impressive 8.04% rental yield in the affordable housing category. Al Reem Island continued to offer a healthy 6.65% ROI for investors interested in luxury flats for sale in Abu Dhabi.

- Bayut’s data analysis for ROI in Abu Dhabi’s popular villa communities also reveals positive stats. In the affordable category, Hydra Village offered a 6.78% ROI for houses, whereas Al Raha Gardens offered the highest ROI of 6.04% for buy-to-let villas in the luxury villas segment.

Trends for Renting Properties in Abu Dhabi

- As reported by Bayut, advertised rental prices for apartments in the most searched-for luxury areas have experienced moderate to major increases by up to 14%, mainly in island communities. Affordable apartment rentals have continued to stay competitive, with a price drop of almost 3% in some areas.

- Rental prices for affordable villas have experienced minor to moderate upticks of up to 4.91%. High-end villas, on the other hand, witnessed major appreciations in rental costs. As per Bayut's report, Yas Island and Saadiyat Island have revealed 12.7% and 22.2% hikes in prices for luxury houses, potentially driven by a solid demand.

- Affordable accommodation seekers have focused on Khalifa City and Al Khalidiya for apartments. Those looking for spacious villas on a budget have mainly picked Mohammed Bin Zayed City and Khalifa City. In the luxury segment, tenants in Abu Dhabi preferred Al Reem Island and Al Raha Beach for apartments, while Al Raha Gardens and Yas Island were favourites for premium villas.

In 2023, the Abu Dhabi market experienced positive shifts in sale and rental segments. This positive momentum suggests sustained interest and investment in Abu Dhabi's real estate landscape. The capital’s increasingly robust market is potentially driven by factors such as increased demand, attractive investment opportunities and a conducive economic environment.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and Head of Dubizzle Group MENA said:

“What we witnessed in 2023 was a record-breaking year for the overall UAE real estate market and Abu Dhabi has also been a major contributor to that success. Local and international HNWIs continue their interest in UAE real estate as a prime market for investment, especially with landmark projects like Jubail Islands and Rahman Islands taking shape. While the factors for the growth in the property sales market in Abu Dhabi certainly include investors taking advantage of favourable market conditions, the steady increases across the capital’s rental sector have also inspired more property-seekers to become homeowners, as opposed to paying large sums in rent.

It’s quite clear that demand is high for properties in the capital. Over the course of 2023 we received over 14 million visits to Bayut for properties advertised in Abu Dhabi. This number continues to grow year-on-year and we expect that trend to stay steady, especially taking into account the growing international interest in the Abu Dhabi market.’’

Note: For an accurate representation of price changes, this report compares the average price-per-square-foot in an area to analyse sales trends for villas and apartments in 2023 to those observed in 2022. These prices are, however, subject to change based on the building, amenities, developer and other deciding factors. For the rental properties, the report compares the average cost for individual unit types between the two periods in popular Abu Dhabi neighbourhoods.

Disclaimer: The above report is based on prices advertised by real estate agencies on behalf of their clients on Bayut.com, and is not representative of actual real estate transactions conducted in Abu Dhabi.