PHOTO

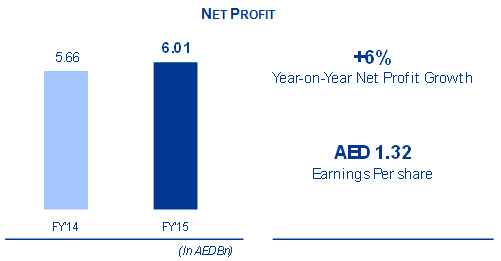

Net profit up 6%, marking 16th consecutive year of increased profitability

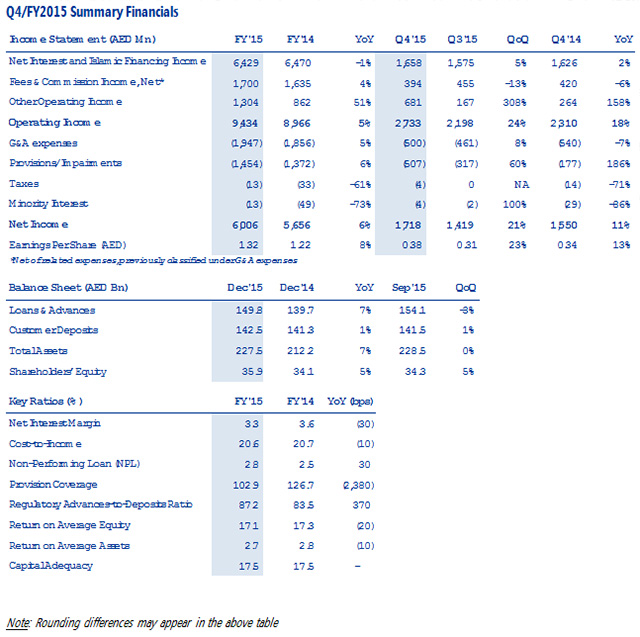

- FGB Group Net Profit of AED 6.01 Billion, up 6% from AED 5.66 Billion in 2014; Full year 2015 Earnings Per Share up 8% to AED1.32

- Board of Directors recommends the distribution of 100% cash dividends for 2015; Cash dividends represent 75% of full year net profits

- After dividend distribution the Bank maintains a robust capital position with total Capital Adequacy Ratio at 17.5% and Tier 1 Capital at 16.3%

- Excellent liquidity position within Central Bank regulatory requirements

- Balance Sheet Indicators: Total Assets at AED 227.5 Billion; Loans and Advances at AED 149.8 Billion and Customer Deposits at AED 142.5 Billion

- FY2015 operating income at AED 9.43 Billion, an increase of 5% compared to 2014; Non-interest revenues contribute 32% to total FY15 revenues

- Key ratios: Cost-to-Income Ratio at 20.6%, Net Interest Margin (NIM) at 3.3%, Non-Performing Loan (NPL) ratio at 2.8% and Provision Coverage at 103%

- Strong Profitability with Return on Average Equity at 17.1% and Return on Average Assets at 2.7%

Abu Dhabi, January 31st, 2016

FGB, one of the leading banks in the UAE, achieved a record Group net profit of AED 6.01 Billion for the full year 2015. Total income for the year grew by 6%, marking the 16th consecutive year of consistent growth in profitability for FGB. Full year 2015 Earnings Per Share amounted to AED 1.32, an increase of 8% from AED 1.22 in 2014.

Commenting on the results, Abdulhamid Saeed, FGB's Managing Director and Board Member, said: "In spite of complex and volatile operating conditions, FGB was able to deliver a solid set of results in 2015, demonstrating our unique ability to show resilience by quickly adapting to new market trends. The Bank's performance shows a consistent growth in net profits for the 16th year in a row, which is an extraordinary achievement. We are looking ahead with confidence as we will continue to deliver on our long term strategy in a disciplined manner and prudently manage risks to continue maximising returns for all our stakeholders."

FGB's Board of Directors recommended the distribution of a cash dividend of 100% (or AED 1 per share) for the financial year ended 31 December 2015. This implies total cash dividends of AED 4.5 Billion, compared to AED 3.9 Billion in 2014. The recommended dividend proposal is subject to the UAE Central Bank's final approval, followed by the approval of the Ordinary General Assembly of Shareholders which will be held in Abu Dhabi on Wednesday 24th February 2016.

André Sayegh, CEO of FGB, added: "In 2015, FGB delivered a robust set of results. In spite of a challenging operating environment we generated a net profit in excess of AED 6.0 Billion, the highest to-date. This achievement reconfirms the solid foundation of our business model, the strength of our franchise and the relevance of our strategy centered on dynamism, specialisation, synergy, speed and diversification. As always, our primary objective, as a leading financial institution, is to maintain a strong balance sheet and solid ratios at all times, which is the foundation enabling us to generate disciplined growth and higher returns year over year. In terms of revenue diversification, we grew the contribution of non-interest income sources to 32% of total revenues, up from 28% in 2014, which is aligned with our strategy to broaden and deepen the relationship with our customers complementing our lending activity. Turning challenges into opportunities is one of our key goals, and our achievements in 2015 reflect our relentless commitment to drive operational excellence by strengthening our competitive advantages as per our business plan."

Note: Rounding differences may appear in the above table

Outlook

Sayegh concluded: "Although global economic conditions appear to be challenging in 2016, it is a market reality that the UAE has always overcome downturns, and reemerged with a stronger momentum. A key factor behind the UAE's resilience is its strong competitiveness and the unique advantages it offers as a business environment including state-of-the-art infrastructure, an environment of low taxation, a strong regulatory framework, and a strategic geographical location within the reach of billions of consumers. Moreover, the UAE enjoys a developed banking sector composed of a mix of local and international banks which facilitate business activities. With a regulatory framework aligned with international standards, the UAE banking sector fundamentals are particularly solid in terms of Capital Adequacy, liquidity and asset quality, placing the industry in a strong position to support economic growth. Furthermore, the sector is quite advanced, always pushing the boundaries of innovation in areas such as products enhancement and digital banking. At FGB, our focus on "efficiency" will enable us to continue to provide superior and innovative products and services, both to the Public and Private sectors, at Corporate and Individual levels, and across our core businesses domestically and internationally. Going forward, we are fully confident that our dynamic and diversified business model, which is based on strong fundamentals, is positioning us well to capture future opportunities and support our sustainable growth."

-Ends-

Awards

- 2015 Banker Middle East Industry Awards: "Best Bank in the UAE" and "Best Bank in the Middle East"

- 2015 Arabian Business Achievement Awards: "Bank of the Year"

- The Banker 2015 Islamic Banker of the Year Awards - "Shariah-Compliant Window"

- Asian Banker 2015 Middle East and Africa Country Awards: "Best Wealth Management in the Middle East Award" and "Best Mortgage and Home Loan Product in the Middle East Award"

- 2015 Banker Middle East UAE Product Awards: 'Best Call Centre', 'Best Credit Card', 'Best Personal Loan', 'Best Wealth Management Service/Proposition,' 'Best Offshore Wealth Proposition', 'Best Deposit Account Product' and 'Best Bancassurance Product'

- 2015 Bonds, Loans & Sukuk Middle East Awards: "Project Finance Deal of the Year", "Structured Finance Deal of the Year" and "Syndicated Loan Deal of the Year"

- 2015 Arabian Business Startup Awards: "SME Bank of the Year"

- 2015 Global Capital Bond Market Awards: "Most Impressive Middle East Borrower Award"

About FGB

As a major leading Bank in the UAE, FGB had Shareholder Equity of AED 35.9 Billion as of December 31st, 2015 making it one of the largest equity based Banks in the UAE. Established in 1979 and headquartered in Abu Dhabi, UAE, the Bank offers a full range of financial services to business and consumer sectors throughout an extensive network of branches across the UAE. Internationally, FGB has branches in Singapore and Qatar, representative offices in India, Hong Kong, Seoul and London and a subsidiary in Libya.

FGB is recognised as a world-class organisation committed to maximising value for shareholders, customers and employees as it focuses on delivering banking products and services that meet client needs and support the UAE's dynamic economy. In line with its commitment to excellence the Bank continues to invest significantly in people and technology to provide superior service standards.

For more information

Visit FGB's corporate website: www.fgb.ae

Download FGB's Investor Relations app: https://www.myirapp.com/fgb/

For analyst and investor enquiries

FGB Investor Relations Department

ir@fgb.ae

For media inquiries:

Jennifer Cain

+ 971 55 4741105

JCain@webershandwick.com

Hiba Haddad

+ 971 56 1679577

hhaddad@webershandwick.com

© Press Release 2016