DUBAI (S&P Global Ratings) -- S&P Global Ratings said today that it believes Oman's (BB-/Stable/B) recent liability management exercise will help reduce the government's debt levels, generate interest cost savings, and smoothen its maturity profile.

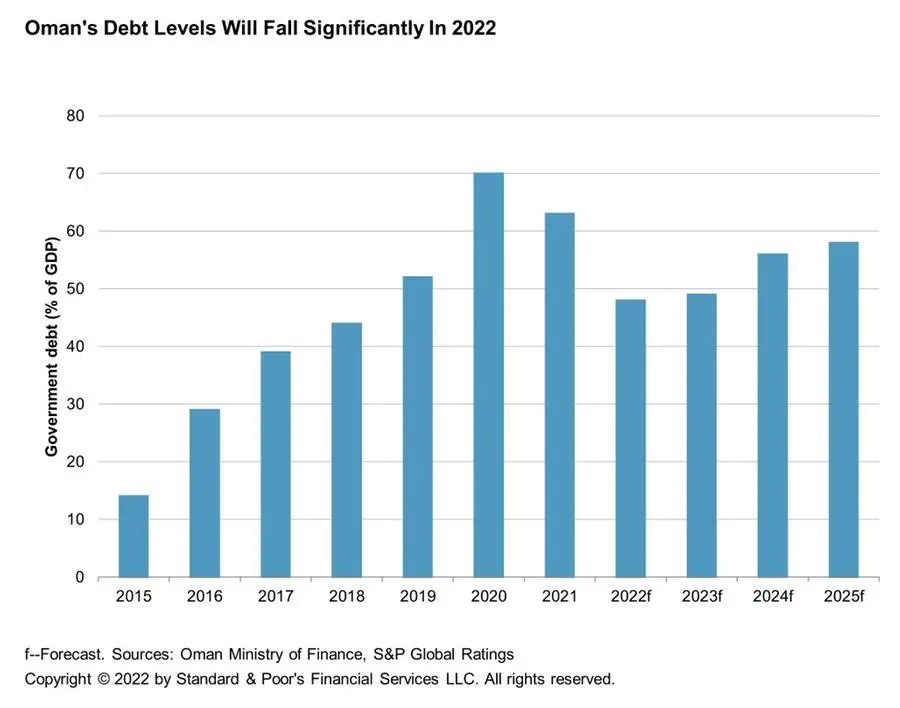

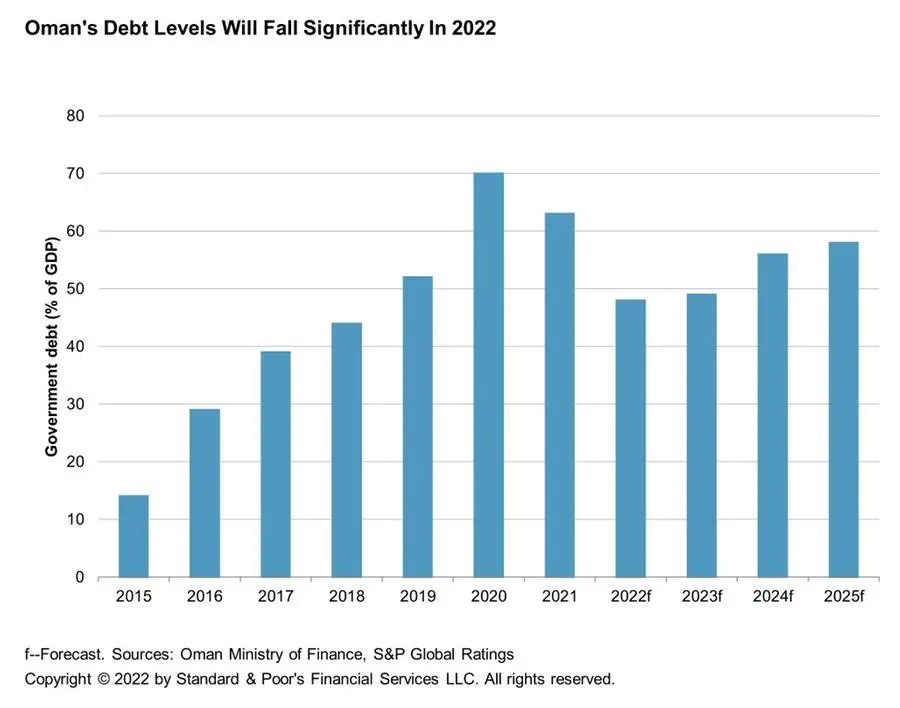

On June 30, Oman completed a voluntary debt buyback transaction totaling $701 million across Eurobonds maturing in 2025, 2026, 2027, 2028, 2029, 2031, and 2032. According to official calculations, this will result in cumulative interest cost savings to maturity of $232 million. We expect gross government debt will fall to 48% of GDP by year-end 2022, compared with 63% in 2021 and a peak of 70% in 2020 (see chart)

Following several years of deteriorating public finances and external accounts until 2020, Oman is now benefitting from higher oil prices and fiscal and governance reforms. Realized Omani crude oil prices have averaged about $95 per barrel (/bbl) so far this year, relative to $61/bbl over 2021. We assume Brent oil prices of $100/bbl over the rest of 2022, falling to $85/bbl in 2023 and $55/bbl from 2024 (see "S&P Global Ratings Raises Oil And Natural Gas Price Assumptions On Further Market Price Step-Ups," published June 8, 2022, on RatingsDirect). Despite some measures to diversify revenue, gross oil receipts comprised about 80% of total government revenue in 2021. We expect favorable oil market dynamics will allow the government to deliver a fiscal surplus of 6.5% of GDP in 2022, following deficits averaging nearly 10% of GDP over 2015-2021. (Unlike official fiscal accounts that net out transfers to the Petroleum Reserve Fund, we incorporate gross hydrocarbon receipts in revenue).

The government intends to largely allocate the fiscal surplus toward higher spending on development projects and reducing government debt. It has also introduced other measures to support economic activity and reduce the effects of past austerity on the population. These include value-added tax exemptions on 488 items from 93 previously, a more gradual reduction in electricity subsidies, reduced work visa fees for expatriates, and lower municipality and services fees.

However, since we expect oil prices to drop again in the medium term, fiscal pressures could re-emerge if progress on fiscal reforms stalls and the government increases current spending significantly. We forecast that a return to fiscal deficits (due to lower oil prices) and fall in nominal GDP will lead to an increase in debt as a proportion of GDP in 2024-2025 (albeit to levels lower than in 2021). In addition, rising interest rates and weaker global growth could weigh on the government's borrowing costs and non-oil sector growth prospects in Oman. Nonetheless, we believe that the government's proactive debt management measures this year, along with liquid assets of about 50% of GDP, should help ease future refinancing risks.

-Ends-

Copyright © 2022 by Standard & Poor’s Financial Services LLC. All rights reserved.

About S&P Ratings

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of Standard & Poor’s Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT’S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by negligence) in connection with any use of the Content even if advised of the possibility of such damages

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact. S&P’s opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.