PHOTO

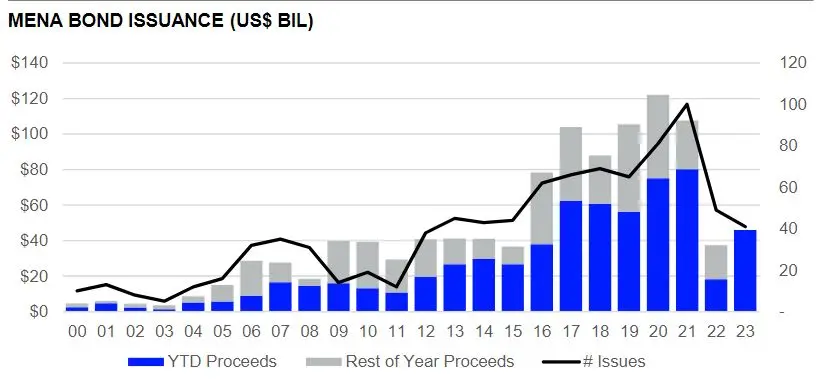

MENA debt issuances more than doubled in value year-on-year (YoY) during H1 2023 to $45.9 billion, a two-year high, according to data from Refinitiv. However, the number of issues declined 16% over the same period.

Saudi Arabia was the most active issuer nation during the period, accounting for 60% of total bond proceeds, followed by the UAE (22%) and Bahrain (6%).

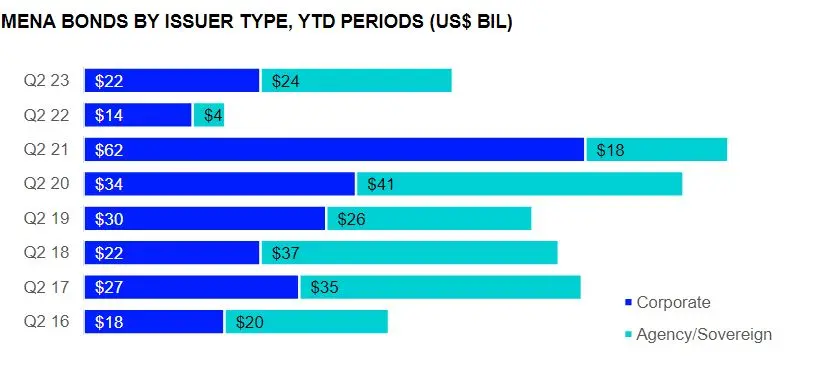

Government and agencies issuers accounted for 52% of proceeds raised during H1 while financial issuers accounted for 40%.

Sukuk or Islamic bonds raised $18.4 billion during the first half of 2023, a 189% jump YoY and a six-year high. Sukuk accounts for 40% of total bond proceeds raised in the region during the period versus 35% during H1 2022.

Citi took the top spot in the MENA bond bookrunner ranking during the first half of 2023 with $5.9 billion of related proceeds, or a 13% market share. Citi also ranks first in the H1 2023 MENA Islamic bonds league table.

(Reporting by Brinda Darasha; editing by Seban Scaria)