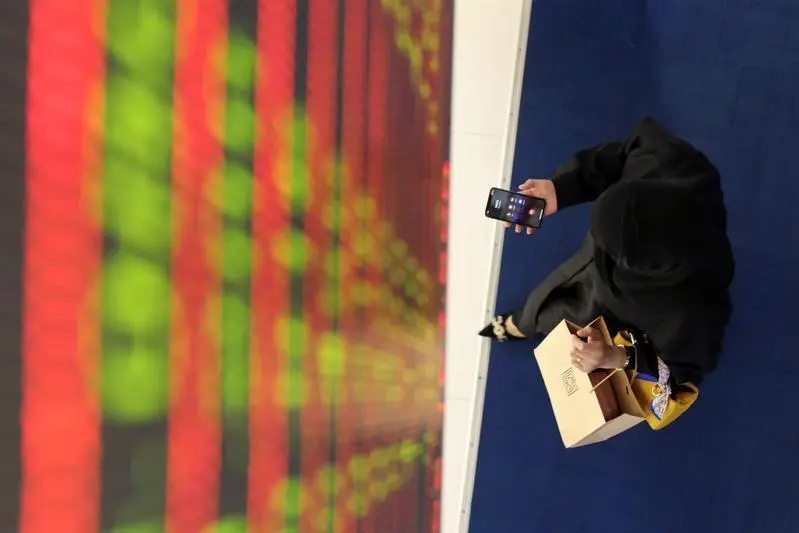

PHOTO

Most stock markets in the Gulf extended losses on Thursday, after the Federal Reserve sharply hiked U.S. interest rates and projected raising them further and faster than investors had expected in order to tame inflation.

Federal Reserve Chair Jerome Powell vowed on Wednesday he and his fellow policymakers would "keep at" their battle to beat down inflation, as the U.S. central bank hiked interest rates by 75 basis point for a third consecutive time and signalled borrowing costs would keep rising this year.

Dubai's main share index dropped 0.8%, hit by a 1.5% fall in Dubai Electricity and Water Authority and a 1.1% decrease in sharia-compliant lender Dubai Islamic Bank.

Most Gulf Cooperation Council countries, including United Arab Emirates, have their currencies pegged to the dollar and generally follow the Fed's policy moves, directly exposing the region to U.S. monetary tightening.

In Abu Dhabi, the index finished flat. The Abu Dhabi bourse found support from stronger oil prices while interest rate hikes eroded sentiment, said Fadi Reyad, Chief Market Analyst at CAPEX.com. "However, the market could see some price corrections after the gains it recorded this month if investors move to secure their gains."

Crude prices rose as the prospect of higher Chinese demand and heightened geopolitical risks outweighed recession fears after a flurry of central bank interest rate hikes, including from the Bank of England.

The Qatari benchmark retreated 0.9%, with most of the stocks on the index were in negative territory including Qatar Islamic Bank, which was down 1.1%.

Outside the Gulf, Egypt's blue-chip index fell 0.2%. ** Saudi Arabia was closed for a public holiday.

(Reporting by Ateeq Shariff in Bengaluru; Editing by Krishna Chandra Eluri)