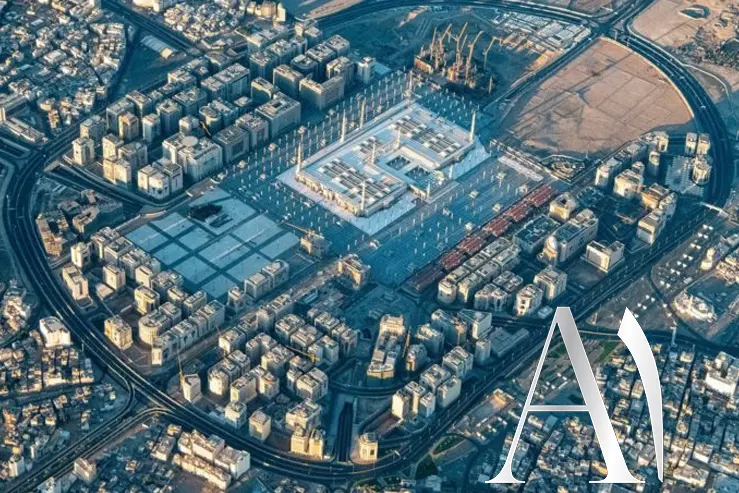

PHOTO

Global real estate advisory firm Alpha1Estates said on January 25, 2026 / 6 Shaban 1447 that the real estate ecosystem for Makkah and Madinah is set to hit a quarter of a century high-inflection point in the first quarter of 2026, starting with foreign real estate ownership becoming legal as of January 22 followed by a key set of sector-enhancing initiatives being introduced by the Saudi Arabia.

Non-Saudi Arabian foreign ownership of real estate in Makkah and Madinah had been restricted to long-term investment lease (usufruct) and inheritance as of ‘The Foreign Ownership of Real Estate Regulation’ in April 2000, but on July 25, 2025, a new framework titled ‘The Updated Law of Real Estate Ownership by non-Saudis’ was published, as approved by the Saudi Arabian Government, becoming law as of January 22, 2026, thereby now allowing non-Saudi Arabian Muslims, be they resident or non-resident, as well as Saudi Arabian companies with foreign shareholders, to own property in Makkah and Madinah in designated geographic zones.

“Fortune favours the bold, driven and patient, as it has taken a quarter of a century for the soft infrastructure to be built for non-Saudi Arabian Muslims to own real estate in Makkah and Madinah, which particularly accelerated this past decade, and we are honoured and privileged that Alpha1Estates has been a global catalyst, demonstrated year after year, to reach this critical inflection point for the past two decades,” said Talal Malik, Founding CEO of Alpha1Estates, the world’s first company to market real estate in Makkah and Madinah globally with the company’s launch on January 1, 2006. “From direct involvement in milestone top-tier projects, key policy advisory recommendations to on-the-ground lived expertise in the entire ecosystem of the Holy Cities as a landing-point for the global market, we are about to witness the potential for the real estate sector in Makkah and Madinah to now lift off for an accelerated decade boom.”

In the first quarter of 2026, Saudi Arabia is directly facilitating the key inflection point in the country’s real estate ecosystem by: legalising non-Saudi Arabian real estate ownership, as of January 22, 2026; launching the Saudi Properties platform as the main vehicle for this through the Real Estate General Authority (REGA) portal; convening and hosting the Real Estate Future Forum (RFF) scheduled to take place in Riyadh on January 26, 2026, with the likes of former US President Bill Clinton, UK Prime Ministers Sir Tony Blair and Boris Johnson, former US Secretary of States Hilary Clinton and John Kerry, as well as Sir Richard Branson, Piers Morgan and Tucker Carlson speaking at the high-level conference; enabling all foreign investors to directly invest in the Saudi Stock Exchange from February 1, 2026, with the Saudi Arabia expected to announce the 170 designated geographic zones for real estate ownership across the Kingdom in the first quarter of 2026.

To coincide with this inflection-high point, Alpha1Estates is also launching three initiatives: firstly, as detailed here, the Ihsan al-Haramain Real Estate Index 2025, the world’s first real estate index for Saudi listed companies involved in the real estate sector in Holy Cities, launched in 2012, for the full year 2025; secondly, the Ihsan al-Haramain Overview 2025, the year in review for the real estate sector in the Holy Cities, available exclusively as market intelligence on Alpha1Estates.com; and thirdly, the enhanced Ihsan al-Haramain Consulting Programme, the world’s first buyer’s advocate consulting programme for the Holy Cites real estate sector launched in 2007, via Alpha1Estates.com. In addition, Alpha1Estates is also hosting the Real Estate General Authority’s Updated Law itself as well as REGA’s Questions and Answers about the law itself on Alpha1Estates.com, and the link to Saudi Properties on REGA at https://saudiproperties.rega.gov.sa/home.

With regards to the Ihsan al-Haramain Real Estate Index (with the inclusion of Retal), 2025 witnessed the landmark publication of the non-Saudi real estate foreign ownership law in July, but the market had already leapt from this envisaged publication in 2024, not in 2025, with the Ihsan al-Haramain Real Estate Index for the Holy Cities in 2024 flying up a colossal 34%%, lifted by both the Madinah real estate sector soaring 35.6% and Makkah by 33%. In contrast in 2025, there was more of an overall market correction influenced by global headwinds than local market ones, with the Ihsan al-Haramain Real Estate Sector for the Holy Cities down by 14.3%, compared with the Real Estate Management & Development market index down by nearly 13% (reconstituted with Umm al-Qura trading from March 24, Banan Real Estate trading January 1 and Dar al Majed trading September 10) and Saudi Arabia’s Tadawul All Share Index (TASI) also down by nearly 13%.

“As the Ihsan al-Haramain Index shows, no sector, now matter how inelastic demand is, is immune from global headwinds from geopolitics and geoeconomics, but if taken over a two-year period, which the market prepared from March 2023 with regards to foreign ownership legislation forthcoming, the Ihsan al-Haramain Index has actually gained 14%,” said Talal Malik, Founding CEO of Alpha1Estates. “Whereas Saudi Arabia’s Tadawul All Share Index (TASI) stayed at 0.28% in 2024, the Ihsan al-Haramain Index, and both Makkah and Madinah sub-indexes, all made over 33% leaps in 2024, demonstrating the fundamentals we see today, which now stand to be genuinely accentuated.”

The Makkah Real Estate listed sector was down 10.5% percent, compared with being up 33% last year, with only Umm al-Qura (Masar) being up 39%, compared to being down 16.9% in 2024; and the Madinah Real Estate listed sector was down 22.7%, having been up 35.6% in 2024, with Taiba down 46.8%, having been up 54% in 2024. Outside the Holy Cities, all listed real estate companies ended the year down by the end of 2025, compared with 2024 when the likes of Arriyadh and Saudi Real Estate, who were also up a colossal near or actual 60%, but the Red Sea Company was stratospheric at 157.5%.

More than two decades ago, Alpha1Estates on December 26, 2005, conducted the first television launch of Saudi Arabian real estate projects in Makkah and Madinah with the first global television launch of Abraj al-Bait with Zamzam Tower in Makkah and Taiba Eastern Tower in Madinah. Alpha1Estates formally launched on January 1, 2006, becoming the world’s first company to market real estate projects in Makkah and Madinah globally, and on January 1, 2007, launched the Ihsan al-Haramain Programme, the world’s first buyer’s advocate consulting programme for the Holy Cites real estate sector, including being consulted by global real estate giant Jones Lang LeSalle, market cap USD $16.71 billion, about its entry into Saudi Arabia. In 2012, Alpha1Estates launched the Ihsan al-Haramain Real Estate index for the Holy Cities and proposed five critical pieces of legislation that focused on globalising the real estate sector in the Holy Cities, becoming clearly the key milestone policy recommendations for the ecosystem, and sector, as a whole: including easing of immigration and travel for non-Saudi Muslims; setting up a real estate regulatory authority to monitor buying and selling of real estate and prevent monopolies; empowering non-Saudi Muslim ownership, leasing and investment of real estate; easing non-Saudi Muslims setting up a company, working, residing or studying in the Kingdom, and introducing and scaling Islamic mortgage financing in the Kingdom.

In April 2016, Saudi Arabia launched its socio-economic diversification roadmap, Vision 2030, and in March 2023, the Real Estate General Authority in the Kingdom stated a new property law was currently being prepared, which would allow for foreign ownership of any kind of property including commercial, residential and agricultural, including the Holy Cities. Since 2020, Saudi Arabia has been working on the non-Saudi real estate ownership law and ecosystem, which has now become law as of January 2026, exactly two decades after the launch of Alpha1Estates.

Alpha1Estates has historically worked with the three of the five largest real estate developers in Saudi Arabia, five of the biggest in the Middle East and on global real estate transactions since 2018, ranging from USD $632 million to USD $1.5 billion for royal family offices, ultra-high net-worth individuals (UHNWIs) and sovereign institutions. Alpha1Estates Founding CEO Talal Malik has been recognised as a world-class entrepreneur, founding Alpha1Corp, and as a top-tier global strategic adviser. He was educated at Oxford University, the world’s pre-eminent university for creating world leaders historically, including educating nearly every Prime Minister in the UK for the past five decades; and has worked as a senior management adviser at McKinsey & Company, the world’s most prestigious management consulting firm, recognised as TIME’s Best Company for Future Leaders. With regards to entrepreneurship, Talal Malik, as a direct result of his influence and achievements as an entrepreneur leading Alpha1Corp and firm-divisions like Alpha1Estates, was invited in February 2025 to be one of 150 people to in-person attend the first international audience address of US President Donald J. Trump in Miami, USA, following his election, attended by the likes of Space X Entrepreneur Elon Musk and televised by the White House.

ABOUT ALPHA1ESTATES

Alpha1Estates is a global real estate advisory firm headquartered in the United Kingdom. It primarily focuses on real estate investment advisory, including in fast-growth markets. The company has advised on some of the Middle East’s most prestigious real estate projects, working with the largest developers. Please visit www.Alpha1Estates.com

Contact:

Ms. Aisha Imam

Head of Talent and Media

Alpha1Estates

Email: A.Imam@Alpha1Estates.com

Website: http://www.Alpha1Estates.com