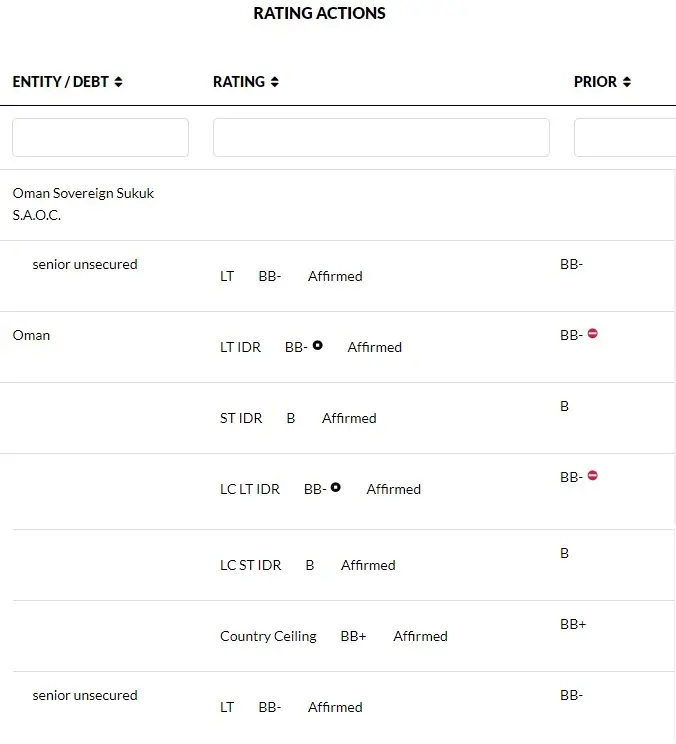

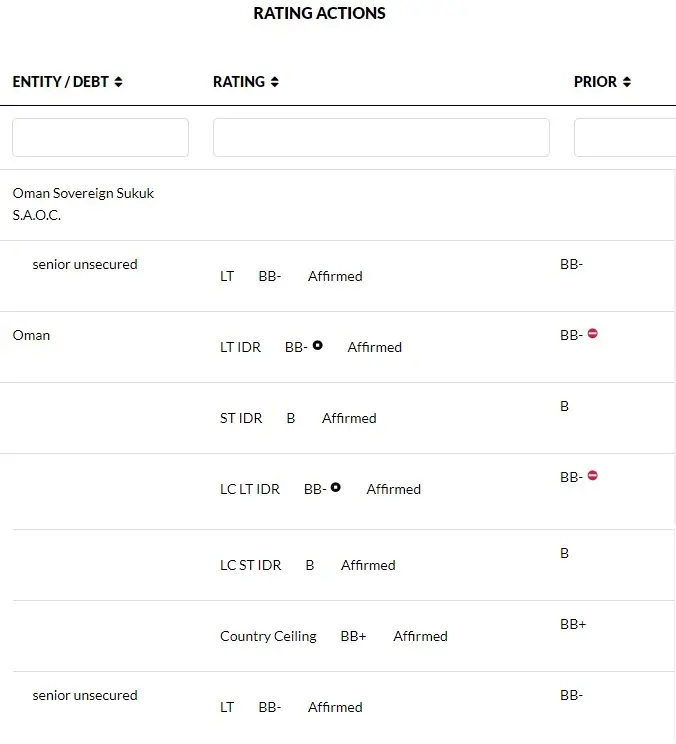

Hong Kong : Fitch Ratings has revised Oman's Outlook to Stable from Negative while affirming the sovereign's Long-Term Foreign- and Local- Currency Issuer Default Ratings (IDR) at 'BB-'.

A full list of rating actions is detailed below.

KEY RATING DRIVERS

The revision of the Outlook reflects actual improvements in, and the expected evolution of, key fiscal metrics including government debt/GDP and the budget deficit, driven by higher oil prices and fiscal reforms, and a lessening of external financing pressures relative to recent years even as external funding needs remain high.

We estimate that the budget deficit narrowed to 3.4% of GDP in 2021, from 16.1% of GDP in 2020. Hydrocarbon revenue grew by a third, according to our estimates, driven largely by a 28% rise in Oman's average fiscal oil price, and likely accounted for more than half of the narrowing in the budget deficit.

The government has made progress with implementation of its medium-term fiscal plan (MTFP), which aims to balance the budget and lower government debt/GDP to 61% by 2025. In January-October non-oil revenue grew 40% yoy, helped by the introduction of a 5% VAT in April, dividends to the budget from the Oman Investment Authority (OIA) and gradual economic normalisation, as Covid-19 related-restrictions were lifted and Oman's vaccination drive accelerated. As of late November, 84% of the targeted population had had two vaccination doses and a booster programme had begun.

Total spending declined 6% yoy, according to preliminary figures, helped by the 4Q21 shift of the majority of hydrocarbon spending off budget to Energy Development Oman (EDO), the state-owned enterprise (SOE) to which the government transferred its stake in Petroleum Development Oman, the main oil company in the country. EDO will pay royalties, profit taxes and dividends to the budget, will retain a portion of revenue to cover some spending and will issue debt to fund its annual capex (possibly USD3 billion annually). Electricity and water prices were increased mildly in 2021 as part of subsidy reforms, which aim to reduce subsidies by around two thirds by 2025, relative to 2020.

Headline figures for the proposed 2022 budget, which is still based conservatively on an oil price of USD50/barrel, indicate higher spending and revenue relative to the MTFP, while the budgeted deficit is around 1.7% of GDP larger. Detailed breakdowns are not yet available to determine what causes the deviations. Nonetheless, we forecast the budget deficit to narrow to 1.6% of GDP in 2022, given another strong year for oil and gas revenue (we assume an average oil price of USD70/b (Brent crude), up from USD53/b at the time of the previous review), a full year of VAT revenue, lower oil and gas capex and a small decline in subsidy costs.

We forecast the budget deficit to widen in 2023, to 2.2% of GDP, largely driven by our assumption for a decline in the Brent crude oil price to USD60/barrel (albeit higher than USD53/b at the previous review). This offsets improvements we forecast for non-oil revenue, which we expect to rise by 1pp of GDP in 2023, helped by the introduction of a personal income tax, and a small decline in spending/GDP. We forecast real GDP growth to accelerate to 3.1% in 2022 and steady to 2.3% in 2023, driven by stronger hydrocarbon growth next year, while non-oil growth will be moderate at just over 2% on average. Non-oil growth will be supported by further recovery from the pandemic and the completion of large projects, but constrained by the impact of fiscal consolidation.

We expect the MTFP, even on our assumption that it falls short of full, timely implementation, to lower the fiscal breakeven oil price to around USD60/b in 2024-2025 from above USD80/b in the past five years, and to narrow the non-oil primary deficit as a percentage of non-oil GDP to 24% in 2024 from 34% in 2020. This would represent an important structural improvement in the budget, even though Oman would nonetheless remain heavily dependent on hydrocarbon revenue and vulnerable to commodity-price shocks.

We forecast government debt/GDP to settle at lower levels, after it peaked at 71% in 2020 (lower than the initial 2020 figure of 79% following an upward revision to nominal GDP owing to improved statistical coverage). Government debt/GDP will have declined in 2021 to 67%, and we expect a further improvement to 64% in 2022, before the ratio edges higher to 65%-66%, as lower oil prices and modest GDP growth offset gains from fiscal reforms. This remains higher than, although much closer to, the median of 57% for 'BB'-rated sovereigns. At the same time, contingent liabilities are high and a risk for government finances, with non-bank SOE debt at around 40% of GDP in 2021 on Fitch's estimates.

External financing pressures on Oman have eased relative to recent years, although funding requirements remain sizeable and Oman's level of external indebtedness is high. Oman executed smoothly its funding plan for 2021, when the sovereign faced USD4.6 billion of external debt maturities. External maturities will peak in 2022 at USD6.1 billion, including a USD3.6 billion syndicated Chinese loan, before moderating to an average of USD3 billion in 2023-2026. In addition, SOEs have USD2.8 billion in average annual external debt payments in 2022-2024.

Sovereign net foreign assets (SNFA) are likely to have improved in 2021, to -9.1% of GDP, relative to 2020, after deteriorating dramatically in recent years, from 60% in 2015. We expect this metric to remain weaker than the 'BB' median and to worsen again over the medium term, although to a much smaller extent, as the current account deficit (CAD) widens with lower oil prices and a recovery in import demand from the Covid-19 induced lows of 2020. Oman's total net external debt position also moderated, but at 63% of GDP is three times worse than the 'BB' median and will likely increase in 2023-2024.

We estimate the Central Bank of Oman's gross foreign reserves to have increased to USD18.1 billion in 2021 (4.8 months of current external payments) from USD15 billion in 2020 as the CAD narrowed sharply to an estimated 3.2% of GDP in 2021, from 11.9% in 2020. As of September 2021, OIA's foreign assets were broadly stable, at USD16.8 billion.

Most of Oman's structural indicators are above the 'BB' median, including World Bank governance indicators. The succession of Sultan Haitham bin Tariq in 2020 has added momentum to Oman's reform agenda. Nonetheless, potential social pressure resulting from the low employment rate of young Omanis remains a risk to public finances and political stability. The economy and government budget revenues will remain heavily linked to the hydrocarbon sector, despite ongoing structural reforms to boost diversification.

ESG - Governance: Oman has an ESG Relevance Score (RS) of '5[+]' for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption. Theses scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model (SRM). Oman has a medium WBGI ranking at the 57th percentile, reflecting strong scores for rule of law and regulatory quality, but a low score for voice and accountability.

RATING SENSITIVITIES

Factors that could, individually or collectively, lead to negative rating action/downgrade:

-Public Finances: A higher trajectory of government debt/GDP than the baseline scenario, for example, stemming from weak implementation of the MTFP, a materialisation of large contingent liabilities or lower-than-expected oil prices

-External Finances: Substantial deterioration of Oman's external balance sheet and liquidity conditions, for example, in the form of a large decline in central bank reserves and OIA assets, or indications that Oman may face less favourable access to debt markets

Factors that could, individually or collectively, lead to positive rating action/upgrade:

- Public Finances: Greater confidence in the moderation of government debt/GDP and stabilisation of SNFA/GDP, for example, through staying broadly on track with the government's fiscal-balance programme or higher-than-expected oil prices

-External Finances: A marked decline in net external debt/GDP, reflecting lower SOE external debt, lowering risks to Oman's external finances

SOVEREIGN RATING MODEL (SRM) AND QUALITATIVE OVERLAY (QO)

Fitch's proprietary SRM assigns Oman a score equivalent to a rating of 'BB+' on the Long-Term Foreign-Currency (LTFC) IDR scale.

Fitch's sovereign rating committee adjusted the output from the SRM to arrive at the final LTFC IDR by applying its QO, relative to SRM data and output, as follows:

- Public Finances: -1 notch, to reflect the risks to public finances from contingent liabilities (with SOE debt at 44% of GDP in 2020), high dependence on hydrocarbon revenues and other fiscal rigidities, which have contributed to high levels of public and external debt.

- External Finances: -1 notch, largely to reflect Oman's high level of net external debt and the risks associated with substantial external funding needs.

Fitch's SRM is the agency's proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LTFC IDR. Fitch's QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

BEST/WORST CASE RATING SCENARIO

International scale credit ratings of Sovereigns, Public Finance and Infrastructure issuers have a best-case rating upgrade scenario (defined as the 99th percentile of rating transitions, measured in a positive direction) of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario (defined as the 99th percentile of rating transitions, measured in a negative direction) of three notches over three years. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from 'AAA' to 'D'. Best- and worst-case scenario credit ratings are based on historical performance. For more information about the methodology used to determine sector-specific best- and worst-case scenario credit ratings, visit https://www.fitchratings.com/site/re/10111579.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG CONSIDERATIONS

Oman has an ESG Relevance Score of '5[+]' for Political Stability and Rights as WBGI have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and a key rating driver with a high weight. As Oman has a percentile rank above 50 for the respective governance indicator, this has a positive impact on the credit profile.

Oman has an ESG Relevance Score of '5[+]' for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as WGBI have the highest weight in Fitch's SRM and are therefore highly relevant to the rating and are a key rating driver with a high weight. As Oman has a percentile rank above 50 for the respective governance indicators, this has a positive impact on the credit profile.

Oman has an ESG Relevance Score of '4'for Human Rights and Political Freedoms as the Voice and Accountability pillar of the WBGI is relevant to the rating and a rating driver. As Oman has a percentile rank below 50 for the respective governance indicator, this has a negative impact on the credit profile.

Oman has an ESG Relevance Score of '4[+]' for Creditor Rights as willingness to service and repay debt is relevant to the rating and is a rating driver for Oman, as for all sovereigns. As Oman has track record of 20+ years without a restructuring of public debt and captured in our SRM variable, this has a positive impact on the credit profile.

Except for the matters discussed above, the highest level of ESG credit relevance, if present, is a score of 3. This means ESG issues are credit-neutral or have only a minimal credit impact on the entity(ies), either due to their nature or to the way in which they are being managed by the entity(ies). For more information on Fitch's ESG Relevance Scores, visit www.fitchratings.com/esg.

VIEW ADDITIONAL RATING DETAILS

Additional information is available on www.fitchratings.com

PARTICIPATION STATUS

The rated entity (and/or its agents) or, in the case of structured finance, one or more of the transaction parties participated in the rating process except that the following issuer(s), if any, did not participate in the rating process, or provide additional information, beyond the issuer’s available public disclosure.

APPLICABLE CRITERIA

- Country Ceilings Criteria (pub. 01 Jul 2020)

- Sukuk Rating Criteria (pub. 15 Feb 2021)

- Sovereign Rating Criteria (pub. 26 Apr 2021) (including rating assumption sensitivity)

APPLICABLE MODELS

Numbers in parentheses accompanying applicable model(s) contain hyperlinks to criteria providing description of model(s).

- Country Ceiling Model, v1.7.2 (1)

- Debt Dynamics Model, v1.3.1 (1)

- Macro-Prudential Indicator Model, v1.5.0 (1)

- Sovereign Rating Model, v3.12.2 (1)

ADDITIONAL DISCLOSURES

- Dodd-Frank Rating Information Disclosure Form

- Solicitation Status

- Endorsement Policy

ENDORSEMENT STATUS

Oman EU Endorsed, UK Endorsed

Oman Sovereign Sukuk S.A.O.C. EU Endorsed, UK Endorsed

-Ends-

DISCLAIMER

ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: HTTPS://WWW.FITCHRATINGS.COM/UNDERSTANDINGCREDITRATINGS. IN ADDITION, THE FOLLOWING

COPYRIGHT

Copyright © 2021 by Fitch Ratings, Inc., Fitch Ratings Ltd. and its subsidiaries. 33 Whitehall Street, NY, NY 10004. Telephone: 1-800-753-4824, (212) 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights reserved. In issuing and maintaining its ratings and in making other report

SOLICITATION STATUS

The ratings above were solicited and assigned or maintained by Fitch at the request of the rated entity/issuer or a related third party. Any exceptions follow below.

ENDORSEMENT POLICY

Fitch’s international credit ratings produced outside the EU or the UK, as the case may be, are endorsed for use by regulated entities within the EU or the UK, respectively, for regulatory purposes, pursuant to the terms of the EU CRA Regulation or the UK Credit Rating Agencies (Amendment etc.) (EU Exit) Regulations 2019, as the case may be. Fitch’s approach to endorsement in the EU and the UK can be found on Fitch’s Regulatory Affairs page on Fitch’s website. The endorsement status of international credit ratings is provided within the entity summary page for each rated entity and in the transaction detail pages for structured finance transactions on the Fitch website. These disclosures are updated on a daily basis.

Peter Fitzpatrick

Senior Director, Corporate Communications

Fitch Group, 30 North Colonnade, London, E14 5GN

Direct: +44 (0) 203 530 1103

peter.fitzpatrick@thefitchgroup.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.