PHOTO

Emirates Islamic announced a record AED 3.2 billion profit before tax for the first nine months of 2025. Total income rose 9% year-on-year to AED 4.5 billion, driven by continued expansion in both funded and non-funded income streams. Highlighting the Bank’s position as one of the leading Islamic banks in the UAE, customer financing grew by an exceptional 20% in the first nine months of 2025 to AED 84.8 billion, while customer deposits grew by 20% to AED 92.4 billion.

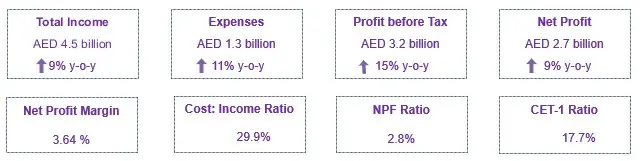

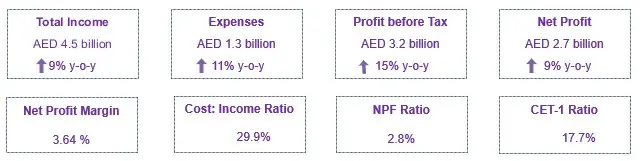

Key Highlights – First Nine Months of 2025

- Strong operating performance on higher funded income and non-funded income

- Total income up 9% y-o-y driven by higher funded and non-funded income

- Expenses increased 11% y-o-y reflecting continued investments to drive growth

- Impairment allowances credit at AED 44 million

- Operating profit improved by 8% y-o-y

- Net profit increased to AED 2.7 billion, up by 9%

- Net profit margin healthy at 3.64%

- Strong capital and liquidity combined with a healthy deposit mix empowering the Bank to provide improved products to customers

- Total assets increased by 24% to AED 138 billion during the first nine months of 2025

- Customer financing at AED 84.8 billion, increased 20% during the first nine months of 2025

- Customer deposits at AED 92.4 billion, increased 20% during the first nine months of 2025 with Current and Saving Account balances at 70% of deposits

- Credit Quality: Non-performing financing ratio at 2.8% with strong coverage ratio at 152.9%

- Capital: Common Equity Tier 1 ratio at 17.7% and Capital adequacy ratio at 18.8% reflect the bank’s strong and stable capital position

- Headline Financing to Deposit ratio at 92% comfortably within the management’s target range

About Emirates Islamic:

Emirates Islamic (DFM: EIB), part of Emirates NBD Group, is a leading Islamic financial institution in the UAE. Established in 2004 as Emirates Islamic Bank, the bank has established itself as a major player in the highly competitive financial services sector in the UAE.

Emirates Islamic offers a comprehensive range of Shariah-compliant products and services across the Personal, Business and Corporate banking spectrum with a network of 39 branches and 230 ATMs/CDMs across the UAE. In the fast-growing area of online and mobile banking, the bank is an innovator, being the first Islamic bank in the UAE to launch a mobile banking app and offer Apple Pay, as well as being the first Islamic bank in the world to launch Chat Banking services for customers via WhatsApp.

Emirates Islamic has consistently received local and international awards, in recognition of its strong record of performance and innovation in banking. Emirates Islamic was recognized as ‘Best Overall Islamic Bank’ and ‘Most Innovative Islamic Bank’ at the Islamic Finance News Awards 2024. The Bank was also named the ‘Most Innovative Islamic Bank’ at the prestigious Euromoney Islamic Finance Awards 2024.

As part of its commitment to the UAE community, the Emirates Islamic Charity Fund provides financial aid to those in need, with a focus on food, shelter, health, education and social welfare contributions.

For further information please visit www.emiratesislamic.ae

Or please contact:

Amina Al Zarooni

Media Relations Manager, Emirates Islamic

Tel: +971 4 4397430; Mob: +971 56 6405080

Email: AminaAlZarooni@emiratesislamic.ae

Ibrahim Sowaidan

SVP - Head - Group Corporate Affairs

Emirates NBD

Tel: +971 4 609 4113 / +971 50 6538937

Email: ibrahims@emiratesnbd.com

Burson

Dubai, UAE

Tel: 971-4-4507600;

Email: ei@bm.com