PHOTO

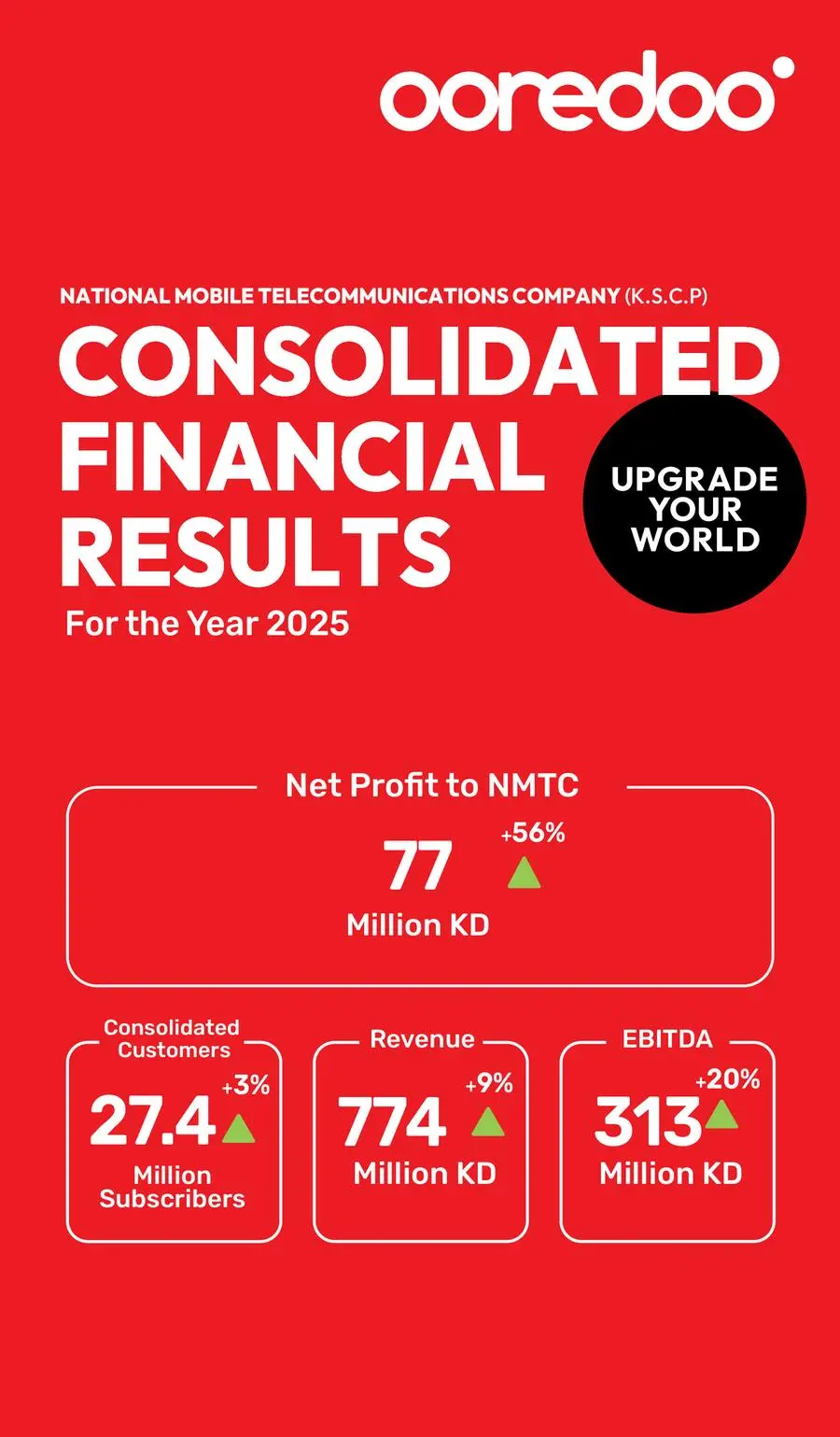

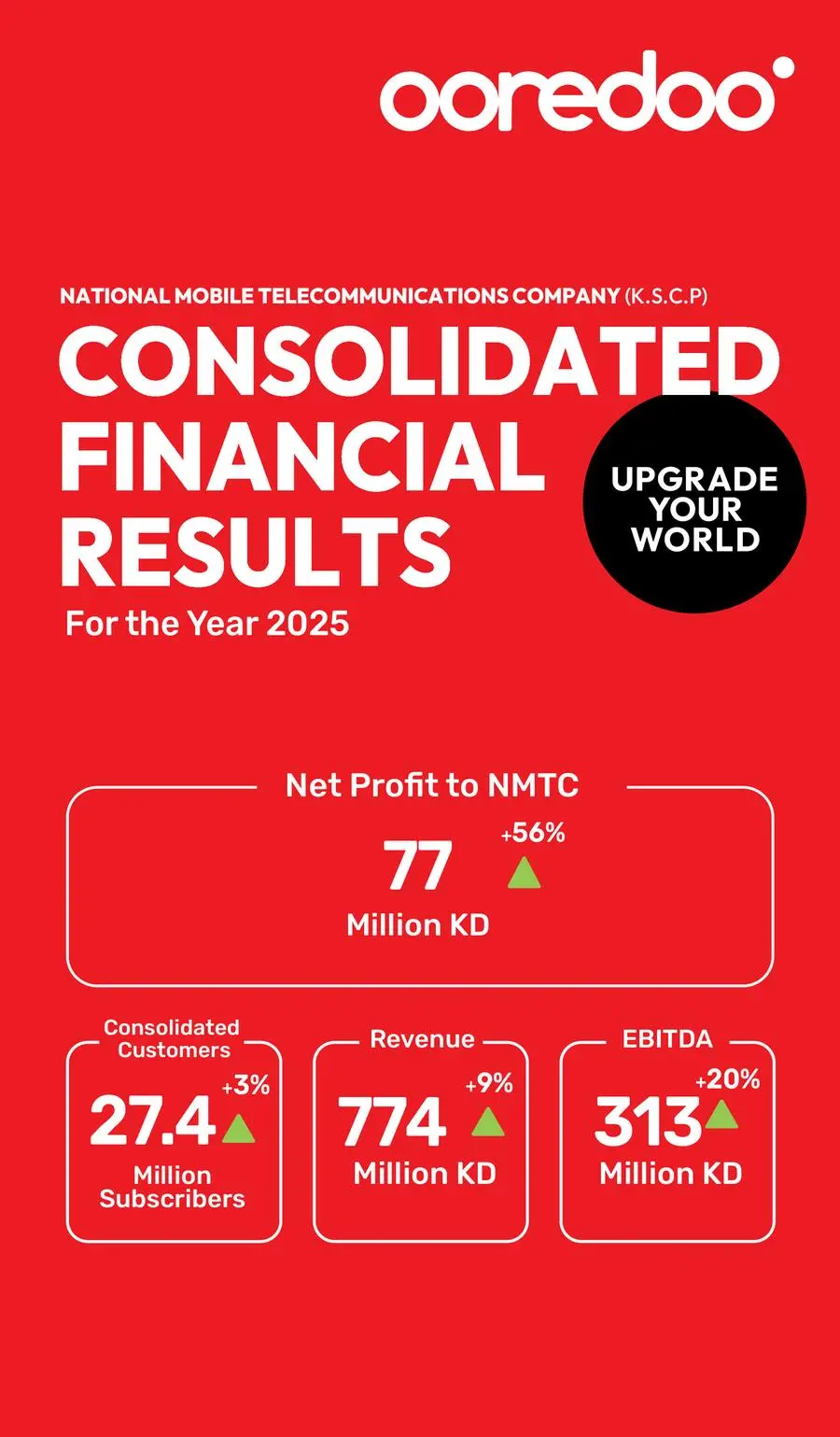

Kuwait City, Kuwait: National Mobile Telecommunications Company K.S.C.P “Ooredoo” (Ticker: OOREDOO) announced today its financial results for the year ended 31 December 2025:

Financial Highlights:

| Full year Analysis | |||

| 2025 | 2024 | % change | |

| Consolidated Revenue (KWD m) | 774 | 711 | 9% |

| EBITDA (KWD m) | 313 | 262 | 20% |

| EBITDA margin (%) | 40% | 37% | - |

| Net Profit attributable to NMTC (KWD m) | 77 | 49 | 56% |

| Consolidated Customers (m) | 27.4 | 26.6 | 3% |

- Consolidated revenue increased by a strong 9% to KWD 774 million in 2025, compared to KWD 711 million in 2024. Revenue growth was supported by the strong operational performances in Algeria, Tunisia and Kuwait.

- Consolidated customer base increased by 3% to 27.4 million in 2025 compared to 26.6 million in 2024.

- EBITDA increased by 20% in 2025 to reach KWD 313 million compared to KWD 262 million in 2024. Normalizing for the impact of the one-off bad debt provision raised in 2025 and 2024, EBITDA increased by 16% YoY.

- Net profit attributable to NMTC increased by 56% to reach KWD 77 million in 2025 from KWD 49 million in 2024. Normalizing for the impact of the one-off bad debt provision in 2025 and 2024, Net profit attributable to NMTC increased by 33% YoY.

- The consolidated earnings per share was 154 fils in 2025, compared to 99 fils earned in 2024.

- The board of directors recommends a dividend payment of 150 fils per share, subject to shareholders’ approval at the General Assembly scheduled for March 2026.

Sheikh Nasser Bin Hamad Bin Nasser Al Thani, Chairman of the Board of Directors commented:

“2025 marked a year of strong and disciplined execution for NMTC, with our core markets in Kuwait, Algeria, and Tunisia delivering sustained commercial momentum, and the Maldives continuing to demonstrate resilience.

Consolidated revenue increased by 9% year‑on‑year to KWD 774 million, while EBITDA grew by 20% to KWD 313 million, resulting in a solid 40% EBITDA margin.

Net profit attributable to NMTC rose by 56% to KWD 77 million. Normalizing for the impact of the one-off bad debt provision raised in 2025 and 2024, Net profit attributable to NMTC expanded by 33%, highlighting the quality of our underlying business performance.

Our performance was supported by solid service‑revenue growth in Kuwait, driven by enhancements in customer experience and network leadership. Algeria and Tunisia continued their strong growth trajectories, benefiting from focused commercial execution, targeted network investments, and ongoing operational efficiencies.

Following strong financial and operational performance, the Board will recommend a dividend of 150 fils per share at the March General Assembly, consistent with our disciplined capital allocation framework and focus on long-term shareholder value.

As we look ahead, NMTC is well positioned to expand connectivity, elevate customer experience, and unlock further efficiency gains across our operations. We remain firmly committed to sustainable growth and long‑term value creation for our stakeholders, and I am confident in our ability to carry this positive momentum into 2026.”

In this regard, Abdulaziz Yaqoub Al-Babtain, CEO of Ooredoo Kuwait, said:

“I am pleased to share our positive results for the end of 2025, which reflect an exceptional year filled with achievements made possible by the collective efforts of the Ooredoo team, whose commitment and professionalism were instrumental to our success. The year marked a pivotal milestone in our journey, beginning with the launch of 5G Advanced technology, representing a significant leap in fifth-generation network capabilities in terms of speed and efficiency. We concluded the year by announcing the readiness of Kuwait’s first AI-powered data center, in collaboration with NVIDIA—a landmark achievement that lays the foundation for a sovereign, secure, and sustainable artificial intelligence ecosystem to drive the country’s digital economy.”

Al-Babtain added that Ooredoo’s accomplishments in 2025 extended beyond technological advancement, as the company was also awarded Telecom Company of the Year for the second consecutive year at the Asian Telecom Awards, in addition to securing several prestigious accolades recognizing its excellence in artificial intelligence, technology, and network development. He noted that all these achievements serve one core objective: upgrading customer experience and empowering customers with the latest digital solutions.

He further emphasized that the company’s exceptional financial performance and profits, along with the Board of Directors’ recommendation to distribute 150% of the share value to shareholders, underscore Ooredoo’s financial strength and solid performance. These results, he explained, reflect the company’s successful investment strategy aimed at driving revenue growth and reinforcing its leadership within the telecommunications sector. Al-Babtain affirmed that Ooredoo continues to lead the technology and telecommunications industry in the region through a disciplined strategic approach and the establishment of impactful partnerships across various sectors, in line with Kuwait Vision 2035.

He explained that Ooredoo plays a pivotal role in forging strategic agreements with both the public and private sectors, enabling a qualitative leap beyond traditional telecommunications and opening new horizons for smarter solutions and advanced next-generation technologies. These include Internet of Things (IoT) applications, cloud solutions, and advanced digital services, all of which support the national economy and align with the objectives of Kuwait Vision 2035.

Al-Babtain concluded by stating that at Ooredoo, the company firmly believes that true investment begins with people. For this reason, employees remain at the heart of its strategy, serving as the foundation of its continued success and the driving force behind its journey toward a more advanced and sustainable digital future. He noted that 2025 was a year rich in achievements, and expressed confidence and optimism for 2026, as Ooredoo prepares to continue its development journey, introduce further innovations, and strengthen its position as a leading digital partner contributing effectively to the shaping of Kuwait’s digital future.

Review of Operations

The Group’s operational performance can be summarised as follows:

Ooredoo – Kuwait

Ooredoo Kuwait’s customer base increased by 1% to reach 2.9 million customers in 2025. The company's revenue increased by 4% to KWD 274 million in 2025 compared to KWD 264 million in 2024. Additionally, EBITDA surged by 27% to KWD 90 million in 2025, up from KWD 71 million in 2024. EBITDA in 2025 and 2024 was impacted by a one-off bad debt provision raised in line with company’s standard policy. When normalizing for this one-off provision, EBITDA grew by 14% YoY.

Ooredoo – Tunisia

Ooredoo Tunisia’s customer base increased by 3% in 2025, reaching a total of 7.2 million customers. Revenue increased by 12% to KWD 145 million in 2025, compared to KWD 130 million in 2024. EBITDA in 2025 increased by 13% to KWD 61 million compared to KWD 54 million in 2024.

Ooredoo – Algeria

Ooredoo Algeria’s customer base increased by 4%, reaching a total of 15.3 million in 2025. Revenue for in 2025 rose by 16% to KWD 278 million, compared to KWD 239 million in 2024. EBITDA increased by 24%, reaching KWD 125 million in 2025 compared to KWD 101 million in 2024.

Ooredoo – Palestine

Ooredoo Palestine’s customer base decreased by 4% to 1.5 million customers. Revenue decreased by 3% in 2025 to KWD 33 million. EBITDA improved by 2% to KWD 13 million in 2025 compared to KWD 12 million in 2024. The performance remained affected by the aftermath of the conflict in Gaza and the West Bank.

Ooredoo – Maldives

Ooredoo Maldives’ customer base increased by 5% to 426 thousand customers in 2025. Revenue in 2025 increased by 1% to KWD 44 million, while EBITDA increased by 5% to KWD 25 million compared to KWD 24 million in 2024.

For more information, please visit www.ooredoo.com.kw

For Media Inquiries:

Ooredoo (NMTC)

Nasser AlArfaj , PR & Media

PO Box 613, Safat 13007, Kuwait

E-mail: nalarfaj@ooredoo.com.kw

About Ooredoo Kuwait (NMTC)

Commercially launched in December 1999, the Company’s share price as of 2025 was KWD 1.414, giving a market valuation for Ooredoo (NMTC) of KWD 0.7 billion.