PHOTO

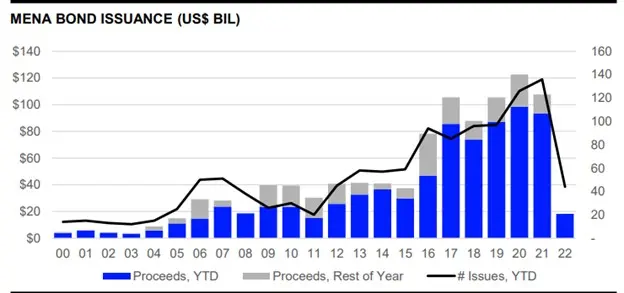

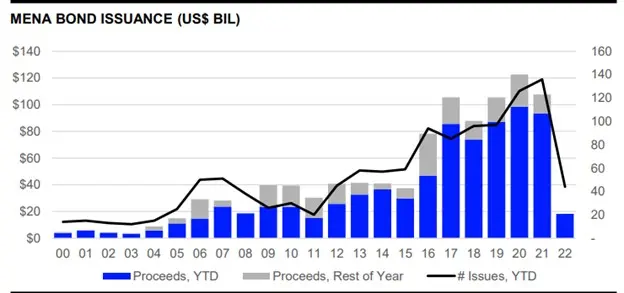

MENA debt issuance amounted to $18.3 billion year-to-date (YTD) in 2022, plumetting 80% from the value recorded in the year-earlier period, according to data from Refinitiv. This is the lowest first nine-month total since 2011.

The number of issues declined 68% from last year at this time, the data showed.

According to Lucille Jones, a Deals Intelligence Analyst at Refinitiv, the fall in MENA debt issuance, was in a large part due to the changing interest rate environment.

"Over the past few years, with interest rates at historic lows, companies have been able to raise and refinance debt at very attractive rates. Many of these companies will still be flush with capital after tapping markets and have been hesitant to issue new debt this year amid rising interest rates and increased volatility."

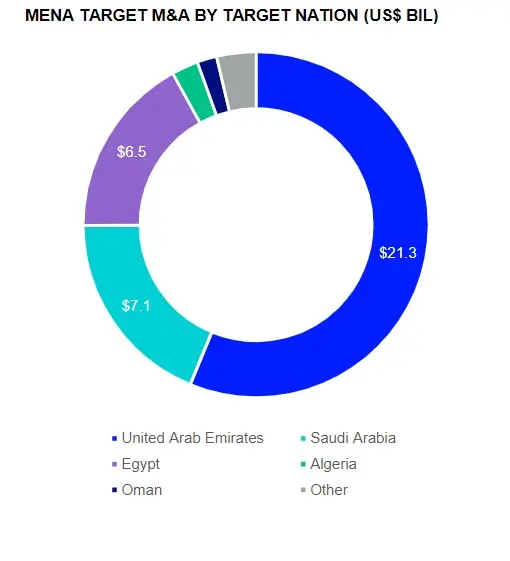

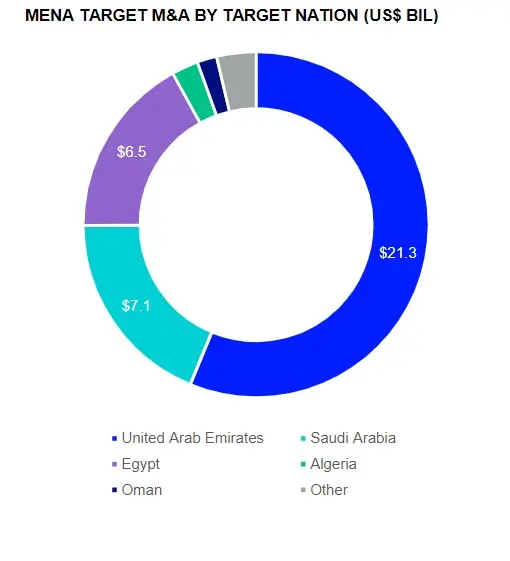

The UAE was the most active issuer nation during the first nine months of 2022, accounting for 61% of total bond proceeds. It also accounted for the largest deal in MENA; a two-tranche US dollar-denominated bond sale worth $3 billion comprising a 10-year tranche and 30-year Formosa portion, issued by the government.

Saudi Arabia was the second largest issuer of debt (23%), followed by Qatar (5%) and Bahrain (5%).

Financial issuers account for 68% of proceeds raised during the first nine months of 2022, while Government & Agency issuers account for 22%.

HSBC took the top spot in the MENA bond bookrunner ranking during the first nine months of 2022, with $2.9 billion of related proceeds, or a 16% market share.

(Reporting by Brinda Darasha; editing by Seban Scaria)