PHOTO

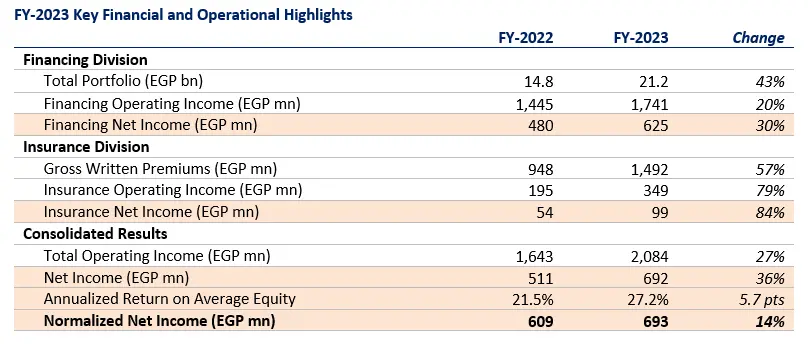

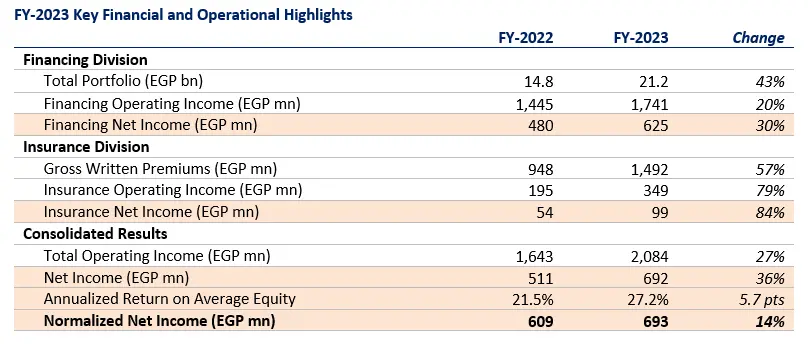

Cairo: Contact Financial Holding SAE (CNFN.CA), Egypt’s largest non-bank financial services provider, announced today its consolidated financial results for the quarter and twelve-month periods ending 31 December 2023. On a full-year basis, the Group reported solid year-on-year operating income growth of 20% and 79% across its financing and insurance divisions, respectively. At the bottom-line, financing net income grew 30% y-o-y, while insurance net income increased by 84% y-o-y. Consolidated normalized net income[1] rose by 14% y-o-y to EGP 693 million, as the Group continued to demonstrate its ability to deliver sustainable growth and value in the midst of a challenging operating environment.

In FY-2023, new financing extended at Contact’s financing division reached EGP 16.6 billion, a 46% y-o-y increase primarily driven by Contact’s Auto and Consumer Finance segments. The division’s operating income rose by 20% y-o-y to EGP 1,741 million in FY-2023, with growth trickling down to the division’s bottom-line, which expanded 30% y-o-y to reach EGP 625 million. Meanwhile, Contact’s insurance division achieved impressive results across both its subsidiaries, with total gross written premiums (GWP) reaching EGP 1,492 million in FY-2023, a 57% y-o-y expansion. The division’s operating income rose 79% y-o-y to reach EGP 349 million, with net income at the insurance division witnessing a remarkable 84% y-o-y increase in FY-2023, to close the year at EGP 99 million.

Commenting on the results, management said: “We are delighted to have ended the year on a high note, delivering another strong set of strong financial and operational results despite the challenging operating environment. Our performance over the past year reflects the continued success of our mitigation, growth, and value-creation strategies, which have enabled us to not only effectively overcome the persistently difficult macroeconomic conditions in our home market, but to also take significant strides in our longer-term growth strategy, setting the foundations for further growth in the years to come.”

“Taking a more detailed look at our results, both our Auto and Truck segments reported solid portfolio growth as they continued to benefit from the significant price increases witnessed over the past year, as well as the gradual recovery of their respective markets. On this front, it is worth noting that auto sales figures in the Egyptian market climbed for the second consecutive month in December, with momentum expected to carry on as the country’s import restrictions and FX availability improve in 2024. Similarly, the Consumer Financing segment continues to be a main growth driver, supported by our rapidly-expanding merchant network, increasingly diversified product offering, and higher market penetration rates. Meanwhile, in line with our digital strategy, both of our online platforms, the ContactNow app and the Contactcars.com platform, recorded a strong 2023, growing operationally and contributing increasingly to our financial results. Turning to our insurance division, both companies continued to deliver solid growth, leveraging an increased market presence, enhanced cross-selling capabilities, and ramped-up product offering to deliver impressive year on year results. Finally, our debt capital markets [GS1] division had one of its most successful years to date, completing a number of landmark issuances with a combined total value EGP 6.6 billion, all of which were concluded irrespective of the challenging market conditions. Most notably, in 2023 we issued the market’s first hybrid Consumer Finance and Auto Credit bond, a demonstration of our ability to devise innovative solutions to tap into capital markets and safeguard the Group’s liquidity requirements,” management added.

At the financing division, the Auto Loans and Consumer Finance segments were the division’s top performers in FY-2023, delivering y-o-y new financing growth of 93% and 41%, respectively. Throughout the year, the Consumer Finance segment continued to capitalize on its growing popularity introducing multiple new products including new financing solutions for motorcycles, watercrafts, weddings, and events, while simultaneously securing multiple new partnerships and capitalizing on existing ones to provide customers with an increasingly diverse offering. Additionally, the segment’s results were further supported by Contact’s expanded direct-to-consumer network, which now comprises 75 fully-fledged branches and 13 strategically located booths. At Contact Trucks, new financing extended increased by 20% y-o-y during the twelve-month period, mainly driven by a more diverse product offering, a wider distribution network, and the continued gradual recovery of the market. On the other hand, new financing extended at Contact’s Mortgage segment shrank by 44% y-o-y during FY-2023, mainly as a consequence of the segment halting its low- and middle-income mortgage product, which had previously been a significant driver of growth. Similarly, management’s conservative approach at the Working Capital segment to shield the business from ongoing market challenges saw new financing extended drop 20% y-o-y in FY-2023.

At the insurance division, Sarwa Life’s GWP reached EGP 739 million in FY-2023, representing a 72% y-o-y expansion. Solid growth during the period was primarily driven by Sarwa Life’s medical insurance offering, as well as the continued ramp up of the company’s new SME life and health products. Additionally, Sarwa Life’s new operational issuance system is now fully implemented, and has been further supporting the company’s performance in the final months of the year. Similarly, Sarwa Insurance’s GWP witnessed a 45% y-o-y rise during the year, reaching EGP 752 million. The year-on-year expansion reflect the company’s increased reach and greater market penetration, highlighting the success of management’s strategy over the past years.

On the digital front, ContactNow, a rebranded and reworked version of the Contact App, continued to build up strongly. The ContactNow app is Egypt’s first comprehensive digital financial platform, offering an unmatched selection of services covering the entire customer cycle, and all complemented by a best-in-class user experience. Since its relaunch, the app has been leveraging the latest AI technology to allow new customers to obtain approvals and credit limits instantaneously. On top of that, the app also enables users to manage their accounts and purchases, complete loan installment repayments, settle utility and mobile bills, as well as conduct a variety of other transactions. The broad range of services available through the app have seen it quickly gain traction in the market, with the total number of registered customers since the app’s launch reaching 600 thousand as of year-end 2023, and with 296 thousand of those coming in 2023 alone. In parallel, the number of instant credit requests submitted thought the app reached 271 thousand requests since inception.

At Contactcars[GS2] .com, the average number of monthly users stood at 1.3 million in FY-2023, with the number of registered users rising 35% y-o-y during the twelve-month period. Throughout the year, the platform successfully converted all ads shown on the platform to paid ads, a major milestone that paves the way for increased monetization. Simultaneously, the platform continued to enhance its car dealership offering, expanding its network of subscribed dealers and introducing a new user segmentation service based on AI with the aim of both increasing advertising sales and improving the overall user experience. On that front, the platform’s efforts are bearing fruit, with the car dealer business seeing the number of subscribed dealers quadruple year-on-year during FY-2023. Additionally, and as part of its efforts in expanding the platform’s product offering, in 4Q-2023 Contactcars.com introduced a new motorcycles segment on both the website and the mobile app, enabling the platform to cater to a new selection of customers.

Regionally, our Kenyan affiliate, Almasi, continues to expand in line with expectations, and has financed contracts worth KES 1.9 billion since inception. Almasi provides the Group with a platform that can be used to not just capitalize on the favourable dynamics of the Kenyan market, but also to expand further into the region over the coming years.

“As we head into the new year, we remain confident that Contact is well-positioned to overcome the ongoing macroeconomic difficulties and deliver on the Group’s short- and long-term targets. With this in mind, in the coming year we will remain focused on delivering on our multi-pronged growth and value creation strategy. On the digital front, the constant expansion and enhancement of our digital capabilities continues to top our list of priorities, and we look forward to rolling out a number of new and upgraded solutions across both ContactNow and Contactcars.com over the year. At the financing division, we will continue to drive growth by expanding and enhancing our service offering, introducing new and diversified products to our already rich portfolio. Finally, we remain on the lookout for new geographical expansion opportunities. In the coming months, we will focus in particular on potential expansion opportunities within the highly-sought-out Emirati market, where we feel that our business model and expertise would be best suited to drive additional growth,” management concluded.

-Ends-

About Contact Financial

Contact Financial Holding SAE (CNFN.CA) is the largest non-bank financial services provider in Egypt changing the way people and business access finance and insurance. Operating since 2001, Contact adopts innovative approaches in extending its services, offering quality services with simple procedures and reaching a wide client base through its various subsidiaries, affiliates and partners. Contact’s financing division offers market leading services including consumer financing for new and used passenger and commercial vehicles and an array of consumer durables through Contact Credit and Contact CrediTech, Mortgage finance through Contact Mortgage, as well as commercial finance through Contact Leasing and Contact Factoring. Contact operates in insurance through Sarwa Insurance and Sarwa Life Insurance. Contact also offers an array of corporate financing services including securitization, structured debt and debt investment management. Contact Financial Holding SAE is authorized and regulated by the Financial Regulatory Authority (FRA).

Investor Relations Contact

Seif Elbassiouni

CFO

E-mail: ir@contact.eg

investorrelations.contact.eg/en/