PHOTO

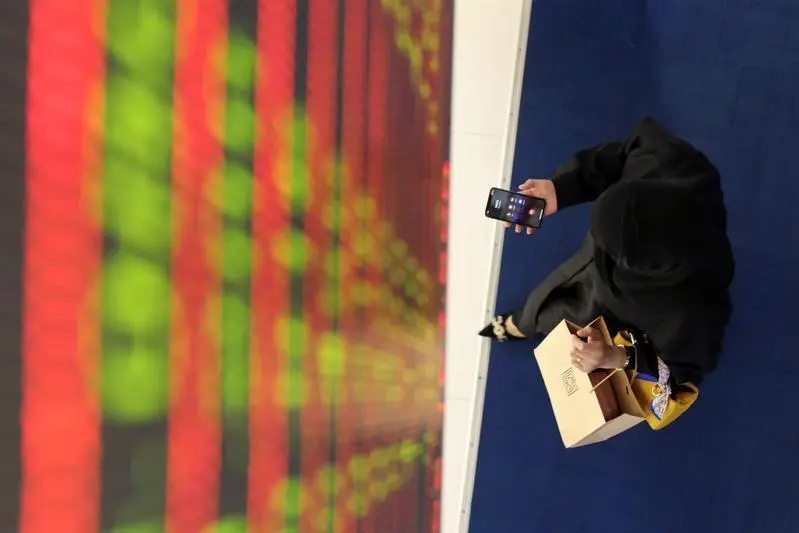

Most stock markets in the Gulf ended lower on Tuesday as investors moved to secure recent gains, while taking account of U.S.-China tensions, with the Qatari index snapping a 12-day winning streak.

The MSCI world equity index, which tracks shares in 47 countries, fell 0.5%, on worries a visit by U.S. House of Representatives Speaker Nancy Pelosi to Taiwan would further harm relations between China and the United States.

Saudi Arabia's benchmark index fell 0.2%, hit by a 0.9% fall in Banque Saudi Fransi and a 1.3% decrease in Yamama Cement Company.

Investors in the Gulf moved to take profits and at the same time are wary of the tensions between the U.S. and China concerning Taiwan, which could impact economic conditions further, said Farah Mourad, senior market analyst of XTB MENA.

Dubai's main share index dropped 0.9%, with top lender Emirates NBD losing 1.1% and sharia-compliant lender Dubai Islamic Bank closing 0.8% lower.

In Qatar, the benchmark retreated 1.2%, ending 12 consecutive sessions of gains, weighed down by a 2.6% fall in Qatar Islamic Bank.

The Abu Dhabi index advanced 1.2%, nearing a one-month high, boosted by a 1.3% rise in the country's biggest lender First Abu Dhabi Bank.

Outside the Gulf, Egypt's blue-chip index added 0.2%, helped by a 4.5% jump in Misr Fertilizers Production Co.

(Reporting by Ateeq Shariff in Bengaluru; Editing by Shailesh Kuber)